Region:Global

Author(s):Rebecca

Product Code:KRAE2745

Pages:100

Published On:February 2026

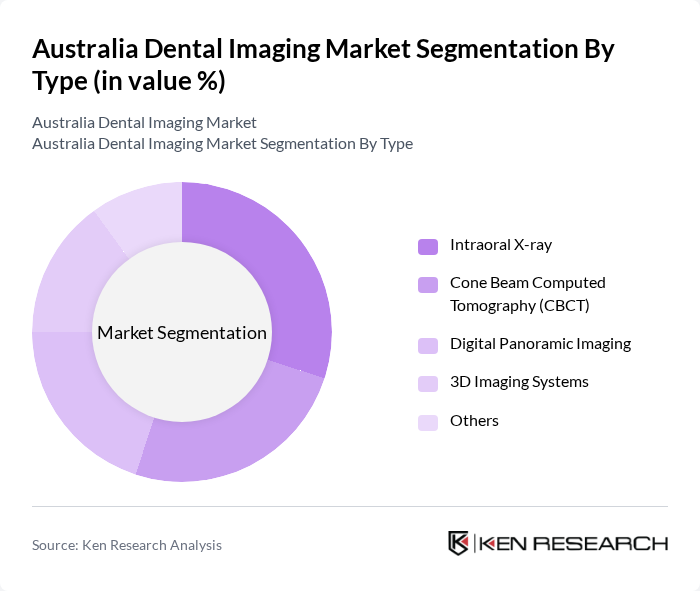

By Type:The market can be segmented into various types of dental imaging technologies, including Intraoral X-ray, Cone Beam Computed Tomography (CBCT), Digital Panoramic Imaging, 3D Imaging Systems, and Others. Each of these technologies serves specific diagnostic and treatment planning needs, catering to the diverse requirements of dental professionals.

The Intraoral X-ray segment is currently dominating the market due to its widespread use in dental practices for routine examinations and diagnostics. This technology is favored for its cost-effectiveness, ease of use, and ability to provide immediate results. Additionally, the increasing adoption of digital X-ray systems enhances image quality and reduces radiation exposure, making it a preferred choice among dental professionals. The growing trend towards preventive dental care further supports the demand for intraoral X-ray imaging.

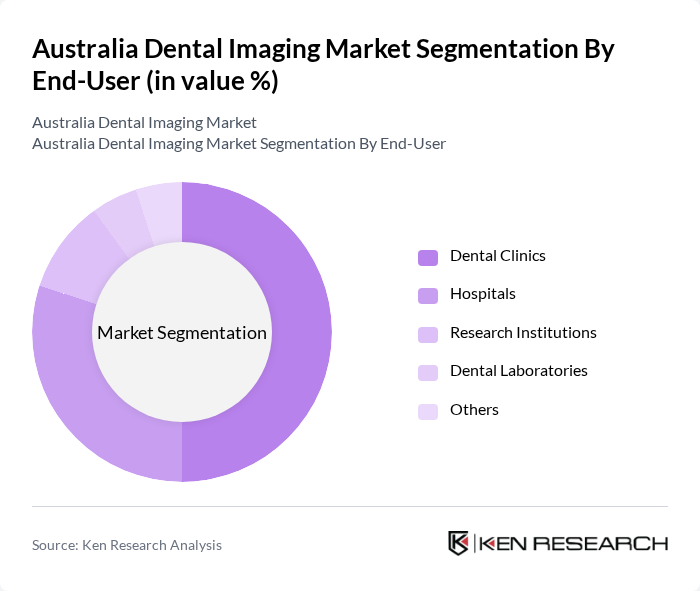

By End-User:The market is segmented based on end-users, including Dental Clinics, Hospitals, Research Institutions, Dental Laboratories, and Others. Each segment plays a crucial role in the overall demand for dental imaging solutions, with varying needs and applications.

Dental Clinics represent the largest end-user segment in the market, driven by the increasing number of dental practices and the growing emphasis on preventive care. These clinics require efficient and accurate imaging solutions to enhance patient diagnosis and treatment planning. The trend towards digitalization in dental practices further propels the demand for advanced imaging technologies, making dental clinics a key player in the dental imaging market.

The Australia Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sirona Dental Systems, Carestream Health, Planmeca, 3Shape, Vatech, Dentsply Sirona, GE Healthcare, Canon Medical Systems, Fujifilm Medical Systems, Agfa HealthCare, Xoran Technologies, Carestream Dental, Midmark Corporation, KaVo Kerr, MyRay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental imaging market in Australia appears promising, driven by ongoing technological advancements and a growing emphasis on preventive care. As tele-dentistry gains traction, more patients will have access to diagnostic services, particularly in underserved areas. Additionally, the integration of artificial intelligence in imaging is expected to enhance diagnostic accuracy and efficiency. These trends indicate a shift towards more accessible and patient-centered dental care, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Intraoral X-ray Cone Beam Computed Tomography (CBCT) Digital Panoramic Imaging D Imaging Systems Others |

| By End-User | Dental Clinics Hospitals Research Institutions Dental Laboratories Others |

| By Application | Diagnostic Imaging Treatment Planning Surgical Guidance Orthodontics Others |

| By Technology | Digital Radiography Computed Tomography Magnetic Resonance Imaging Ultrasound Imaging Others |

| By Region | New South Wales Victoria Queensland Western Australia Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Pricing Model | Pay-per-use Subscription-based Bundled Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 150 | Dentists, Clinic Owners |

| Radiology Centers | 100 | Radiologists, Imaging Technicians |

| Dental Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Dental Associations | 50 | Policy Makers, Industry Experts |

| Research Institutions | 70 | Researchers, Academic Professionals |

The Australia Dental Imaging Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advancements in imaging technologies, increased awareness of oral health, and a rising prevalence of dental diseases.