Region:Global

Author(s):Shubham

Product Code:KRAA5329

Pages:85

Published On:January 2026

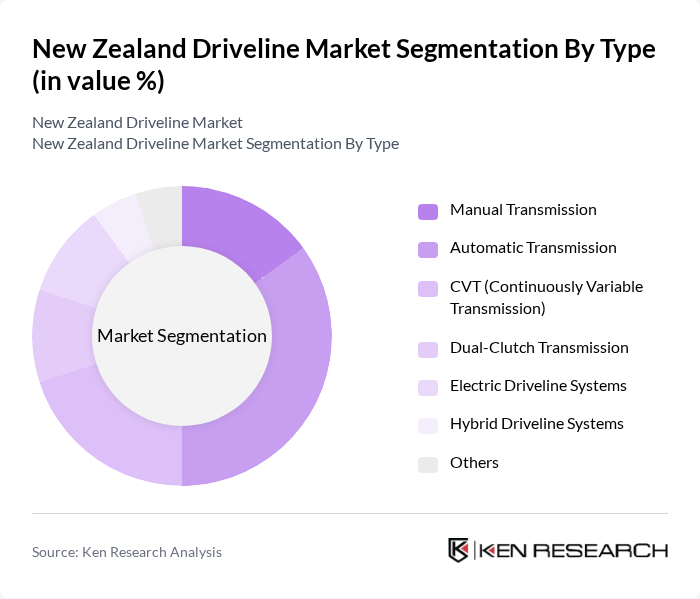

By Type:The driveline market can be segmented into various types, including Manual Transmission, Automatic Transmission, CVT (Continuously Variable Transmission), Dual-Clutch Transmission, Electric Driveline Systems, Hybrid Driveline Systems, and Others. Each type serves different consumer preferences and vehicle requirements, with automatic and electric systems gaining significant traction due to their convenience and efficiency.

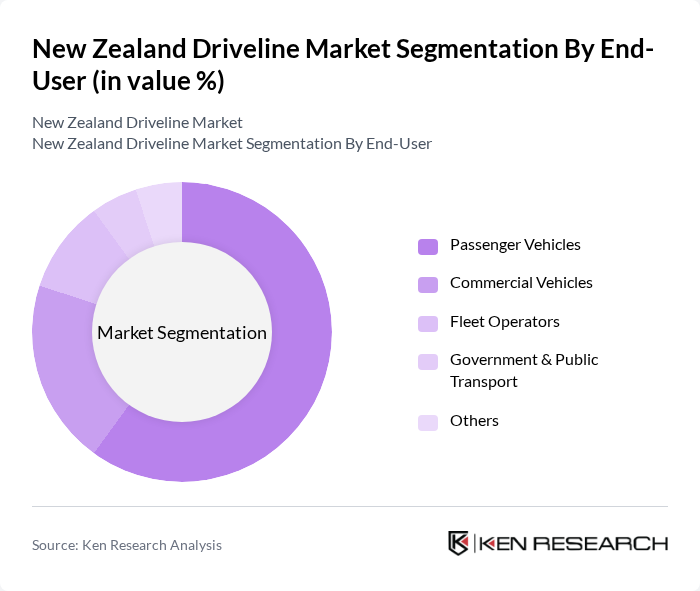

By End-User:The market can also be segmented by end-user categories, including Passenger Vehicles, Commercial Vehicles, Fleet Operators, Government & Public Transport, and Others. The passenger vehicle segment dominates the market due to the high demand for personal transportation and the increasing trend towards electric and hybrid vehicles among consumers.

The New Zealand Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota New Zealand, Ford New Zealand, Holden New Zealand, Mitsubishi Motors New Zealand, Honda New Zealand, Nissan New Zealand, Volkswagen New Zealand, BMW New Zealand, Mercedes-Benz New Zealand, Isuzu New Zealand, Subaru New Zealand, Kia New Zealand, Hyundai New Zealand, Tesla New Zealand, Land Rover New Zealand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the New Zealand driveline market appears promising, driven by the ongoing transition towards electric and hybrid vehicles. With government initiatives aimed at reducing carbon emissions and increasing EV adoption, the market is expected to see a surge in innovative driveline technologies. Additionally, the integration of smart technologies and lightweight materials will enhance vehicle efficiency and performance. As consumer preferences shift towards sustainability, the market is poised for significant growth, supported by advancements in infrastructure and technology.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission CVT (Continuously Variable Transmission) Dual-Clutch Transmission Electric Driveline Systems Hybrid Driveline Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Fleet Operators Government & Public Transport Others |

| By Vehicle Type | SUVs Sedans Trucks Buses Others |

| By Component | Driveline Control Systems Differentials Driveshafts Axles Others |

| By Fuel Type | Petrol Diesel Electric Hybrid Others |

| By Market Channel | OEMs (Original Equipment Manufacturers) Aftermarket Online Retail Dealerships Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Hybrid Vehicles Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Driveline Systems | 100 | Fleet Managers, Procurement Officers |

| Electric and Hybrid Driveline Technologies | 80 | R&D Managers, Sustainability Officers |

| Aftermarket Driveline Services | 70 | Service Center Managers, Automotive Technicians |

| Driveline Regulatory Compliance | 60 | Compliance Officers, Policy Makers |

The New Zealand Driveline Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for fuel-efficient vehicles, advancements in driveline technologies, and the increasing popularity of electric and hybrid vehicles.