Region:Asia

Author(s):Dev

Product Code:KRAA5328

Pages:91

Published On:January 2026

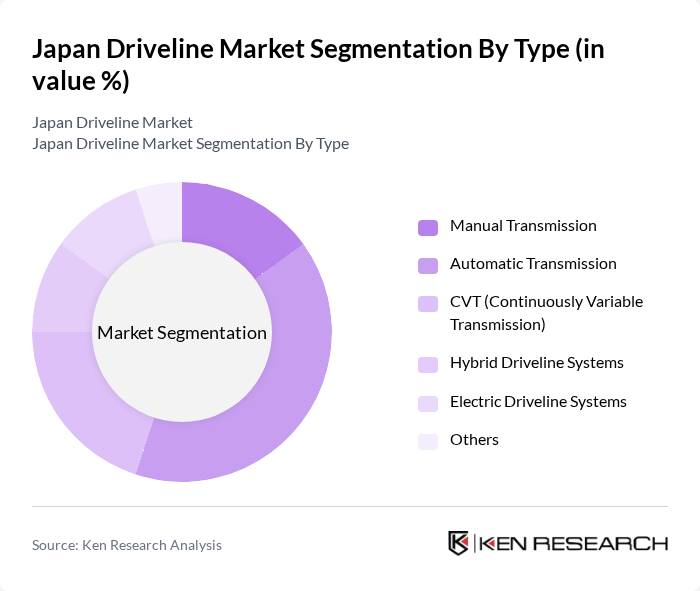

By Type:The driveline market can be segmented into various types, including Manual Transmission, Automatic Transmission, CVT (Continuously Variable Transmission), Hybrid Driveline Systems, Electric Driveline Systems, and Others. Among these, Automatic Transmission is currently the leading sub-segment due to its growing popularity among consumers seeking convenience and ease of use. The trend towards automation in vehicles has led to increased demand for automatic systems, which are favored for their smooth driving experience and efficiency.

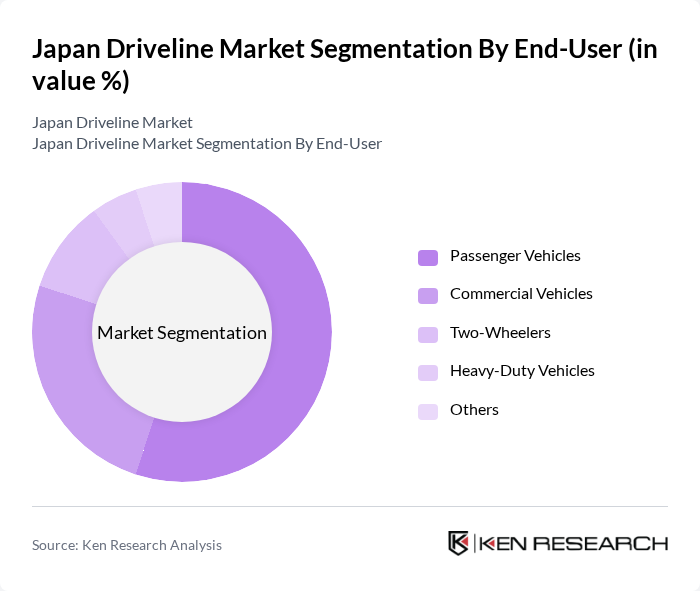

By End-User:The market can also be segmented based on end-users, including Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Heavy-Duty Vehicles, and Others. The Passenger Vehicles segment is the most significant contributor to the market, driven by the increasing consumer preference for personal mobility and the rising number of households owning cars. This segment's growth is further supported by the introduction of new models and features that enhance comfort and safety.

The Japan Driveline Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Honda Motor Co., Ltd., Nissan Motor Co., Ltd., Subaru Corporation, Mazda Motor Corporation, Mitsubishi Motors Corporation, Isuzu Motors Ltd., Suzuki Motor Corporation, Denso Corporation, Aisin Seiki Co., Ltd., JTEKT Corporation, Hitachi Automotive Systems, Ltd., NTN Corporation, Bosch Corporation, ZF Friedrichshafen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan driveline market appears promising, driven by ongoing technological advancements and a strong push towards electrification. As consumer preferences shift towards sustainable mobility solutions, manufacturers are expected to invest heavily in innovative driveline technologies. Additionally, the collaboration between automotive and technology companies is likely to accelerate the development of smart driveline systems. This synergy will enhance vehicle performance and efficiency, positioning the market for robust growth in the coming years, despite existing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission CVT (Continuously Variable Transmission) Hybrid Driveline Systems Electric Driveline Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles Others |

| By Vehicle Type | Electric Vehicles Hybrid Vehicles Conventional Vehicles Others |

| By Component | Gearbox Driveshaft Differential Axles Others |

| By Distribution Channel | OEMs Aftermarket Online Retail Others |

| By Technology | Conventional Technology Advanced Technology Smart Technology Others |

| By Application | Personal Use Commercial Use Industrial Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Driveline Components | 150 | Product Managers, R&D Engineers |

| Commercial Vehicle Driveline Systems | 100 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Driveline Technologies | 80 | Battery Engineers, Electric Drive Specialists |

| Hybrid Vehicle Driveline Solutions | 70 | Systems Engineers, Automotive Designers |

| Aftermarket Driveline Parts | 90 | Aftermarket Managers, Sales Representatives |

The Japan Driveline Market is valued at approximately USD 11.5 billion, reflecting a five-year historical analysis. This growth is driven by factors such as the demand for fuel-efficient vehicles and advancements in automotive technology.