Region:Middle East

Author(s):Rebecca

Product Code:KRAE2743

Pages:83

Published On:February 2026

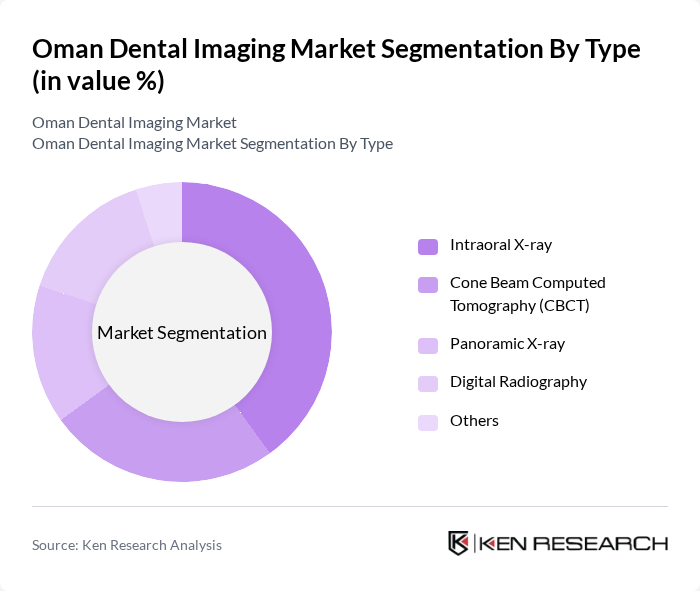

By Type:The market is segmented into various types of dental imaging technologies, including Intraoral X-ray, Cone Beam Computed Tomography (CBCT), Panoramic X-ray, Digital Radiography, and Others. Among these, Intraoral X-ray is the most widely used due to its cost-effectiveness and ease of use in routine dental examinations. The demand for CBCT is also rising, particularly for complex cases requiring detailed 3D imaging.

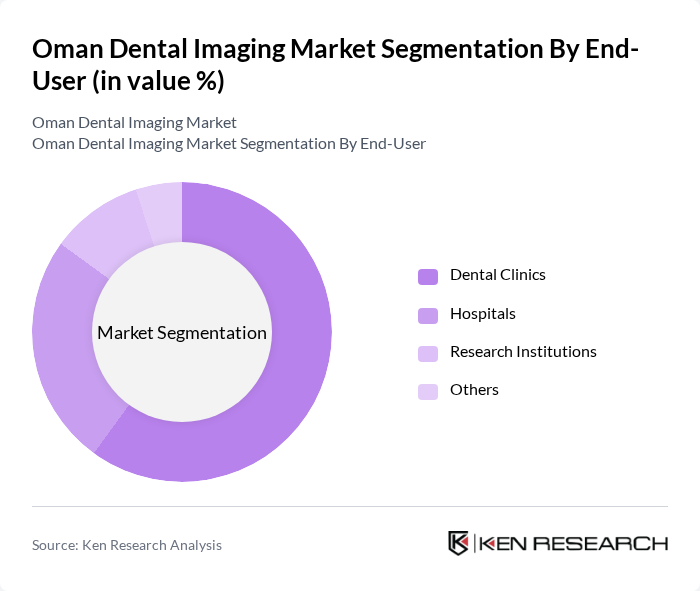

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Research Institutions, and Others. Dental Clinics are the primary end-users, accounting for a significant portion of the market due to the high volume of routine dental procedures performed. Hospitals also contribute to the market, particularly for specialized dental services and treatments.

The Oman Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Carestream Health, Planmeca, Dentsply Sirona, Vatech, 3Shape, Gendex, Xoran Technologies, Fujifilm, Konica Minolta, Midmark Corporation, Carestream Dental, Dental Wings, MyRay, Aribex contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman dental imaging market appears promising, driven by technological advancements and increasing public awareness of oral health. As the government continues to invest in healthcare infrastructure, the expansion of dental clinics is expected to facilitate greater access to imaging services. Additionally, the integration of artificial intelligence in imaging processes is anticipated to enhance diagnostic accuracy and efficiency, further propelling market growth. Overall, these trends indicate a robust future for dental imaging in Oman, with significant opportunities for innovation and service expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Intraoral X-ray Cone Beam Computed Tomography (CBCT) Panoramic X-ray Digital Radiography Others |

| By End-User | Dental Clinics Hospitals Research Institutions Others |

| By Application | Diagnostic Imaging Treatment Planning Patient Monitoring Others |

| By Technology | D Imaging D Imaging Digital Imaging Others |

| By Region | Muscat Salalah Sohar Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Service Type | Preventive Services Restorative Services Cosmetic Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics Imaging Practices | 100 | Dentists, Clinic Managers |

| Hospital Radiology Departments | 80 | Radiologists, Department Heads |

| Dental Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Dental Imaging Technology Innovators | 50 | R&D Managers, Technology Officers |

| Dental Health Policy Makers | 40 | Health Officials, Policy Advisors |

The Oman Dental Imaging Market is valued at approximately USD 150 million, reflecting a significant growth driven by the rising prevalence of dental diseases, increased awareness of oral health, and advancements in imaging technologies.