Region:Asia

Author(s):Rebecca

Product Code:KRAE2741

Pages:85

Published On:February 2026

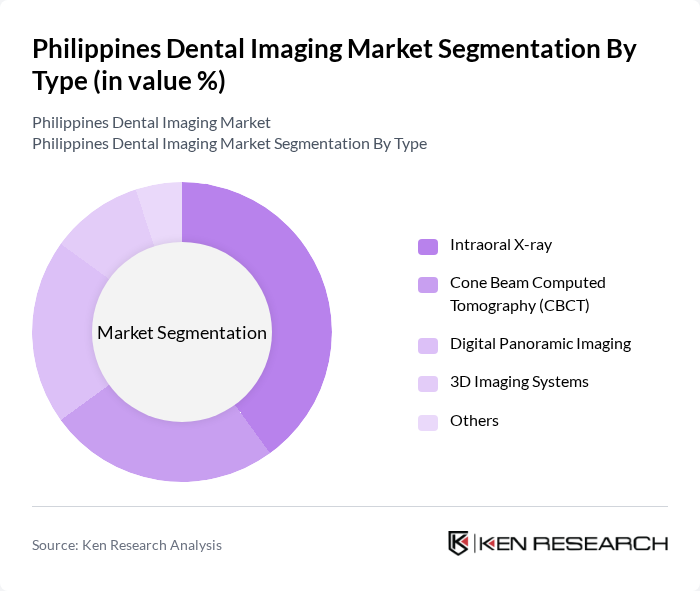

By Type:The market is segmented into various types of dental imaging technologies, including Intraoral X-ray, Cone Beam Computed Tomography (CBCT), Digital Panoramic Imaging, 3D Imaging Systems, and Others. Among these, Intraoral X-ray is the most widely used due to its cost-effectiveness and ease of use in routine dental examinations. CBCT is gaining traction for its ability to provide detailed 3D images, which are essential for complex dental procedures.

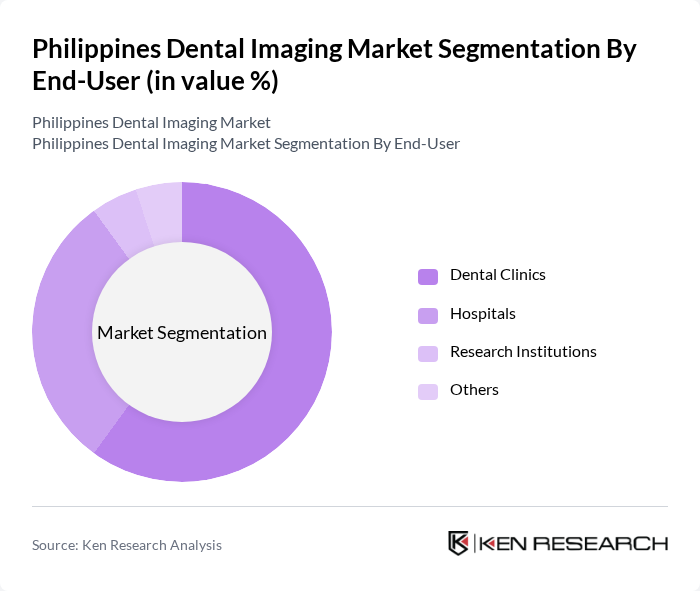

By End-User:The end-user segmentation includes Dental Clinics, Hospitals, Research Institutions, and Others. Dental Clinics are the primary users of dental imaging technologies, as they require efficient and accurate diagnostic tools for patient care. Hospitals also utilize these technologies for comprehensive dental services, while research institutions focus on advanced imaging techniques for studies and innovations.

The Philippines Dental Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Carestream Health, Dentsply Sirona, Planmeca, Vatech, Sirona Dental Systems, 3M Health Care, GE Healthcare, Canon Medical Systems, Fujifilm Medical Systems, Xoran Technologies, Gendex, Midmark Corporation, KaVo Kerr, Carestream Dental contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dental imaging market in the Philippines appears promising, driven by ongoing technological advancements and increasing public awareness of oral health. As more dental clinics adopt digital imaging technologies, the quality of care is expected to improve significantly. Additionally, the integration of artificial intelligence in imaging processes will enhance diagnostic accuracy, further propelling market growth. The government’s initiatives to promote oral health will also play a crucial role in expanding access to dental imaging services across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | Intraoral X-ray Cone Beam Computed Tomography (CBCT) Digital Panoramic Imaging D Imaging Systems Others |

| By End-User | Dental Clinics Hospitals Research Institutions Others |

| By Application | Diagnostic Imaging Treatment Planning Orthodontics Oral Surgery Others |

| By Technology | Digital Radiography Computed Tomography Magnetic Resonance Imaging Others |

| By Region | Luzon Visayas Mindanao |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics Imaging Practices | 150 | Dentists, Clinic Managers |

| Hospital Radiology Departments | 100 | Radiologists, Department Heads |

| Dental Equipment Suppliers | 80 | Sales Managers, Product Specialists |

| Dental Imaging Technology Users | 120 | Dental Technicians, Imaging Specialists |

| Dental Health Policy Makers | 50 | Health Officials, Policy Advisors |

The Philippines Dental Imaging Market is valued at approximately USD 150 million, reflecting a significant growth driven by the rising prevalence of dental diseases, increased awareness of oral health, and advancements in imaging technologies.