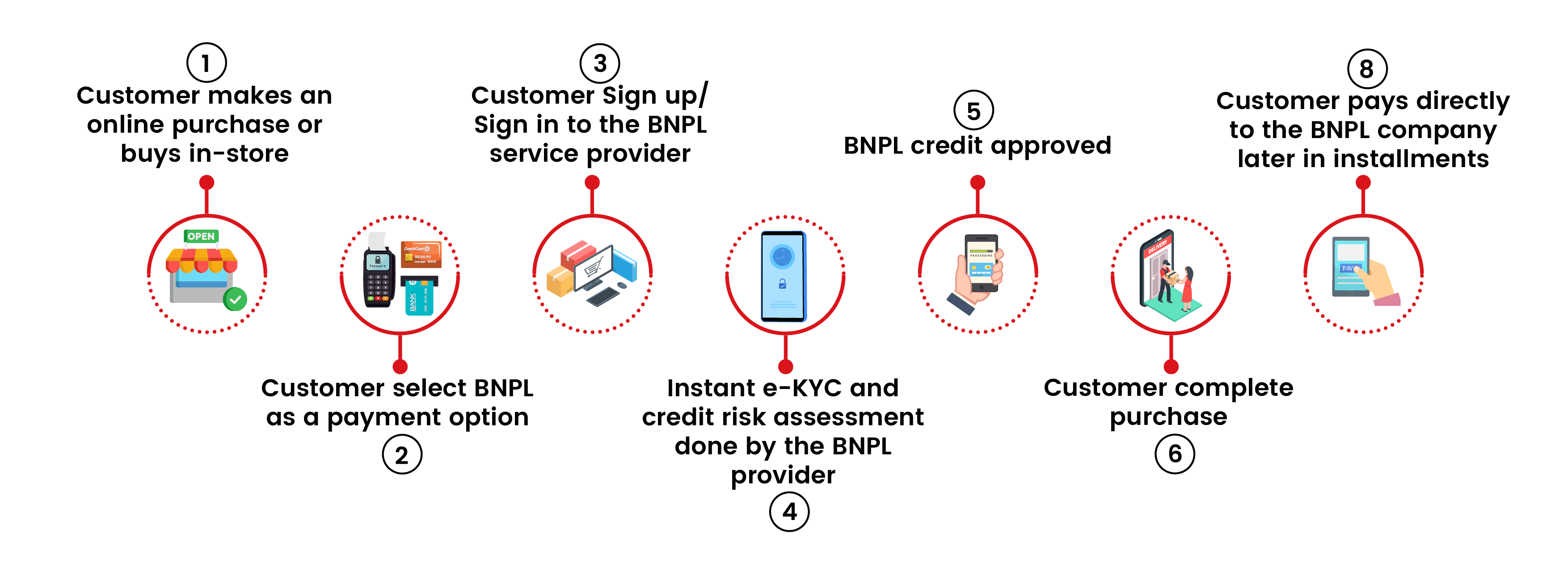

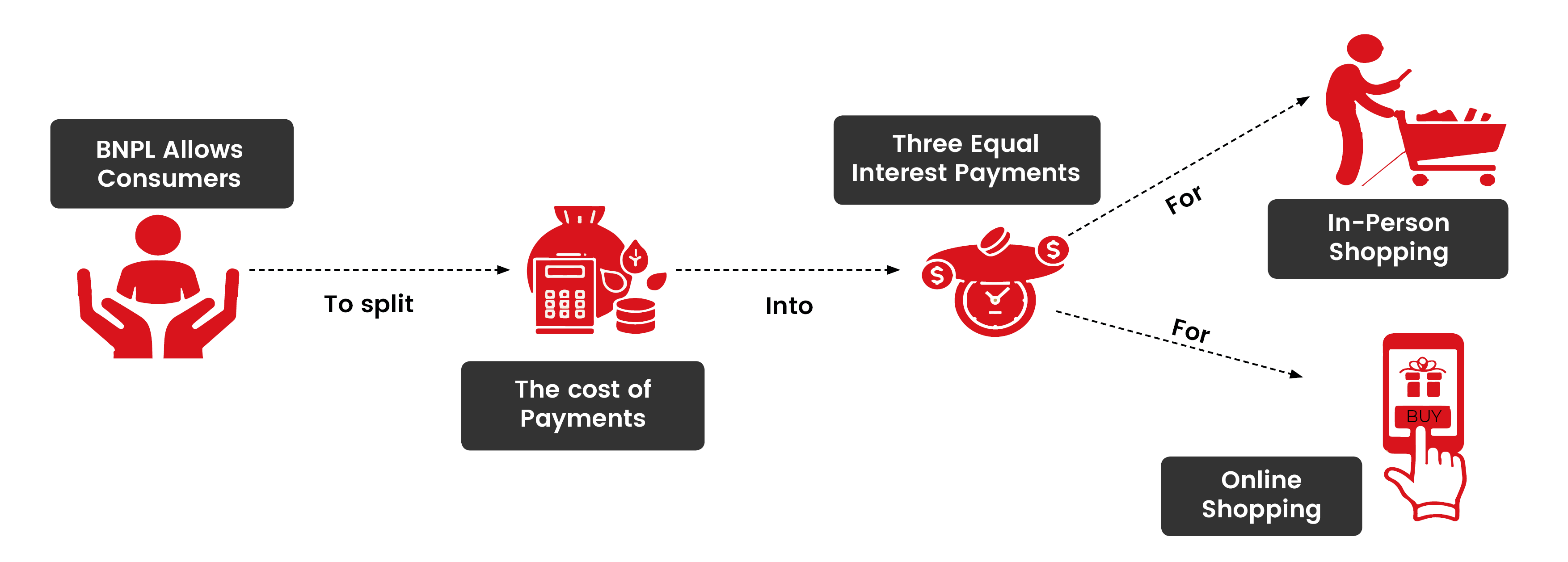

The FinTech sector has been at the forefront of financial innovation and the new form of lending and payment option Buy Now Pay Later (BNPL) is the new evolution-changing dynamics in the payments ecosystem. Though the market is at a nascent stage globally as well as in Saudi Arabia, early signs signify a promising future where it could capture the largest market share among payment methods.

Integrated Shopping apps and Off-card financing solutions are business models in the BNPL space that have seen high adoption rates across the globe.

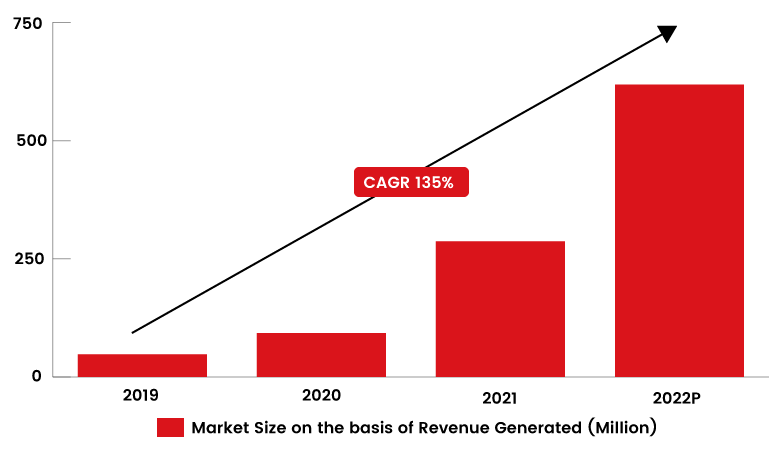

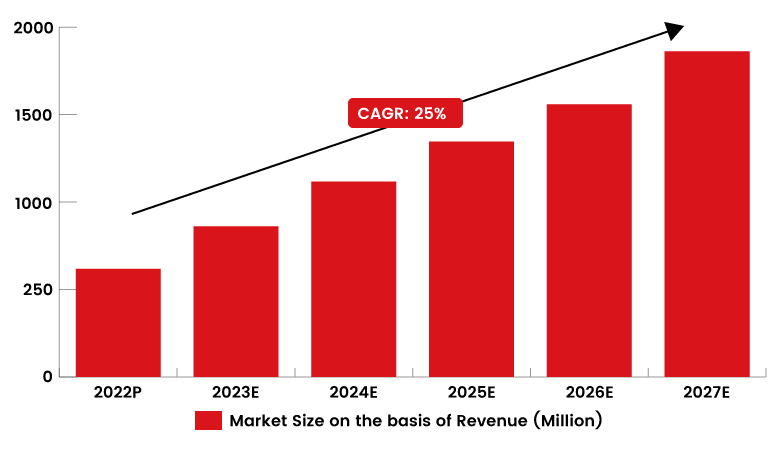

Buy Now Pay Later industry has gained huge traction in KSA due to easy credit checks which are solely not based upon the CIBIL score, unlike credit cards. As per report, it has expanded at a CAGR of 135% between 2019 and 2022P.

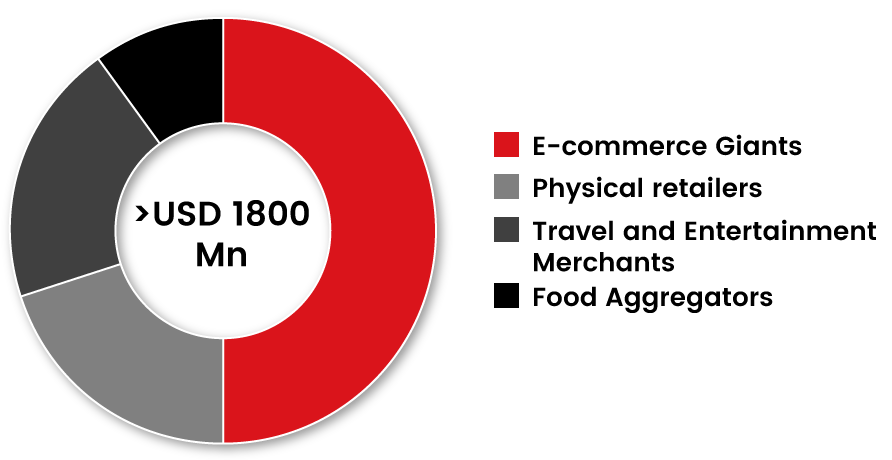

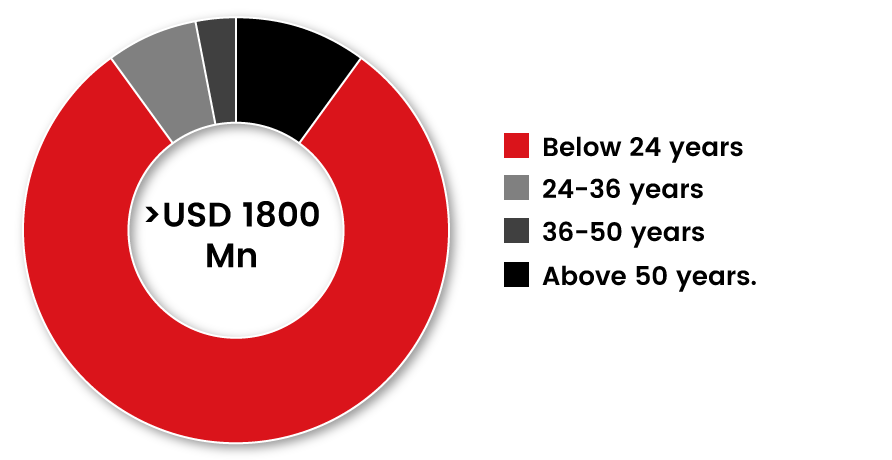

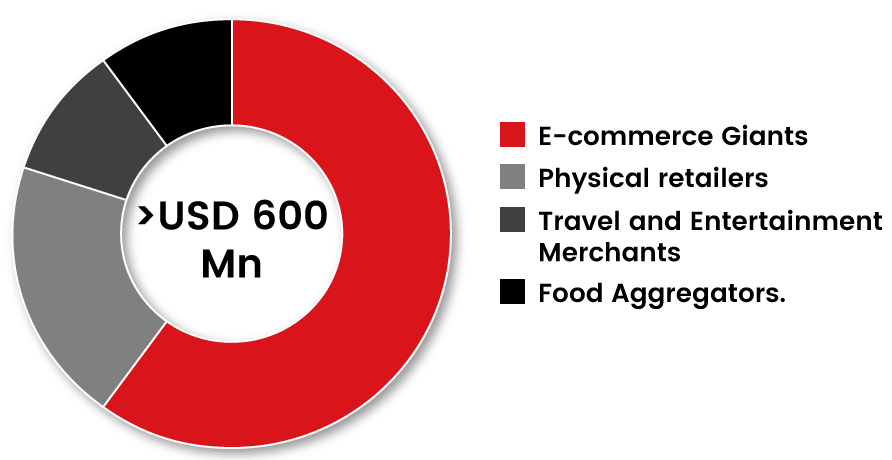

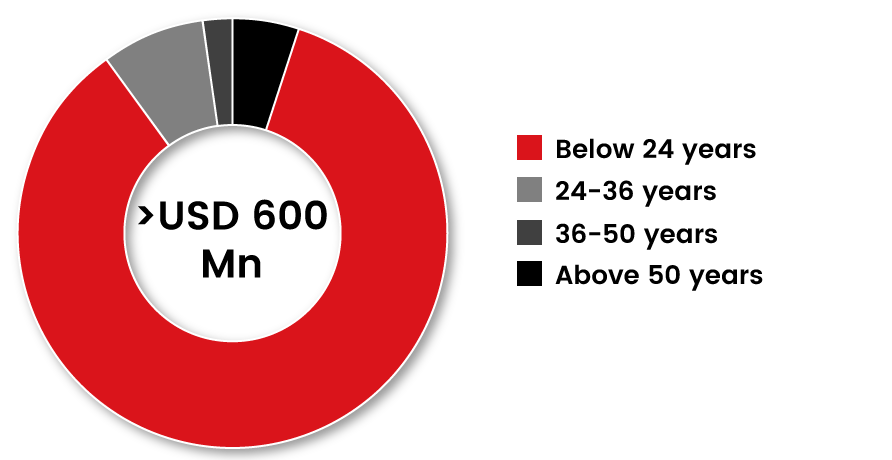

Around 60% of the revenue share is captured alone by e-commerce Giants in KSA in 2022P. Gen Z and the millennials remain the first ones to adopt this service due to fewer barriers to adoption, lower fees, and a seamless user experience

With increasing demand for extra credit line with less stringent KYC procedures, the Buy Now Pay Later market in KSA is expected to expand at a CAGR of 25% between 2022P and 2027E

Revenue generated from e-commerce giants will continue to account for the majority share by around 50% in 2027E. Additionally, a gradual increase in the contribution of below 24 years of age group in market share is also forecasted.