Region:Asia

Author(s):Shubham

Product Code:KRAB1247

Pages:83

Published On:October 2025

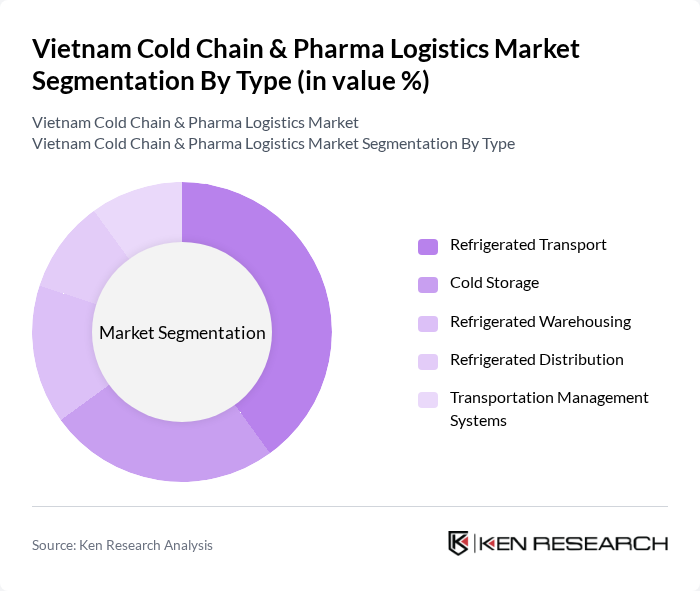

By Type:The market is segmented into various types, including Refrigerated Transport, Cold Storage, Refrigerated Warehousing, Refrigerated Distribution, and Transportation Management Systems. Each of these segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain. The Refrigerated Transport segment is particularly dominant due to the increasing demand for efficient logistics solutions in the food and pharmaceutical industries, as well as the need for validated cold storage and last-mile delivery vehicles equipped with real-time temperature and geo-location monitoring .

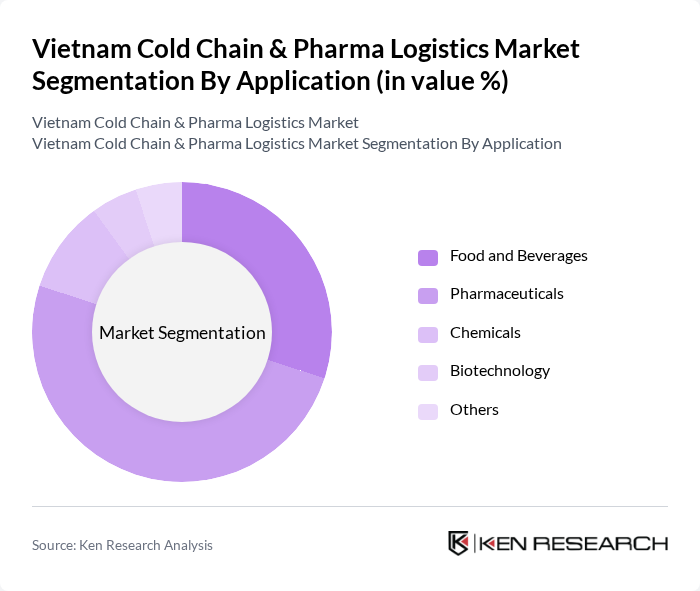

By Application:The market is further segmented by application into Food and Beverages, Pharmaceuticals, Chemicals, Biotechnology, and Others. The Pharmaceuticals segment is the leading application area, driven by the increasing demand for vaccines and other temperature-sensitive medications, which require stringent cold chain management to maintain efficacy. The food and beverage sector also shows robust growth, propelled by rising demand for fresh and processed foods, health-conscious consumer trends, and the expansion of online grocery shopping .

The Vietnam Cold Chain & Pharma Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as VIETPHAT Group, Cold Storage THANG LOI, TransContinental, Vinamilk, CJ Logistics, DHL Supply Chain, Kuehne + Nagel, DB Schenker, Maersk Logistics, Nippon Express, APL Logistics, Yusen Logistics, Gemadept Corporation, Saigon Newport Corporation, Vinalines Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of Vietnam's cold chain and pharma logistics market appears promising, driven by technological advancements and increasing investments in infrastructure. As the government continues to implement supportive policies, the sector is likely to see enhanced efficiency and reliability. Additionally, the growing trend towards e-commerce in healthcare will further necessitate the development of sophisticated logistics solutions, ensuring that temperature-sensitive products are delivered safely and efficiently to consumers across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Refrigerated Warehousing Refrigerated Distribution Transportation Management Systems |

| By Application | Food and Beverages Pharmaceuticals Chemicals Biotechnology Others |

| By Temperature Range | Chilled (2-8°C) Frozen (-20°C) Ultra-Low Temperature (-80°C) Ambient (15-25°C) |

| By Service Type | Transportation Services Warehousing Services Monitoring Services Packaging Solutions |

| By End-User | Pharmaceutical Companies Healthcare Providers Food Processing Companies Biotechnology Firms Clinical Research Organizations |

| By Distribution Channel | Direct Distribution Third-Party Logistics E-commerce Platforms Retail Distribution |

| By Geography | Ho Chi Minh City Hanoi Da Nang Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 60 | Logistics Managers, Supply Chain Directors |

| Cold Chain Service Providers | 50 | Operations Managers, Business Development Heads |

| Regulatory Compliance in Pharma Logistics | 40 | Compliance Officers, Quality Assurance Managers |

| Temperature-Controlled Storage Facilities | 40 | Facility Managers, Technical Directors |

| Pharmaceutical Retail Logistics | 45 | Retail Operations Managers, Inventory Control Specialists |

The Vietnam Cold Chain & Pharma Logistics Market is valued at approximately USD 1.2 billion, driven by the increasing demand for temperature-sensitive products in the pharmaceutical and food sectors, as well as the growth of e-commerce and retail channels.