Region:Asia

Author(s):Dev

Product Code:KRAA5327

Pages:83

Published On:January 2026

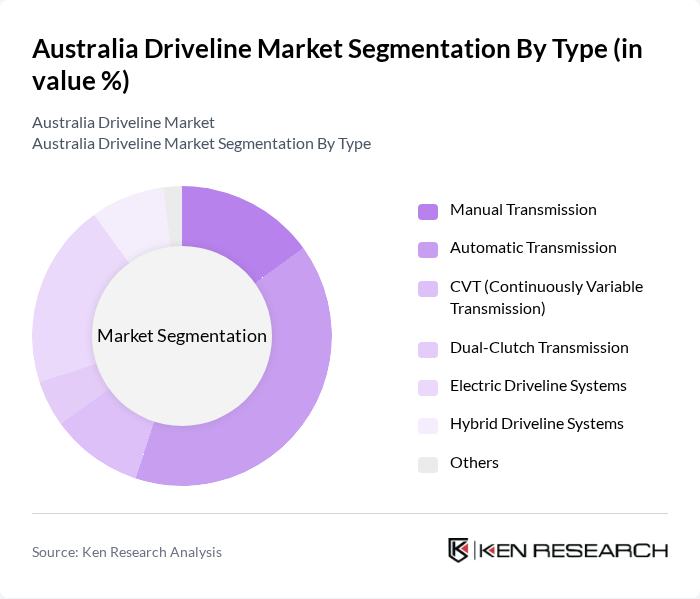

By Type:The driveline market can be segmented into various types, including Manual Transmission, Automatic Transmission, CVT (Continuously Variable Transmission), Dual-Clutch Transmission, Electric Driveline Systems, Hybrid Driveline Systems, and Others. Among these, Automatic Transmission is currently the leading sub-segment due to its growing popularity among consumers seeking convenience and ease of use. The trend towards electric drivetrains is also gaining momentum, driven by environmental concerns and government incentives. All-wheel drive (AWD) systems are emerging as the fastest-growing sub-segment, gaining popularity due to their superior traction and handling capabilities, particularly with the increasing demand for SUVs and crossover vehicles.

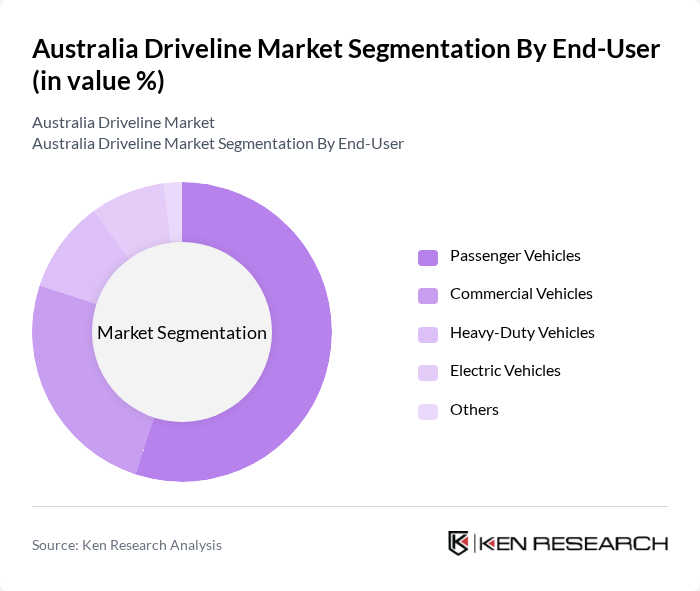

By End-User:The market can also be segmented by end-user categories, including Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles, Electric Vehicles, and Others. The Passenger Vehicles segment is the most significant contributor to the market, driven by the increasing demand for personal transportation and the growing trend of urbanization. The commercial vehicle segment is experiencing rapid growth due to increasing demand for transportation and logistics services, coupled with stringent emissions and fuel efficiency regulations. The rise in electric vehicle adoption is also noteworthy, as consumers become more environmentally conscious and manufacturers transition to advanced driveline solutions.

The Australia Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Australia, Ford Australia, General Motors Holden, Volkswagen Group Australia, Honda Australia, Nissan Australia, Hyundai Australia, Kia Australia, Mercedes-Benz Australia, BMW Australia, Isuzu UTE Australia, Subaru Australia, Mitsubishi Motors Australia, Tesla Australia, and Volvo Car Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian driveline market appears promising, driven by ongoing advancements in electrification and sustainability. As consumer preferences shift towards eco-friendly vehicles, the market is expected to see increased investments in electric and hybrid technologies. Additionally, the integration of AI and IoT in vehicle systems is anticipated to enhance performance and user experience. With government support and a growing focus on reducing emissions, the market is poised for significant transformation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission CVT (Continuously Variable Transmission) Dual-Clutch Transmission Electric Driveline Systems Hybrid Driveline Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Electric Vehicles Others |

| By Vehicle Type | SUVs Sedans Trucks Vans Others |

| By Component | Gearboxes Driveshafts Differentials Axles Others |

| By Distribution Channel | OEMs (Original Equipment Manufacturers) Aftermarket Online Retail Dealerships Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 150 | Product Managers, Automotive Engineers |

| Commercial Vehicle Driveline Systems | 100 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Driveline Innovations | 80 | R&D Engineers, Technology Officers |

| Aftermarket Driveline Parts | 70 | Retail Managers, Supply Chain Coordinators |

| Driveline Manufacturing Processes | 60 | Operations Managers, Quality Assurance Leads |

The Australia Driveline Market is valued at approximately USD 5.2 billion, reflecting significant growth driven by the demand for fuel-efficient vehicles, advancements in automotive technology, and a shift towards electric and hybrid drivetrains.