Region:Middle East

Author(s):Dev

Product Code:KRAA6586

Pages:87

Published On:January 2026

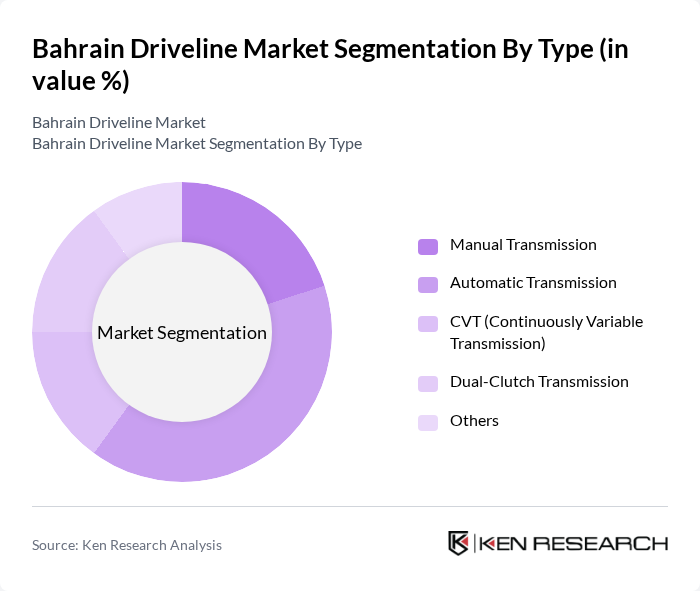

By Type:The driveline market can be segmented into various types, including Manual Transmission, Automatic Transmission, CVT (Continuously Variable Transmission), Dual-Clutch Transmission, and Others. Among these, Automatic Transmission is currently the leading sub-segment due to its growing popularity among consumers seeking convenience and ease of use. The trend towards automation in vehicles has led to a significant increase in the adoption of automatic systems, which are favored for their smooth driving experience and enhanced fuel efficiency.

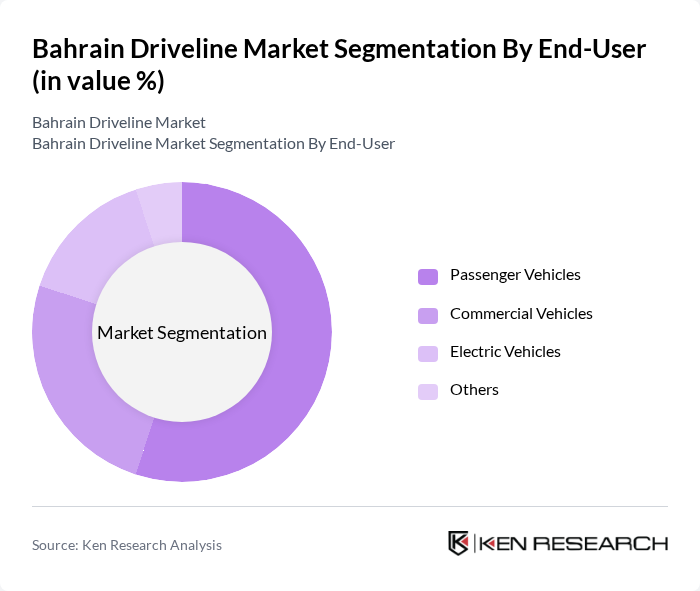

By End-User:The market is also segmented by end-user categories, including Passenger Vehicles, Commercial Vehicles, Electric Vehicles, and Others. The Passenger Vehicles segment is the most significant contributor to the market, driven by the increasing consumer preference for personal mobility solutions and the growing population in urban areas. The rise in disposable income and changing lifestyles have further fueled the demand for passenger vehicles, making it a dominant segment in the driveline market.

The Bahrain Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain Automotive Manufacturing Company, Gulf Automotive Solutions, Almoayyed International Group, Al-Hidd Automotive, Bahrain Motors, Al-Futtaim Automotive, Euro Motors, Al-Moayyed Group, Al-Salam Automotive, Al-Bahar Group, Al-Mansoori Specialized Engineering, Al-Hassan Group, Al-Muharraq Automotive, Bahrain National Holding Company, Al-Mohsin Group contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain driveline market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. The integration of smart technologies and lightweight materials is expected to enhance vehicle performance and efficiency. Additionally, the growing focus on electric and hybrid vehicles will likely reshape consumer preferences, leading to increased investments in research and development. As the government continues to support the automotive sector, Bahrain is set to emerge as a competitive player in the regional automotive landscape, fostering innovation and economic growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission CVT (Continuously Variable Transmission) Dual-Clutch Transmission Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Others |

| By Vehicle Type | SUVs Sedans Trucks Vans Others |

| By Component | Gearbox Driveshaft Differential Axles Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Others |

| By Technology | Conventional Technology Hybrid Technology Electric Technology Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 100 | Manufacturers, Product Managers |

| Commercial Vehicle Driveline Systems | 80 | Fleet Managers, Procurement Officers |

| Aftermarket Driveline Parts | 70 | Retailers, Distributors |

| Electric Vehicle Driveline Innovations | 60 | R&D Engineers, Automotive Consultants |

| Driveline Technology Trends | 90 | Industry Analysts, Market Researchers |

The Bahrain Driveline Market is valued at approximately USD 1.2 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient driveline systems in the automotive sector and the rising trend of electric vehicles.