Region:Asia

Author(s):Shubham

Product Code:KRAB6574

Pages:90

Published On:October 2025

By Type:The market is segmented into various types, including Performance Apparel, Casual Athleisure, Footwear, Accessories, Sports Equipment, Compression Wear, and Others. Among these, Performance Apparel is currently the leading subsegment, driven by the increasing participation in sports and fitness activities. Consumers are increasingly seeking high-quality, functional apparel that enhances performance, leading to a surge in demand for this category.

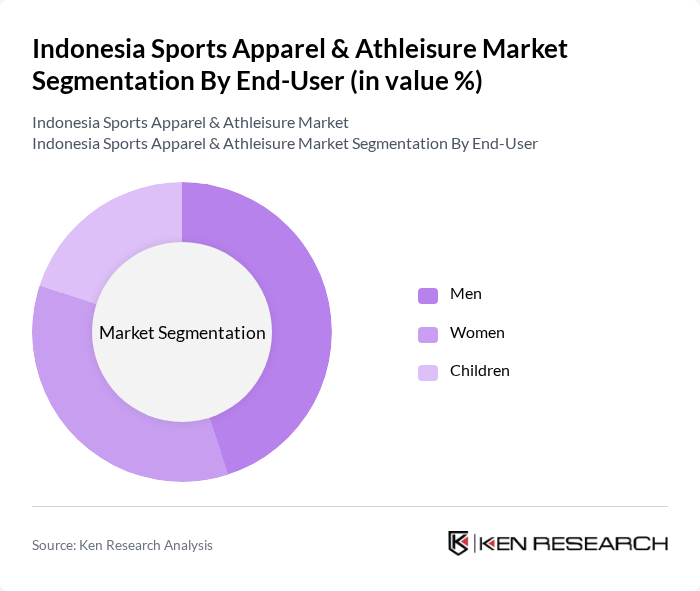

By End-User:The end-user segmentation includes Men, Women, and Children. The Men’s segment is currently the largest, driven by a growing trend of fitness and sports participation among males. This demographic is increasingly investing in high-performance apparel and footwear, reflecting a shift towards a more active lifestyle.

The Indonesia Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike Indonesia, Adidas Indonesia, Puma Indonesia, Reebok Indonesia, Under Armour Indonesia, Asics Indonesia, New Balance Indonesia, Skechers Indonesia, Fila Indonesia, Champion Indonesia, Lululemon Indonesia, Decathlon Indonesia, H&M Sportswear, ZALORA Sports, Alpinestars Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian sports apparel and athleisure market appears promising, driven by a growing emphasis on health and fitness among consumers. As the market adapts to evolving consumer preferences, brands are likely to invest in innovative designs and sustainable practices. Additionally, the integration of technology in apparel, such as smart fabrics, is expected to enhance user experience. The rise of social media influencers will further shape marketing strategies, creating new avenues for brand engagement and consumer interaction.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Athleisure Footwear Accessories Sports Equipment Compression Wear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Mid-range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers |

| By Material | Synthetic Fabrics Natural Fabrics Blended Fabrics |

| By Occasion | Sports Events Casual Wear Gym Wear Outdoor Activities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Apparel | 150 | Active Lifestyle Consumers, Athletes, Fitness Enthusiasts |

| Retail Insights on Athleisure Trends | 100 | Store Managers, Retail Buyers, Merchandisers |

| Brand Perception and Loyalty | 120 | Brand Loyal Customers, Casual Buyers, Influencers |

| Market Entry Barriers for New Brands | 80 | Entrepreneurs, Business Development Managers, Market Analysts |

| Impact of E-commerce on Sports Apparel Sales | 90 | E-commerce Managers, Digital Marketing Specialists, Logistics Coordinators |

The Indonesia Sports Apparel & Athleisure Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increased health consciousness, fitness activities, and the popularity of athleisure as a fashion choice among consumers.