Bahrain Digital Insurance Market Overview

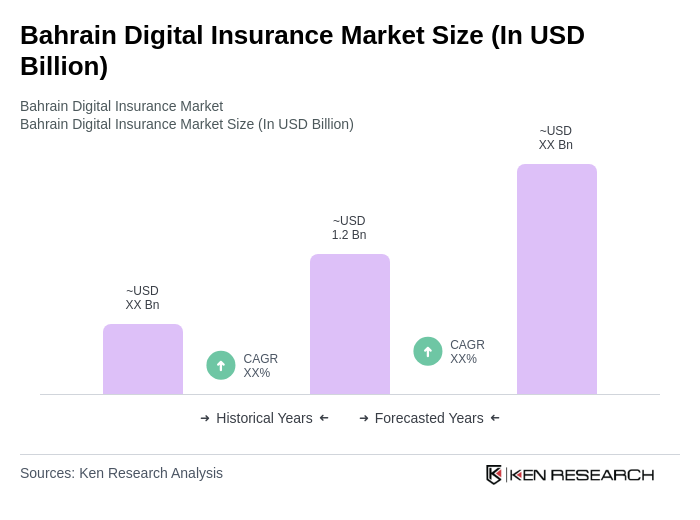

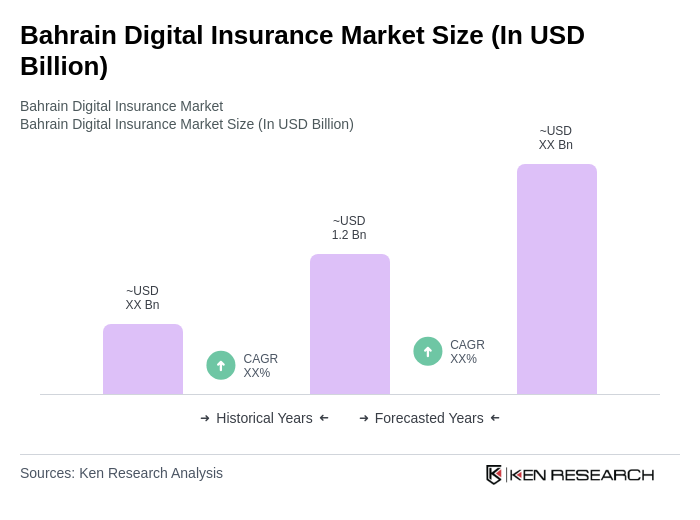

- The Bahrain Digital Insurance Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital technologies, rising consumer demand for convenient insurance solutions, and the growing awareness of the importance of insurance products among the population. The market has seen a significant shift towards online platforms, enhancing accessibility and customer engagement.

- Key players in this market include Manama, the capital city, which serves as a financial hub, and other major cities like Muharraq and Riffa. These locations dominate the market due to their developed infrastructure, concentration of financial institutions, and a growing population that is increasingly seeking digital insurance solutions. The urbanization and economic growth in these areas further contribute to their market leadership.

- In 2023, the Bahrain government implemented a regulatory framework aimed at enhancing the digital insurance landscape. This framework includes guidelines for digital transactions, data protection, and consumer rights, ensuring that digital insurance providers adhere to high standards of service and security. The initiative is designed to foster innovation while protecting consumers in the rapidly evolving digital insurance market.

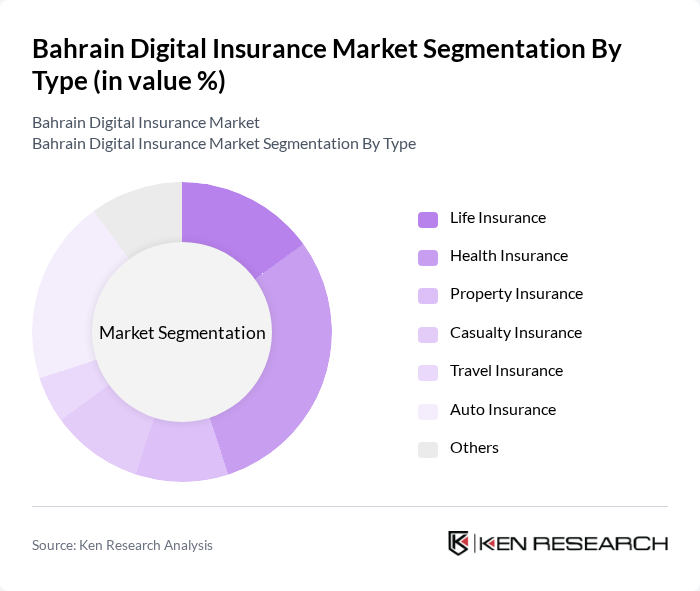

Bahrain Digital Insurance Market Segmentation

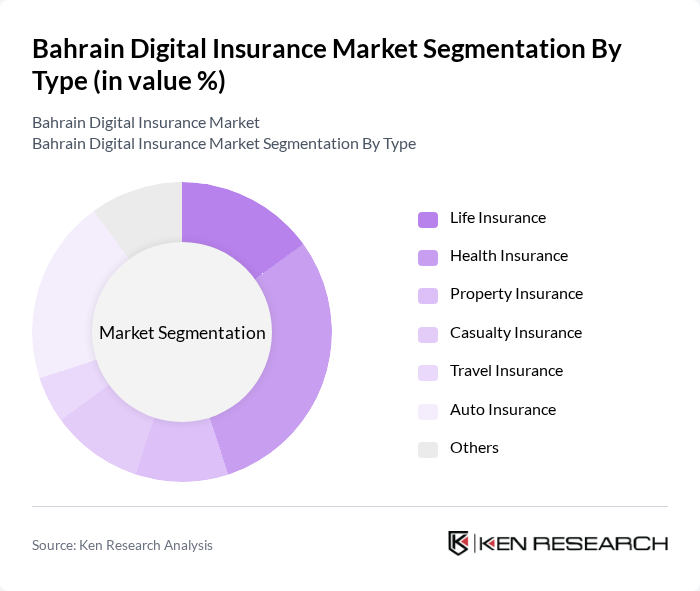

By Type:The digital insurance market can be segmented into various types, including Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Travel Insurance, Auto Insurance, and Others. Among these, Health Insurance is currently the leading sub-segment, driven by the increasing healthcare costs and a growing awareness of health-related issues among consumers. The demand for comprehensive health coverage has surged, particularly in the wake of the COVID-19 pandemic, leading to a significant rise in digital health insurance solutions.

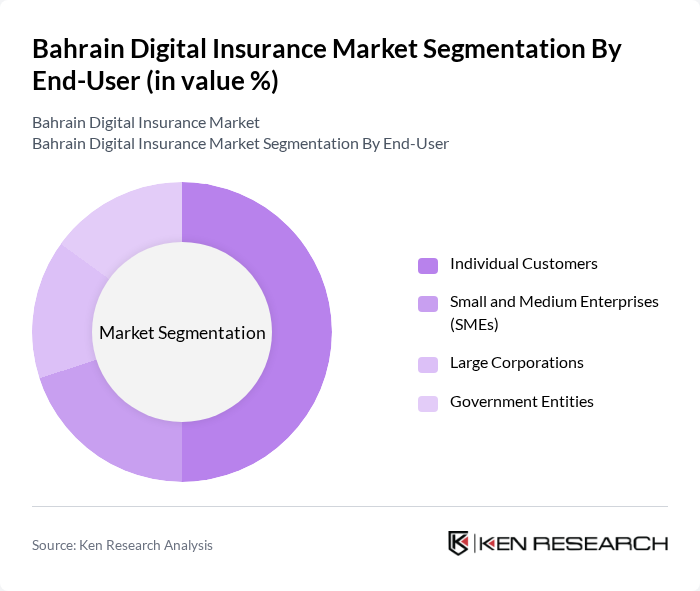

By End-User:The end-user segmentation includes Individual Customers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual Customers dominate this segment, as the growing population and increasing awareness of insurance benefits drive demand for personal insurance products. The trend towards digital solutions has made it easier for individuals to access and manage their insurance policies online, further boosting this segment's growth.

Bahrain Digital Insurance Market Competitive Landscape

The Bahrain Digital Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Insurance Company B.S.C., Gulf Insurance Group, Takaful International Company B.S.C., Al Ahlia Insurance Company B.S.C., Bahrain Kuwait Insurance Company B.S.C., Arab Insurance Group (ARIG), Allianz Bahrain, MetLife Bahrain, AXA Gulf, Qatar Insurance Company, Oman Insurance Company, Zurich Insurance Group, AIG Bahrain, Bupa Arabia, National Life & General Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

Bahrain Digital Insurance Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Bahrain has witnessed a significant rise in internet penetration, reaching approximately 99% in future, according to the Telecommunications Regulatory Authority. This high connectivity facilitates access to digital insurance platforms, enabling consumers to compare products and purchase policies online. The growing number of smartphone users, projected to exceed 2 million, further supports this trend, as mobile devices become primary tools for engaging with digital insurance services.

- Rising Demand for Personalized Insurance Products:The demand for personalized insurance solutions in Bahrain is on the rise, driven by changing consumer preferences. A report from the Bahrain Insurance Association indicates that 70% of consumers prefer tailored insurance products that meet their specific needs. This shift is prompting insurers to leverage data analytics to create customized offerings, enhancing customer satisfaction and retention, which is crucial in a competitive market landscape.

- Adoption of InsurTech Solutions:The adoption of InsurTech solutions is transforming the insurance landscape in Bahrain. In future, investments in InsurTech are expected to reach $60 million, as reported by the Bahrain Economic Development Board. These technologies streamline operations, improve customer engagement, and reduce costs. Insurers are increasingly utilizing AI and machine learning to enhance underwriting processes and claims management, driving efficiency and innovation in the digital insurance sector.

Market Challenges

- Regulatory Compliance Issues:Regulatory compliance remains a significant challenge for digital insurers in Bahrain. The Central Bank of Bahrain has implemented stringent regulations that require digital insurers to adhere to specific licensing and operational standards. In future, compliance costs are projected to increase by 25%, impacting profitability. Insurers must navigate these regulations while ensuring they meet consumer expectations for digital services, creating a complex operational environment.

- Cybersecurity Risks:As digital insurance platforms grow, so do cybersecurity risks. In future, the cost of cybercrime in the financial sector in Bahrain is estimated to reach $40 million, according to the Bahrain Cybersecurity Strategy. Insurers face the challenge of protecting sensitive customer data from breaches and attacks. The increasing sophistication of cyber threats necessitates significant investment in cybersecurity measures, which can strain resources and divert funds from innovation.

Bahrain Digital Insurance Market Future Outlook

The future of the Bahrain digital insurance market appears promising, driven by technological advancements and evolving consumer expectations. As insurers increasingly adopt AI and data analytics, they will enhance their ability to offer personalized products and improve customer experiences. Additionally, the growing trend of on-demand insurance will likely reshape traditional models, allowing consumers to purchase coverage tailored to their immediate needs. This dynamic environment will foster innovation and competition, ultimately benefiting consumers and driving market growth.

Market Opportunities

- Expansion of Mobile Insurance Services:The expansion of mobile insurance services presents a significant opportunity for growth. With over 2 million smartphone users in Bahrain, insurers can leverage mobile platforms to offer convenient, user-friendly services. This approach can enhance customer engagement and streamline the purchasing process, making insurance more accessible to a broader audience.

- Integration of AI and Big Data Analytics:The integration of AI and big data analytics into insurance operations offers substantial opportunities for efficiency and innovation. By utilizing these technologies, insurers can improve risk assessment, enhance customer targeting, and optimize claims processing. This strategic focus on data-driven decision-making can lead to better product offerings and increased market competitiveness.