Region:Asia

Author(s):Rebecca

Product Code:KRAE2740

Pages:90

Published On:February 2026

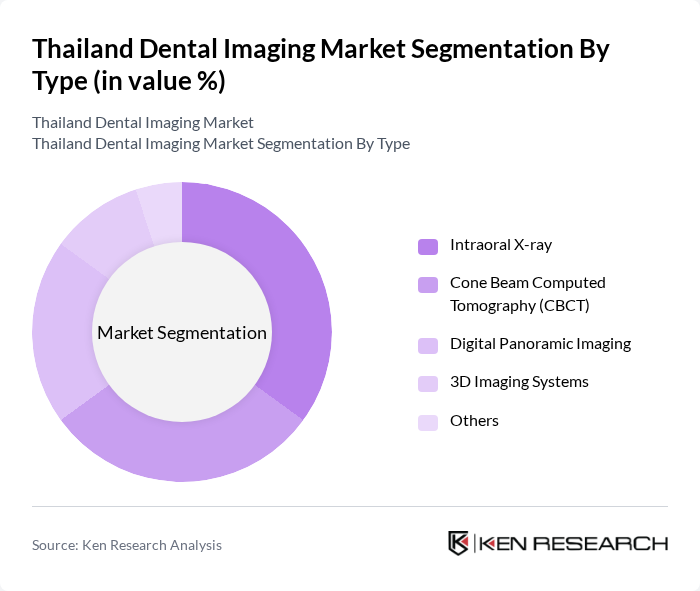

By Type:The market is segmented into various types of dental imaging technologies, including Intraoral X-ray, Cone Beam Computed Tomography (CBCT), Digital Panoramic Imaging, 3D Imaging Systems, and Others. Each of these technologies serves specific diagnostic and treatment planning needs in dental practices.

The Intraoral X-ray segment is currently dominating the market due to its widespread use in dental practices for routine examinations and diagnostics. This technology is favored for its cost-effectiveness, ease of use, and ability to provide immediate results. Additionally, the increasing number of dental clinics adopting digital X-ray systems is further propelling the growth of this segment. The convenience and efficiency of intraoral imaging make it a preferred choice among dental professionals.

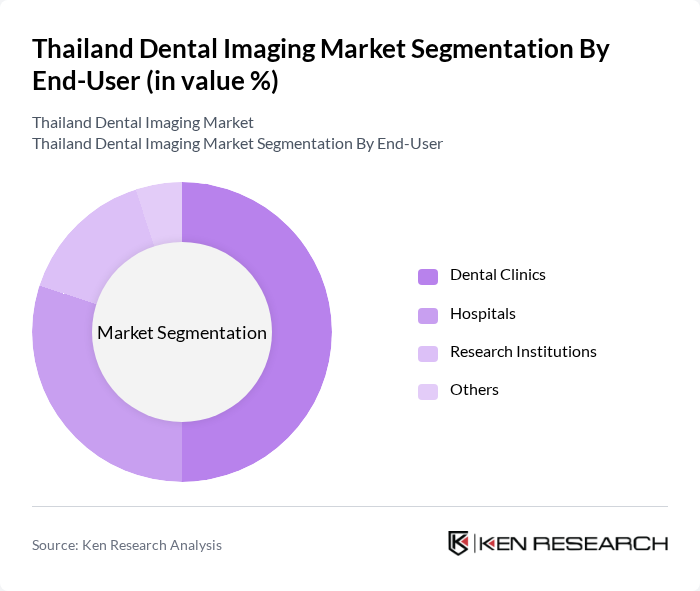

By End-User:The market is segmented based on end-users, including Dental Clinics, Hospitals, Research Institutions, and Others. Each segment plays a crucial role in the overall demand for dental imaging technologies.

Dental Clinics represent the largest end-user segment in the market, driven by the increasing number of private practices and the growing demand for preventive dental care. These clinics are increasingly investing in advanced imaging technologies to enhance diagnostic capabilities and improve patient care. The trend towards preventive dentistry and patient education is further boosting the adoption of dental imaging solutions in clinics across Thailand.

The Thailand Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sirona Dental Systems, Carestream Health, Planmeca, Dentsply Sirona, Vatech, 3Shape, Gendex, Fujifilm, Konica Minolta, XDR Radiology, Carestream Dental, Midmark Corporation, Dental Wings, MyRay, i-CAT contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental imaging market in Thailand appears promising, driven by ongoing technological innovations and an increasing focus on preventive care. As digital imaging solutions become more affordable and accessible, dental practices are likely to adopt these technologies at a higher rate. Additionally, the integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, further transforming the landscape. Overall, the market is poised for significant growth, with evolving consumer preferences and advancements in technology shaping its trajectory.

| Segment | Sub-Segments |

|---|---|

| By Type | Intraoral X-ray Cone Beam Computed Tomography (CBCT) Digital Panoramic Imaging D Imaging Systems Others |

| By End-User | Dental Clinics Hospitals Research Institutions Others |

| By Application | Diagnostic Imaging Treatment Planning Patient Monitoring Others |

| By Technology | Digital Radiography Computed Tomography Magnetic Resonance Imaging Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Northeastern Thailand |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 150 | Dentists, Clinic Owners |

| Radiology Departments | 100 | Radiologists, Imaging Technicians |

| Dental Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Dental Associations | 50 | Association Leaders, Policy Makers |

| Insurance Providers | 70 | Healthcare Analysts, Claims Managers |

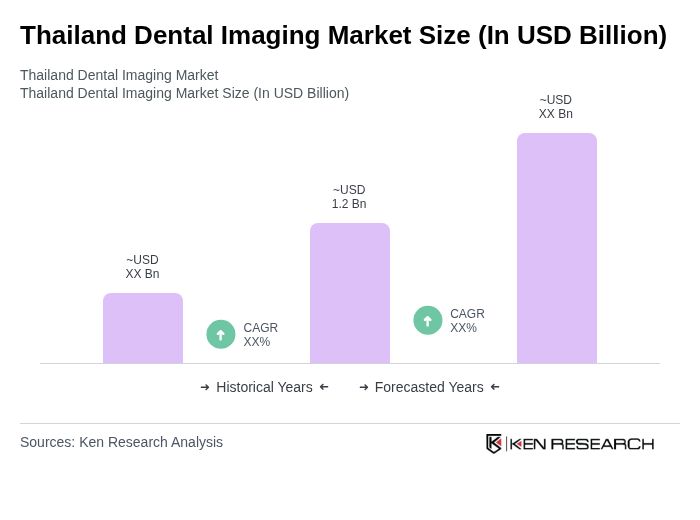

The Thailand Dental Imaging Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing prevalence of dental diseases, heightened awareness of oral health, and advancements in imaging technologies.