Australia Sports Apparel & Athleisure Market Overview

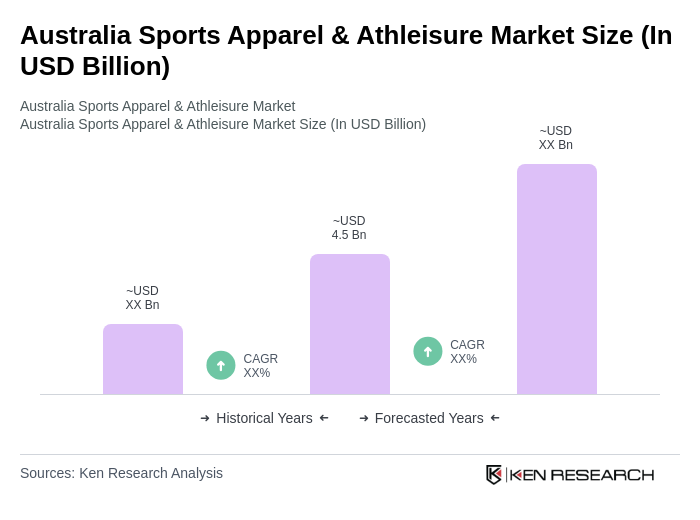

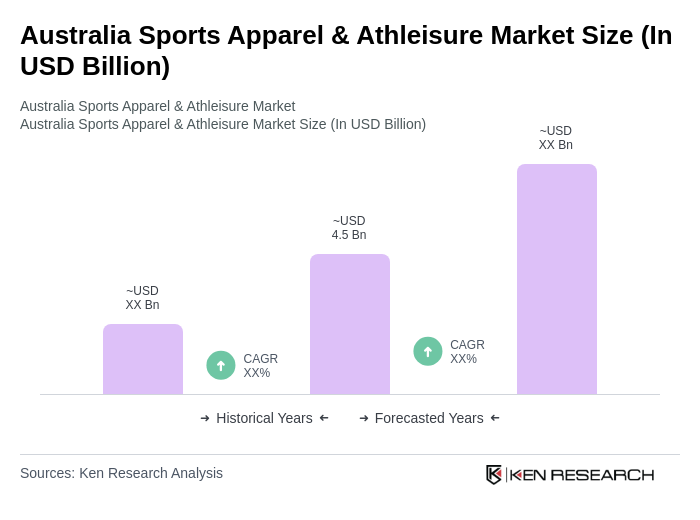

- The Australia Sports Apparel & Athleisure Market is valued at USD 4.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness, a rise in fitness activities, and the growing trend of athleisure wear among consumers. The market has seen a significant shift towards casual and comfortable clothing, which has further fueled demand for sports apparel and athleisure products.

- Key cities such as Sydney, Melbourne, and Brisbane dominate the market due to their large urban populations and active lifestyles. These cities have a high concentration of fitness centers, sports events, and outdoor activities, which contribute to the demand for sports apparel. Additionally, the presence of major retail outlets and e-commerce platforms in these urban areas enhances accessibility for consumers.

- In 2023, the Australian government implemented regulations aimed at promoting sustainable practices in the sports apparel industry. This includes guidelines for manufacturers to reduce waste and improve the recyclability of materials used in production. The initiative encourages brands to adopt eco-friendly practices, aligning with the growing consumer demand for sustainable products.

Australia Sports Apparel & Athleisure Market Segmentation

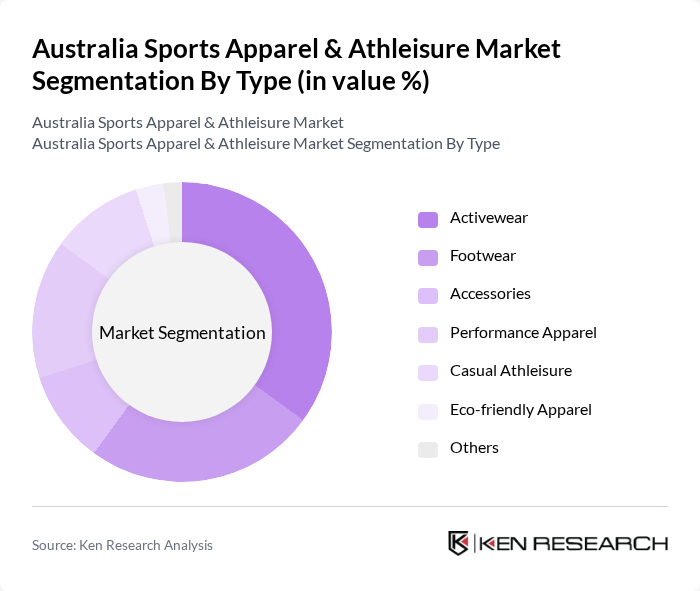

By Type:The market is segmented into various types, including Activewear, Footwear, Accessories, Performance Apparel, Casual Athleisure, Eco-friendly Apparel, and Others. Among these, Activewear is the leading sub-segment, driven by the increasing participation in fitness activities and sports. Consumers are increasingly seeking high-performance clothing that offers comfort and functionality, which has led to a surge in demand for this category.

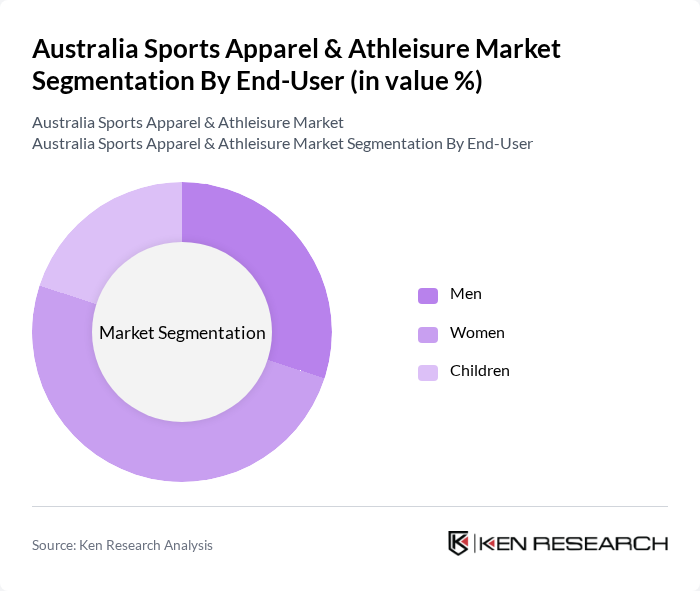

By End-User:The market is segmented by end-user into Men, Women, and Children. The Women’s segment is currently the dominant category, reflecting the growing trend of women participating in sports and fitness activities. This shift is supported by targeted marketing campaigns and the introduction of stylish and functional apparel designed specifically for women.

Australia Sports Apparel & Athleisure Market Competitive Landscape

The Australia Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Under Armour, Inc., Lululemon Athletica Inc., Puma SE, ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Champion Athleticwear, Fabletics, Inc., Gymshark Ltd., The North Face, Inc., Columbia Sportswear Company, Decathlon S.A., Athleta, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Australia Sports Apparel & Athleisure Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness:The Australian population is increasingly prioritizing health and fitness, with 67% of adults engaging in regular physical activity as of 2023. This trend is supported by the Australian Institute of Health and Welfare, which reported that 55% of Australians aged 18-64 are meeting the recommended physical activity guidelines. This growing health consciousness drives demand for sports apparel, as consumers seek functional and stylish clothing that supports their active lifestyles.

- Rise of Athleisure Fashion Trends:Athleisure has become a dominant fashion trend in Australia, with the market for athleisure apparel projected to reach AUD 1.5 billion in the future. According to IBISWorld, the segment has seen a 20% increase in sales over the past three years, driven by the blending of comfort and style. This trend is particularly popular among millennials and Gen Z, who prioritize versatile clothing that can transition from workouts to casual outings, further fueling market growth.

- Expansion of E-commerce Platforms:E-commerce sales in the Australian sports apparel sector reached AUD 800 million in 2023, reflecting a 30% increase from the previous year. The rise of online shopping, accelerated by the COVID-19 pandemic, has made sports apparel more accessible to consumers. According to the Australian Bureau of Statistics, online retail sales accounted for 16% of total retail sales in 2023, indicating a significant shift in consumer purchasing behavior that benefits the sports apparel market.

Market Challenges

- Intense Competition Among Brands:The Australian sports apparel market is characterized by fierce competition, with over 200 brands vying for market share. Major players like Nike, Adidas, and Lululemon dominate, but numerous local brands are emerging, intensifying price wars and marketing efforts. According to MarketLine, the competitive landscape is expected to lead to reduced profit margins, as brands invest heavily in advertising and promotions to attract consumers in a crowded marketplace.

- Fluctuating Raw Material Prices:The sports apparel industry faces challenges from volatile raw material prices, particularly cotton and synthetic fibers. In the future, cotton prices surged by 15% due to supply chain disruptions and adverse weather conditions. The Australian Bureau of Agricultural and Resource Economics and Sciences reported that these fluctuations can significantly impact production costs, forcing brands to either absorb costs or pass them on to consumers, which may affect sales and profitability.

Australia Sports Apparel & Athleisure Market Future Outlook

The future of the Australian sports apparel and athleisure market appears promising, driven by ongoing trends in health consciousness and fashion. As consumers increasingly seek multifunctional clothing, brands are likely to innovate with sustainable materials and technology integration. Additionally, the rise of social media influencers will continue to shape consumer preferences, encouraging brands to engage in targeted marketing strategies. The market is expected to adapt to these trends, ensuring sustained growth and relevance in a dynamic retail environment.

Market Opportunities

- Growth in Online Retailing:The shift towards online shopping presents a significant opportunity for sports apparel brands. With e-commerce sales projected to grow by 25% in the future, companies can leverage digital platforms to reach a broader audience. Enhanced online marketing strategies and user-friendly websites can facilitate this growth, allowing brands to capitalize on the increasing consumer preference for convenient shopping experiences.

- Increasing Demand for Sustainable Products:As environmental awareness rises, consumers are increasingly seeking sustainable sports apparel. A report by the Australian Fashion Council indicates that 40% of consumers are willing to pay more for eco-friendly products. This trend presents an opportunity for brands to innovate with sustainable materials and practices, potentially capturing a loyal customer base that prioritizes ethical consumption in their purchasing decisions.