Region:Central and South America

Author(s):Rebecca

Product Code:KRAA4815

Pages:100

Published On:September 2025

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Facility Management (IFM), Specialized Services, and Others. Each of these segments plays a crucial role in addressing the diverse needs of clients across different sectors. Hard Services encompass building maintenance, HVAC, electrical, and plumbing, which are essential for operational continuity and compliance with safety standards. Soft Services include cleaning, security, landscaping, and waste management, supporting the overall environment and safety of facilities. Integrated Facility Management combines multiple service lines for streamlined operations, while Specialized Services focus on energy management and sustainability consulting. The Others category covers ancillary services such as catering, mailroom, and document management.

The Hard Services segment is currently dominating the market due to the essential nature of maintenance and repair services in ensuring operational efficiency for buildings. This includes critical services such as HVAC, plumbing, and electrical maintenance, which are necessary for the safety and functionality of facilities. The increasing complexity of building systems and the need for compliance with safety regulations further drive the demand for these services. As businesses prioritize operational continuity, the reliance on hard services is expected to remain strong.

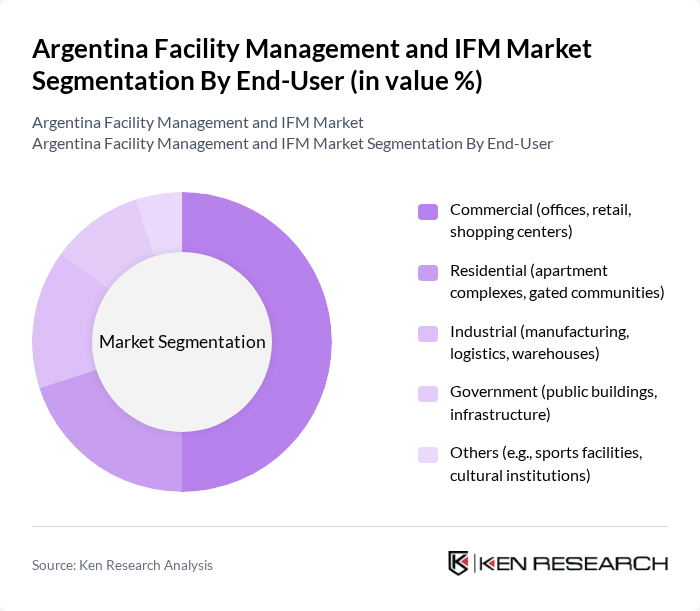

By End-User:The facility management market is segmented by end-user into Commercial, Residential, Industrial, Government, and Others. Each segment reflects the specific needs and requirements of different sectors. The Commercial segment includes offices, retail, and shopping centers, requiring robust facility management for high-traffic environments. Residential covers apartment complexes and gated communities, focusing on safety and comfort. Industrial comprises manufacturing, logistics, and warehouses, demanding specialized maintenance and compliance. Government includes public buildings and infrastructure, while Others represent sports facilities and cultural institutions.

The Commercial segment leads the market, driven by the high demand for facility management services in office buildings, retail spaces, and shopping centers. As businesses increasingly focus on enhancing customer experiences and operational efficiency, the need for professional facility management services has surged. This segment benefits from the growing trend of outsourcing non-core functions, allowing companies to concentrate on their primary business activities while ensuring their facilities are well-managed and maintained.

The Argentina Facility Management and IFM Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services Argentina, Sodexo Argentina, Grupo Prosegur, JLL Argentina, CBRE Argentina, G4S Argentina, Atalian Global Services Argentina, OHL Servicios Inmobiliarios, Grupo Eulen Argentina, Cushman & Wakefield Argentina, Axxon Group, Facility Service S.A., Facility Argentina, Acciona Facility Services Argentina, Grupo Sancor Seguros contribute to innovation, geographic expansion, and service delivery in this space.

The Argentina facility management market is poised for transformation as urbanization and technological advancements reshape the landscape. In future, the integration of smart technologies and a focus on sustainability will drive demand for innovative facility management solutions. Companies will increasingly prioritize energy efficiency and health standards, aligning with global trends. As the market evolves, service providers must adapt to these changes, leveraging technology to enhance service delivery and meet the growing expectations of clients.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (e.g., building maintenance, HVAC, electrical, plumbing) Soft Services (e.g., cleaning, security, landscaping, waste management) Integrated Facility Management (IFM) Specialized Services (e.g., energy management, sustainability consulting) Others (e.g., catering, mailroom, document management) |

| By End-User | Commercial (offices, retail, shopping centers) Residential (apartment complexes, gated communities) Industrial (manufacturing, logistics, warehouses) Government (public buildings, infrastructure) Others (e.g., sports facilities, cultural institutions) |

| By Service Model | Outsourced Facility Management In-House Facility Management Hybrid Model |

| By Region | Buenos Aires Córdoba Mendoza Rosario Others (e.g., Santa Fe, Tucumán) |

| By Sector | Healthcare (hospitals, clinics) Education (schools, universities) Retail (shopping malls, supermarkets) Hospitality (hotels, resorts) Others (transportation, entertainment) |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts |

| By Investment Source | Domestic Investment Foreign Direct Investment Public-Private Partnerships Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Management | 100 | Facility Managers, Property Owners |

| Corporate Office Facilities | 60 | Office Managers, HR Managers |

| Healthcare Facility Management | 50 | Healthcare Administrators, Facility Managers |

| Educational Institution Facilities | 40 | Campus Facility Managers, Administrative Officers |

| Retail Space Management | 45 | Retail Operations Managers, Store Managers |

The Argentina Facility Management and IFM Market is valued at approximately USD 7 billion, driven by the increasing demand for efficient building management solutions, rapid urbanization, and the expansion of commercial and residential infrastructure.