Region:Asia

Author(s):Dev

Product Code:KRAE0253

Pages:84

Published On:December 2025

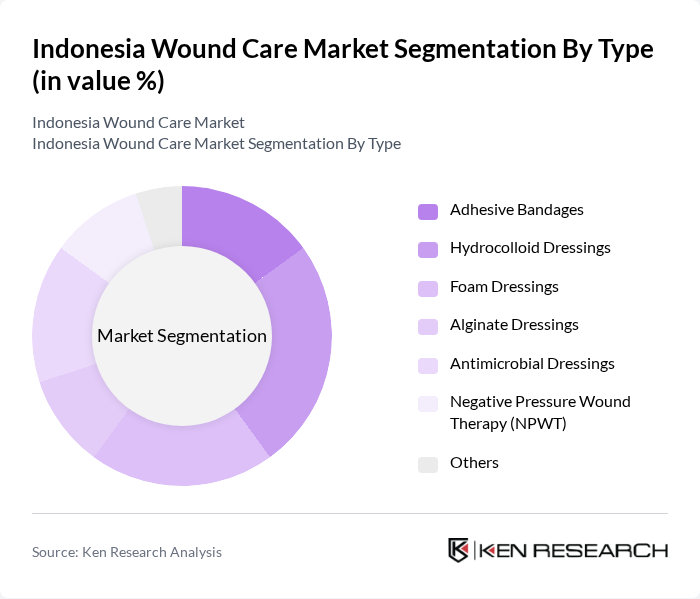

By Type:The wound care market is segmented into various types, including adhesive bandages, hydrocolloid dressings, foam dressings, alginate dressings, antimicrobial dressings, negative pressure wound therapy (NPWT), and others. Among these, hydrocolloid dressings are gaining traction due to their moisture-retentive properties, which promote faster healing and are preferred for chronic wounds. The increasing awareness of advanced wound care solutions is driving the demand for these products, particularly in urban healthcare settings.

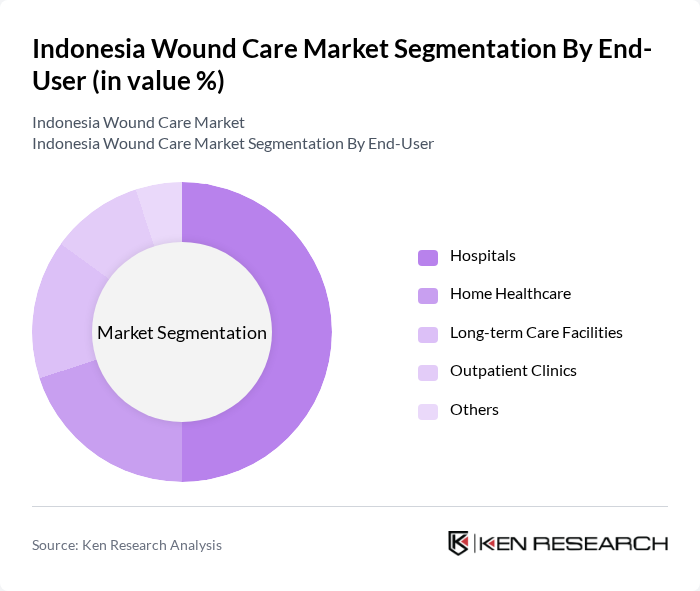

By End-User:The end-user segmentation includes hospitals, home healthcare, long-term care facilities, outpatient clinics, and others. Hospitals dominate the market due to their advanced facilities and the high volume of surgical procedures performed, which necessitate effective wound management solutions. The increasing number of hospitals and healthcare facilities in urban areas is further driving the demand for advanced wound care products.

The Indonesia Wound Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Smith & Nephew, 3M, Medtronic, B. Braun, Coloplast, ConvaTec, Mölnlycke Health Care, Hartmann Group, Derma Sciences, Acelity, Medline Industries, Ethicon, Systagenix, and Winner Medical contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia wound care market appears promising, driven by technological advancements and increased healthcare investments. The integration of digital health solutions is expected to enhance wound management efficiency, while the growing geriatric population will further boost demand for specialized care. Additionally, the government's commitment to improving healthcare access will likely facilitate the introduction of innovative products, ultimately leading to better patient outcomes and market expansion in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Adhesive Bandages Hydrocolloid Dressings Foam Dressings Alginate Dressings Antimicrobial Dressings Negative Pressure Wound Therapy (NPWT) Others |

| By End-User | Hospitals Home Healthcare Long-term Care Facilities Outpatient Clinics Others |

| By Application | Surgical Wounds Chronic Wounds Traumatic Wounds Burn Wounds Others |

| By Distribution Channel | Retail Pharmacies Online Pharmacies Direct Sales Hospitals and Clinics Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Product Formulation | Liquid Formulations Gel Formulations Powder Formulations Others |

| By Policy Support | Subsidies for Wound Care Products Tax Exemptions for Manufacturers Government Grants for Research Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 100 | Wound Care Specialists, Department Heads |

| Pharmaceutical Distributors | 80 | Sales Managers, Distribution Coordinators |

| Private Clinics and Practices | 70 | General Practitioners, Dermatologists |

| Healthcare Policy Makers | 50 | Health Ministry Officials, Policy Analysts |

| Patient Advocacy Groups | 60 | Patient Representatives, Community Health Workers |

The Indonesia Wound Care Market is valued at approximately USD 110 billion, driven by the increasing prevalence of chronic conditions such as diabetes and obesity, which heightens the demand for advanced wound care solutions.