Region:Asia

Author(s):Dev

Product Code:KRAB6496

Pages:90

Published On:October 2025

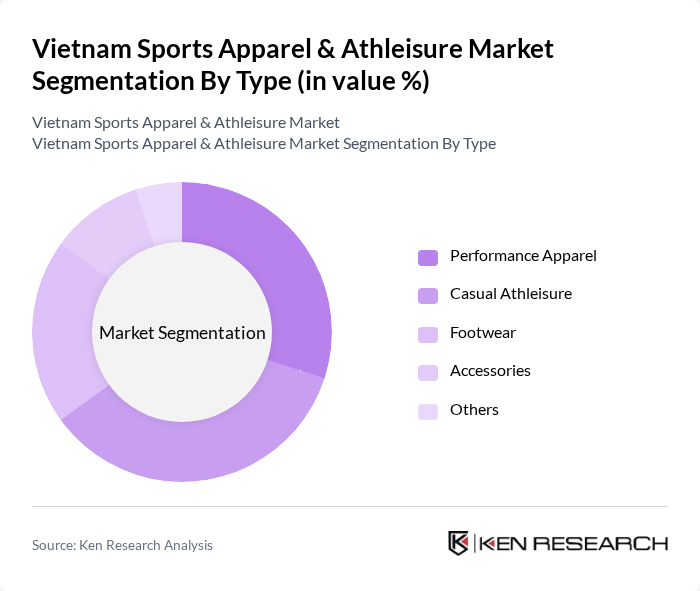

By Type:The market is segmented into various types, including Performance Apparel, Casual Athleisure, Footwear, Accessories, and Others. Performance Apparel is gaining traction due to the increasing participation in sports and fitness activities, while Casual Athleisure is popular for its versatility and comfort. Footwear, particularly sports shoes, is also a significant segment, driven by the growing trend of fitness and casual wear.

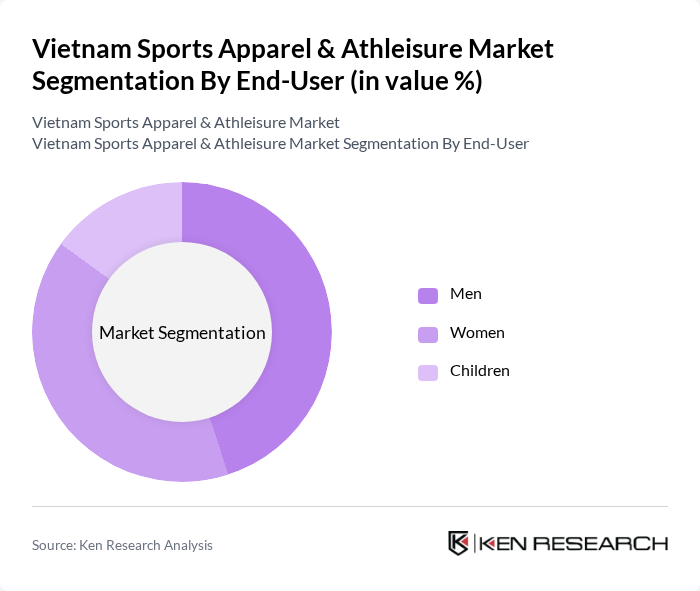

By End-User:The market is categorized into Men, Women, and Children. The men's segment is currently the largest due to the increasing focus on fitness and sports among male consumers. Women are also becoming significant consumers of sports apparel, driven by the athleisure trend. The children's segment is growing as parents increasingly invest in quality sportswear for their kids.

The Vietnam Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lining Company Limited, The North Face, Inc., Columbia Sportswear Company, Asics Corporation, New Balance Athletics, Inc., Anta Sports Products Limited, Skechers USA, Inc., Gymshark Ltd., Decathlon S.A., Mizuno Corporation, Fila Holdings Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam sports apparel and athleisure market is poised for significant growth, driven by increasing health awareness and rising disposable incomes. As e-commerce continues to expand, brands will need to adapt their strategies to leverage online platforms effectively. Additionally, the focus on sustainability and eco-friendly materials is expected to shape product development. Companies that can innovate and respond to consumer preferences will likely thrive in this dynamic market landscape, ensuring long-term success and profitability.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Athleisure Footwear Accessories Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Offline Retail Wholesale |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers |

| By Occasion | Sports Events Casual Wear Gym and Fitness |

| By Material | Synthetic Fabrics Natural Fabrics Blended Fabrics |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Apparel | 150 | Active Lifestyle Consumers, Athletes, Fitness Enthusiasts |

| Retail Insights from Sports Apparel Stores | 100 | Store Managers, Sales Representatives, Brand Ambassadors |

| Market Trends in Athleisure | 80 | Fashion Retail Analysts, Trend Forecasters, Marketing Executives |

| Supply Chain Perspectives in Sports Apparel | 70 | Logistics Managers, Procurement Officers, Warehouse Supervisors |

| Brand Perception Studies | 90 | Brand Managers, Marketing Directors, Consumer Insights Analysts |

The Vietnam Sports Apparel & Athleisure Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing health consciousness and the popularity of athleisure wear as everyday clothing.