Region:Asia

Author(s):Geetanshi

Product Code:KRAA4172

Pages:90

Published On:January 2026

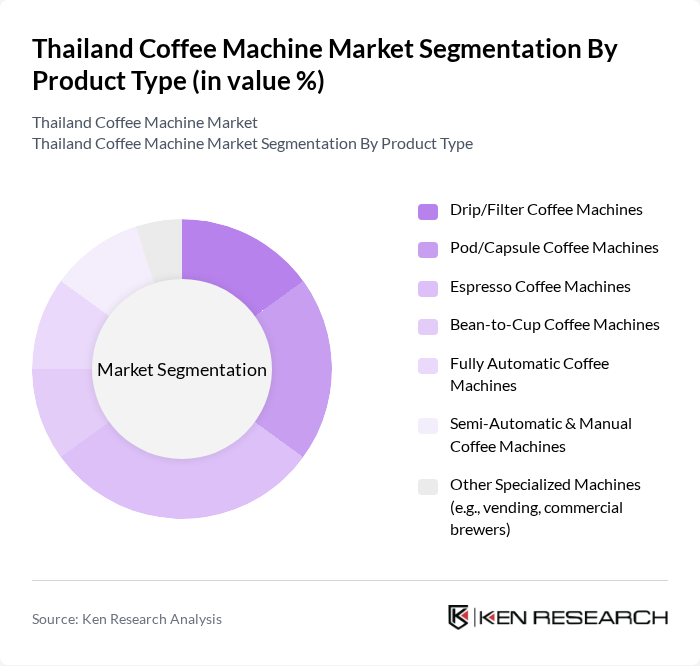

By Product Type:The product type segmentation includes various coffee machine categories that cater to different consumer preferences and usage scenarios. The subsegments are Drip/Filter Coffee Machines, Pod/Capsule Coffee Machines, Espresso Coffee Machines, Bean-to-Cup Coffee Machines, Fully Automatic Coffee Machines, Semi-Automatic & Manual Coffee Machines, and Other Specialized Machines (e.g., vending, commercial brewers). Among these, the Espresso Coffee Machines segment is currently one of the leading categories, supported by the growing popularity of espresso-based beverages and the increasing penetration of fully automatic and semi-automatic machines in both residential and commercial settings.

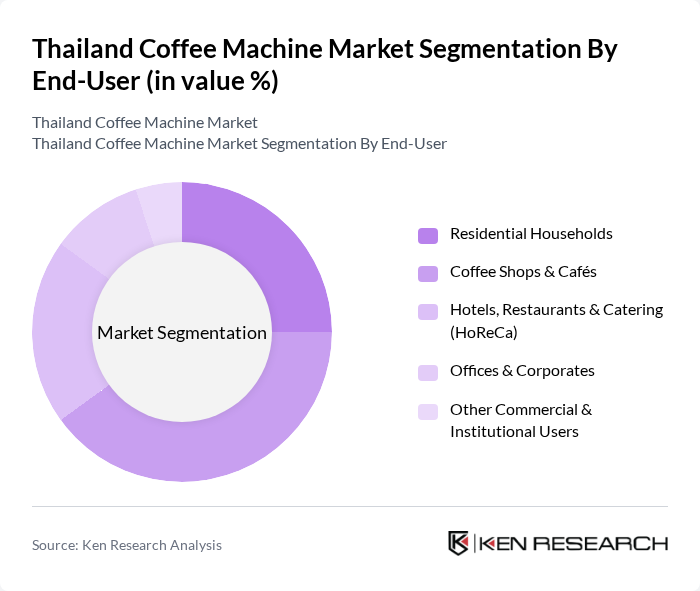

By End-User:The end-user segmentation encompasses various consumer categories, including Residential Households, Coffee Shops & Cafés, Hotels, Restaurants & Catering (HoReCa), Offices & Corporates, and Other Commercial & Institutional Users. The Coffee Shops & Cafés segment is currently a dominant end-user category, driven by the increasing number of branded chains, specialty cafés, and independent coffee shops, as well as sustained out-of-home coffee consumption among urban consumers and tourists.

The Thailand Coffee Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Breville Group Limited, De'Longhi S.p.A., Koninklijke Philips N.V., Nestlé Nespresso S.A., Krups (Groupe SEB), Cuisinart (Conair Corporation), Hamilton Beach Brands Holding Company, JURA Elektroapparate AG, Rancilio Group S.p.A., Saeco (Philips), Gaggia (Philips), Smeg S.p.A., Miele & Cie. KG, La Marzocco International, LLC, and local players like Boncafé Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand coffee machine market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As urbanization continues, with over 50% of the population living in urban areas in future, the demand for convenient coffee solutions will rise. Additionally, the increasing focus on sustainability will likely lead to innovations in eco-friendly coffee machines. The integration of IoT technology will further enhance user experience, making coffee preparation more efficient and personalized, thus attracting a broader consumer base.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drip/Filter Coffee Machines Pod/Capsule Coffee Machines Espresso Coffee Machines Bean-to-Cup Coffee Machines Fully Automatic Coffee Machines Semi-Automatic & Manual Coffee Machines Other Specialized Machines (e.g., vending, commercial brewers) |

| By End-User | Residential Households Coffee Shops & Cafés Hotels, Restaurants & Catering (HoReCa) Offices & Corporates Other Commercial & Institutional Users |

| By Price Range | Economy (< THB X) Mid-Range (THB X–Y) Premium (THB Y–Z) Luxury (> THB Z) |

| By Distribution Channel | Multi-brand Stores Specialty Coffee & Appliance Stores Online Retail & Marketplaces Other Channels (direct sales, B2B distributors) |

| By Mode of Operation | Manual Semi-Automatic Fully Automatic Smart/Connected (IoT-enabled) |

| By Application Environment | Home Use Professional/Commercial Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Coffee Machine Users | 120 | Café Owners, Restaurant Managers |

| Home Coffee Machine Consumers | 100 | Home Baristas, Coffee Enthusiasts |

| Retail Coffee Machine Sellers | 80 | Store Managers, Sales Representatives |

| Importers of Coffee Machines | 60 | Import Managers, Supply Chain Coordinators |

| Industry Experts and Analysts | 40 | Market Analysts, Coffee Industry Consultants |

The Thailand Coffee Machine Market is valued at approximately USD 95 million, reflecting a significant growth trend driven by increasing coffee consumption and the expansion of modern retail and café outlets across urban areas.