Region:Asia

Author(s):Rebecca

Product Code:KRAB2864

Pages:94

Published On:October 2025

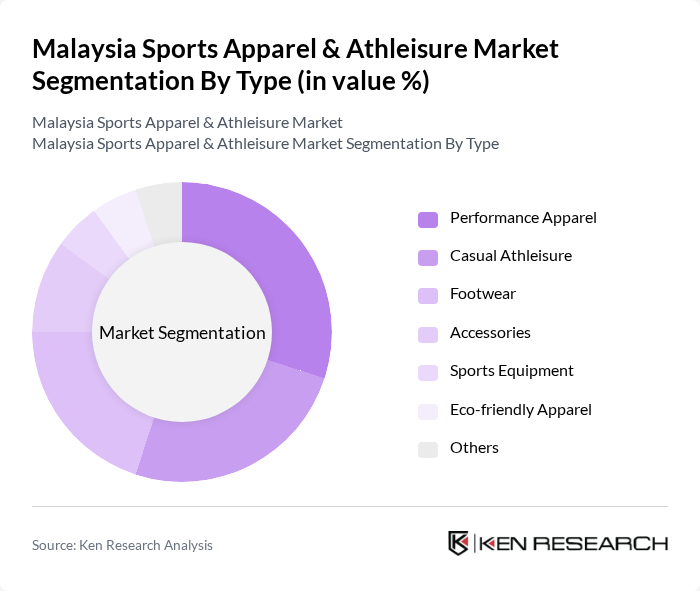

By Type:The market is segmented into various types, including Performance Apparel, Casual Athleisure, Footwear, Accessories, Sports Equipment, Eco-friendly Apparel, and Others. Among these, Performance Apparel is gaining traction due to the increasing participation in sports and fitness activities, while Casual Athleisure is popular for its versatility and comfort in everyday wear.

By End-User:The end-user segmentation includes Men, Women, and Children. The market is predominantly driven by the male demographic, which shows a higher inclination towards performance and sports-related apparel. However, the female segment is rapidly growing, fueled by the increasing popularity of athleisure and fitness activities among women.

The Malaysia Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Skechers USA, Inc., Fila Holdings Corp., Columbia Sportswear Company, Mizuno Corporation, Champion Athleticwear, H&M Group, Decathlon S.A., Diadora S.p.A., Everlast Worldwide, Inc., CFBRAZIL Sportswear contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian sports apparel and athleisure market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with smart fabrics and sustainable materials. Additionally, the increasing integration of e-commerce platforms will facilitate broader access to diverse product offerings, enhancing consumer engagement. The market is expected to adapt to these trends, positioning itself for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Casual Athleisure Footwear Accessories Sports Equipment Eco-friendly Apparel Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Supermarkets/Hypermarkets Direct Sales Others |

| By Price Range | Budget Mid-range Premium |

| By Occasion | Sports Activities Casual Wear Gym and Fitness |

| By Material | Cotton Polyester Nylon Blends |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers Trend-driven Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Athleisure | 100 | Fitness Enthusiasts, Casual Athleisure Buyers |

| Retail Insights on Sports Apparel | 60 | Store Managers, Sales Associates |

| Brand Perception Studies | 50 | Marketing Executives, Brand Managers |

| Online Shopping Behavior | 80 | eCommerce Shoppers, Digital Marketing Analysts |

| Trends in Fitness Participation | 40 | Fitness Trainers, Gym Owners |

The Malaysia Sports Apparel & Athleisure Market is valued at approximately USD 3.2 billion, reflecting a significant growth trend driven by increased health consciousness and the popularity of athleisure wear as everyday clothing.