Region:Middle East

Author(s):Rebecca

Product Code:KRAB7359

Pages:94

Published On:October 2025

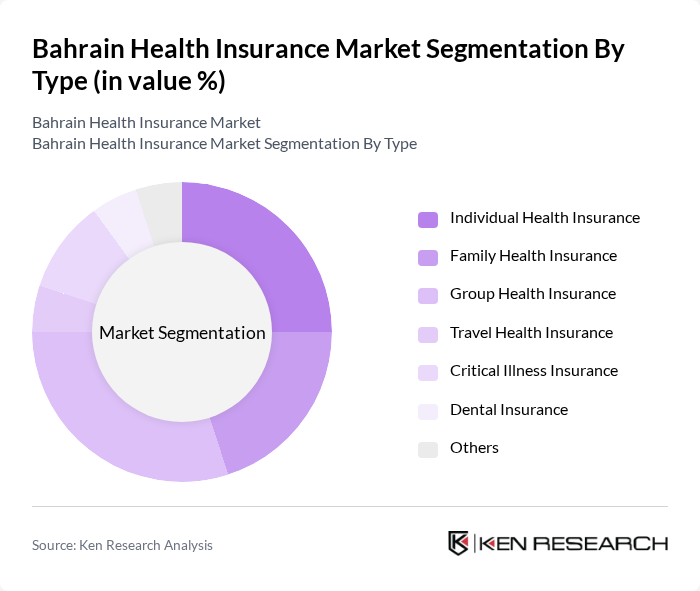

By Type:The market is segmented into various types of health insurance products, including Individual Health Insurance, Family Health Insurance, Group Health Insurance, Travel Health Insurance, Critical Illness Insurance, Dental Insurance, and Others. Each sub-segment caters to different consumer needs and preferences, reflecting the diverse requirements of the population.

The Group Health Insurance segment is currently dominating the market due to the increasing number of employers providing health insurance as part of employee benefits. Corporates are recognizing the importance of health insurance in attracting and retaining talent, leading to a surge in group policies. Additionally, the rising costs of healthcare have prompted businesses to invest in comprehensive health plans for their employees, further solidifying the group's market leadership.

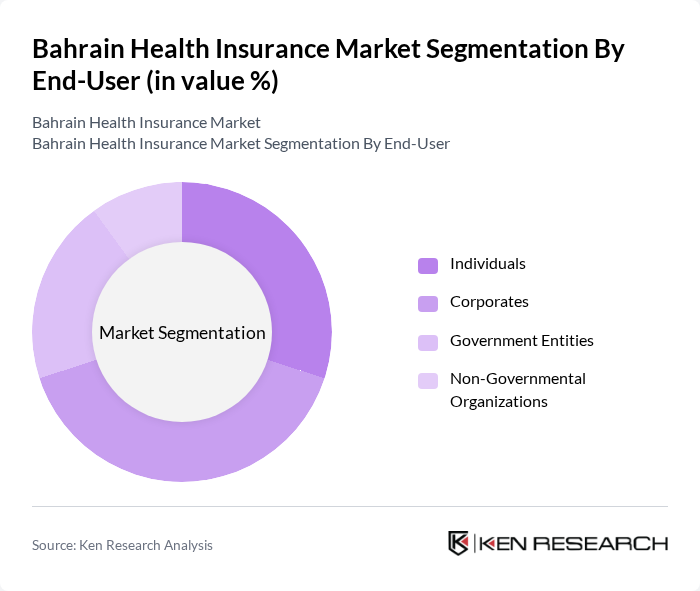

By End-User:The market is segmented by end-users, including Individuals, Corporates, Government Entities, and Non-Governmental Organizations. Each segment has unique requirements and purchasing behaviors, influencing the types of health insurance products they seek.

The Corporates segment is leading the market, driven by the increasing trend of employers offering health insurance as part of their employee benefits packages. This trend is further supported by the need for companies to ensure employee well-being and productivity, making corporate health insurance a critical component of business strategy.

The Bahrain Health Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bupa Arabia, Gulf Insurance Group, Bahrain National Holding Company, Takaful International, Al Ahlia Insurance Company, Trust International Insurance, MetLife Bahrain, AXA Gulf, Daman, Qatar Insurance Company, Oman Insurance Company, Arab Orient Insurance Company, Al Hilal Life Insurance, National Life & General Insurance Company, Zurich Insurance Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain health insurance market appears promising, driven by increasing healthcare demands and government support. As the population grows and healthcare costs rise, insurers are likely to innovate their offerings, focusing on preventive care and digital solutions. Additionally, the integration of technology in insurance services will enhance customer experience and operational efficiency. These trends indicate a dynamic market landscape, with opportunities for growth and improved health outcomes for the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Individual Health Insurance Family Health Insurance Group Health Insurance Travel Health Insurance Critical Illness Insurance Dental Insurance Others |

| By End-User | Individuals Corporates Government Entities Non-Governmental Organizations |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Coverage Type | Inpatient Coverage Outpatient Coverage Maternity Coverage Emergency Coverage |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Type | Comprehensive Plans Basic Plans Add-On Plans Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Health Insurance Policyholders | 150 | Policyholders aged 25-60, diverse income levels |

| Corporate Health Insurance Clients | 100 | HR Managers, Benefits Coordinators from various industries |

| Healthcare Providers (Hospitals & Clinics) | 80 | Administrators, Financial Officers, and Medical Directors |

| Regulatory Bodies and Health Authorities | 50 | Policy Makers, Health Economists, Regulatory Analysts |

| Insurance Brokers and Agents | 70 | Insurance Brokers, Sales Agents with health insurance focus |

The Bahrain Health Insurance Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by rising healthcare costs, an increasing population, and heightened awareness of health insurance benefits among residents.