Region:Asia

Author(s):Rebecca

Product Code:KRAE2746

Pages:85

Published On:February 2026

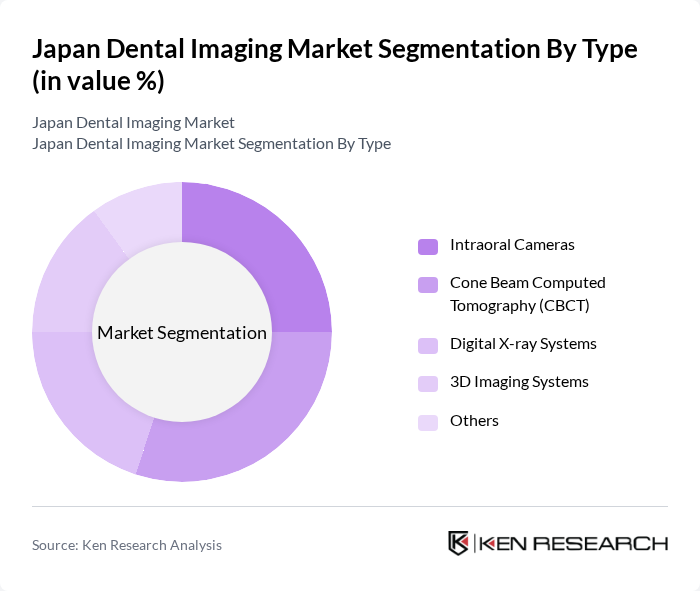

By Type:The market is segmented into various types of dental imaging technologies, including Intraoral Cameras, Cone Beam Computed Tomography (CBCT), Digital X-ray Systems, 3D Imaging Systems, and Others. Each of these technologies plays a crucial role in enhancing diagnostic capabilities and treatment planning in dental practices.

The dominant subsegment in the market is Cone Beam Computed Tomography (CBCT), which is favored for its ability to provide detailed 3D images of dental structures. This technology is increasingly adopted due to its precision in diagnosing complex dental issues, making it a preferred choice among dental professionals. The growing trend towards minimally invasive procedures and the need for accurate treatment planning further bolster the demand for CBCT systems.

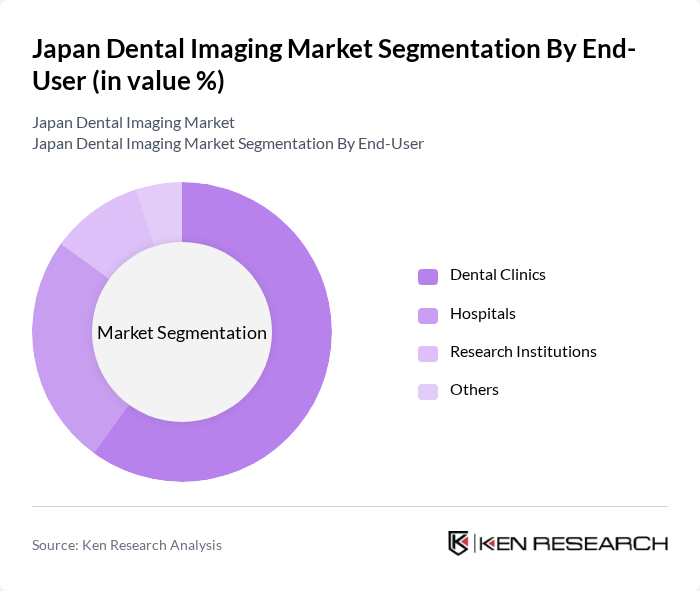

By End-User:The market is segmented based on end-users, including Dental Clinics, Hospitals, Research Institutions, and Others. Each segment has unique requirements and contributes differently to the overall market dynamics.

Dental Clinics represent the largest end-user segment, driven by the increasing number of private practices and the growing emphasis on preventive dental care. These clinics are investing in advanced imaging technologies to enhance patient experience and improve diagnostic accuracy. The trend towards personalized dental care and the rising awareness of oral health are key factors contributing to the dominance of this segment.

The Japan Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Medical Systems Corporation, Carestream Health, Inc., Dentsply Sirona Inc., Planmeca Oy, 3M Company, Vatech Co., Ltd., GE Healthcare, Fujifilm Holdings Corporation, Sirona Dental Systems, Inc., Xoran Technologies, LLC, Midmark Corporation, KaVo Kerr, Agfa-Gevaert Group, Shimadzu Corporation, Hitachi Medical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan dental imaging market appears promising, driven by ongoing technological innovations and an increasing focus on preventive care. As digital imaging technologies continue to evolve, practitioners are likely to adopt more sophisticated tools that enhance diagnostic accuracy. Additionally, the integration of artificial intelligence in imaging systems is expected to streamline workflows and improve patient outcomes. These trends indicate a shift towards more efficient and patient-centered dental care solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Intraoral Cameras Cone Beam Computed Tomography (CBCT) Digital X-ray Systems D Imaging Systems Others |

| By End-User | Dental Clinics Hospitals Research Institutions Others |

| By Application | Diagnostic Imaging Treatment Planning Patient Monitoring Others |

| By Technology | Digital Radiography Computed Tomography Magnetic Resonance Imaging Others |

| By Region | Kanto Kansai Chubu Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Customer Type | Individual Patients Corporate Clients Insurance Providers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 150 | Dentists, Clinic Managers |

| Radiology Centers | 100 | Radiologists, Imaging Technicians |

| Dental Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Administrators, Policy Analysts |

| Dental Imaging Technology Developers | 70 | R&D Managers, Product Development Leads |

The Japan Dental Imaging Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by advancements in dental technology, increased awareness of oral health, and a rising prevalence of dental diseases.