Region:Europe

Author(s):Shubham

Product Code:KRAB6611

Pages:94

Published On:October 2025

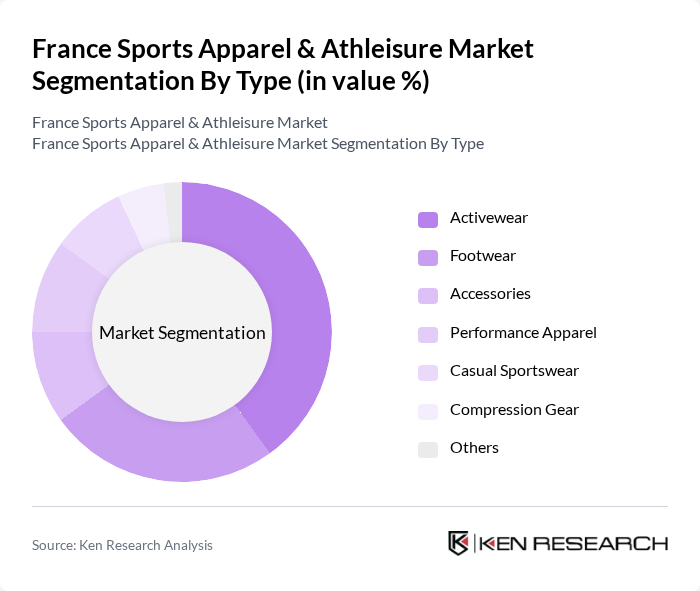

By Type:The market is segmented into various types, including Activewear, Footwear, Accessories, Performance Apparel, Casual Sportswear, Compression Gear, and Others. Activewear is currently the leading segment, driven by the increasing popularity of fitness activities and the trend of wearing sports clothing in casual settings. Footwear also holds a significant share, as consumers seek both functionality and style in their athletic shoes.

By End-User:The end-user segmentation includes Men, Women, and Children. The men's segment is currently the largest, driven by a growing interest in fitness and sports among men. Women’s participation in sports and fitness activities has also increased significantly, leading to a robust demand for women’s sports apparel. The children’s segment is growing as parents increasingly invest in quality sportswear for their kids.

The France Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Decathlon S.A., ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Columbia Sportswear Company, Lululemon Athletica Inc., The North Face, Inc., Fabletics, Inc., Gymshark Ltd., H&M Hennes & Mauritz AB, Li-Ning Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France sports apparel and athleisure market appears promising, driven by ongoing trends in health and wellness. As consumers continue to prioritize fitness, brands are likely to innovate in product offerings, focusing on sustainability and technology integration. Additionally, the expansion of e-commerce will facilitate greater access to diverse products, enhancing consumer engagement. Companies that adapt to these trends while addressing challenges will be well-positioned for growth in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Activewear Footwear Accessories Performance Apparel Casual Sportswear Compression Gear Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Discount Stores Direct Sales Others |

| By Price Range | Premium Mid-Range Budget |

| By Fabric Type | Cotton Polyester Nylon Spandex Others |

| By Occasion | Gym and Fitness Outdoor Activities Casual Wear Sports Events |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Sports Apparel | 150 | Active Consumers, Athletes, Fitness Enthusiasts |

| Retail Insights from Sports Apparel Stores | 100 | Store Managers, Sales Associates |

| Market Trends in Athleisure | 80 | Fashion Retail Buyers, Trend Analysts |

| Impact of Social Media on Sports Apparel Purchases | 120 | Social Media Influencers, Digital Marketers |

| Insights from Fitness Centers and Gyms | 90 | Gym Owners, Personal Trainers |

The France Sports Apparel & Athleisure Market is valued at approximately USD 15 billion, reflecting a significant growth trend driven by increasing health consciousness and the popularity of athleisure wear as everyday clothing.