Region:Middle East

Author(s):Dev

Product Code:KRAA5326

Pages:84

Published On:January 2026

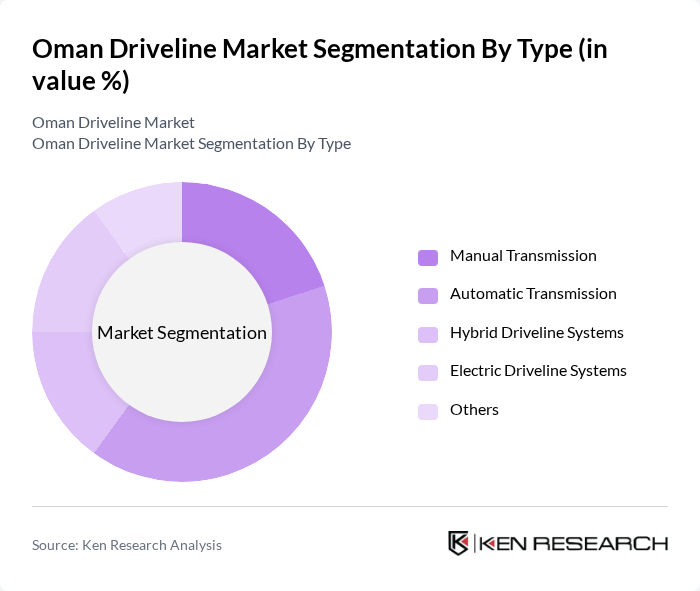

By Type:The driveline market can be segmented into various types, including Manual Transmission, Automatic Transmission, Hybrid Driveline Systems, Electric Driveline Systems, and Others. Each of these subsegments caters to different consumer preferences and vehicle requirements, with automatic transmission systems gaining popularity due to their ease of use and efficiency. Electric driveline systems represent the fastest-growing segment in the market.

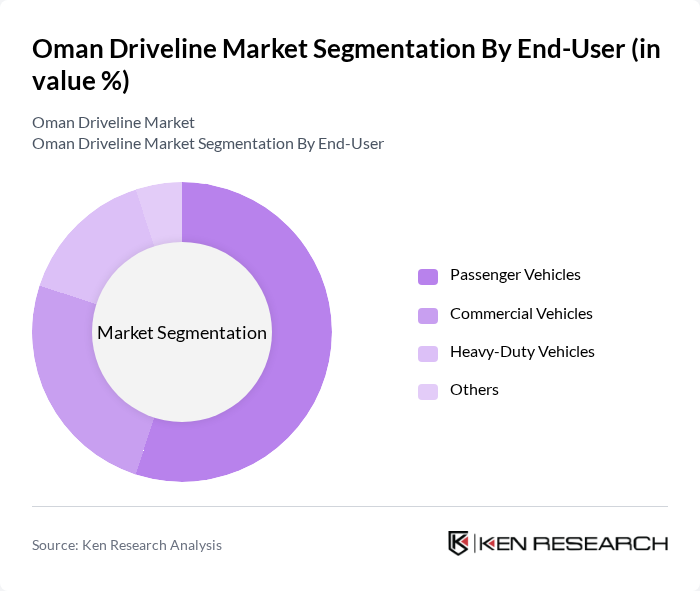

By End-User:The market can also be segmented based on end-users, which include Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles, and Others. The passenger vehicle segment is the largest due to the increasing number of personal vehicles on the road, driven by rising disposable incomes and urbanization. Commercial vehicle unit sales in Oman are projected to reach 9.34k vehicles, reflecting steady demand in the logistics and transportation sectors.

The Oman Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Automotive Association, Al-Futtaim Motors, Nissan Oman, Toyota Oman, Oman Driveline Solutions, Muscat Motors, Al-Muhaidib Group, Al-Harthy Group, Gulf Automotive, Al-Jazira Vehicles, Oman Trading Establishment, Al-Mansoori Specialized Engineering, Al-Bahja Group, Al-Mahrouqi Group, Oman Driveline Technologies contribute to innovation, geographic expansion, and service delivery in this space. Toyota maintains a dominant market position with a 50.9% market share in the broader automotive sector.

The Oman driveline market is poised for transformation as it adapts to global trends in sustainability and technology. With the increasing adoption of electric vehicles and hybrid driveline systems, local manufacturers are likely to invest in research and development to innovate. Additionally, strategic partnerships with global automotive firms can enhance local capabilities, enabling Oman to become a competitive player in the regional automotive landscape. The focus on eco-friendly solutions will drive further advancements in driveline technologies, aligning with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission Hybrid Driveline Systems Electric Driveline Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Others |

| By Vehicle Type | SUVs Sedans Trucks Buses Others |

| By Component | Gearboxes Driveshafts Differentials Axles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Muscat Salalah Sohar Nizwa Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for R&D Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 100 | Product Managers, R&D Engineers |

| Commercial Vehicle Driveline Systems | 80 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Driveline Technologies | 70 | Technical Directors, Innovation Managers |

| Aftermarket Driveline Services | 60 | Service Managers, Parts Distributors |

| Driveline Manufacturing Processes | 90 | Operations Managers, Quality Assurance Engineers |