Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB6369

Pages:92

Published On:October 2025

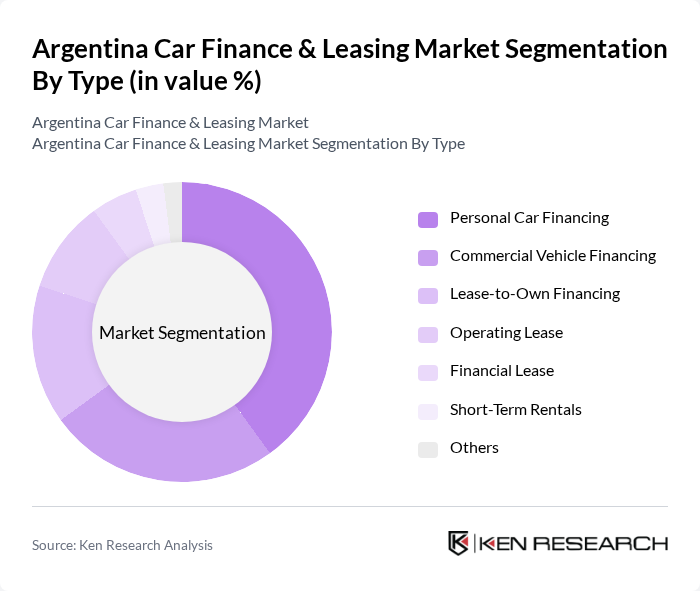

By Type:The market is segmented into various types of financing options, including Personal Car Financing, Commercial Vehicle Financing, Lease-to-Own Financing, Operating Lease, Financial Lease, Short-Term Rentals, and Others. Among these, Personal Car Financing is the most dominant segment, driven by the increasing number of individual consumers seeking affordable vehicle ownership solutions. The trend towards personal mobility, especially in urban areas, has led to a surge in demand for personal car loans and financing options.

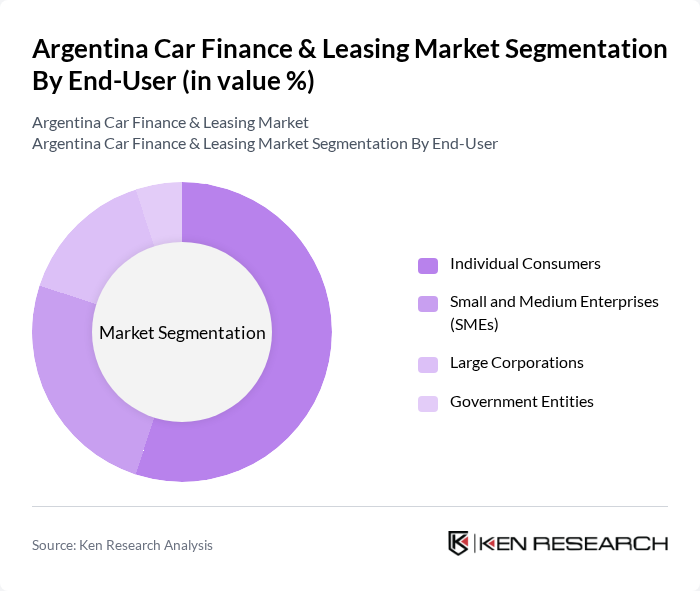

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Consumers represent the largest segment, as the growing middle class in Argentina increasingly opts for personal vehicles. The rise in disposable income and changing consumer preferences towards personal mobility have significantly contributed to the growth of this segment.

The Argentina Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco Santander Río, Banco Galicia, BBVA Argentina, Citibank N.A., Volkswagen Financial Services, Renault Credit, Toyota Financial Services, Ford Credit, Banco de la Nación Argentina, Cetelem Argentina, Banco Macro, Scotiabank Argentina, HSBC Argentina, Creditea, CrediAuto contribute to innovation, geographic expansion, and service delivery in this space.

The Argentina car finance and leasing market is poised for transformation in the coming years, driven by technological advancements and evolving consumer preferences. The shift towards digital financing platforms is expected to streamline loan applications, enhancing customer experience. Additionally, the rise of subscription-based leasing models will cater to younger consumers seeking flexibility. As sustainability becomes a priority, financing solutions for electric vehicles will gain traction, supported by government incentives and consumer demand for greener options, ultimately reshaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Financing Commercial Vehicle Financing Lease-to-Own Financing Operating Lease Financial Lease Short-Term Rentals Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Financing Type | Secured Loans Unsecured Loans Leasing Options |

| By Vehicle Type | Sedans SUVs Trucks Electric Vehicles |

| By Duration of Financing | Short-Term Financing Medium-Term Financing Long-Term Financing |

| By Payment Structure | Fixed Payments Variable Payments Balloon Payments |

| By Region | Buenos Aires Cordoba Mendoza Rosario Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 150 | Car Buyers, Financial Advisors |

| Leasing Company Insights | 100 | Leasing Managers, Financial Analysts |

| Dealership Financing Practices | 80 | Dealership Owners, Sales Managers |

| Consumer Preferences in Leasing | 120 | Potential Lessees, Market Researchers |

| Impact of Economic Factors on Financing | 90 | Economists, Financial Planners |

The Argentina Car Finance & Leasing Market is valued at approximately USD 5 billion, reflecting a significant increase driven by rising consumer demand for vehicles and favorable financing options from financial institutions.