Region:Global

Author(s):Shubham

Product Code:KRAC4212

Pages:84

Published On:January 2026

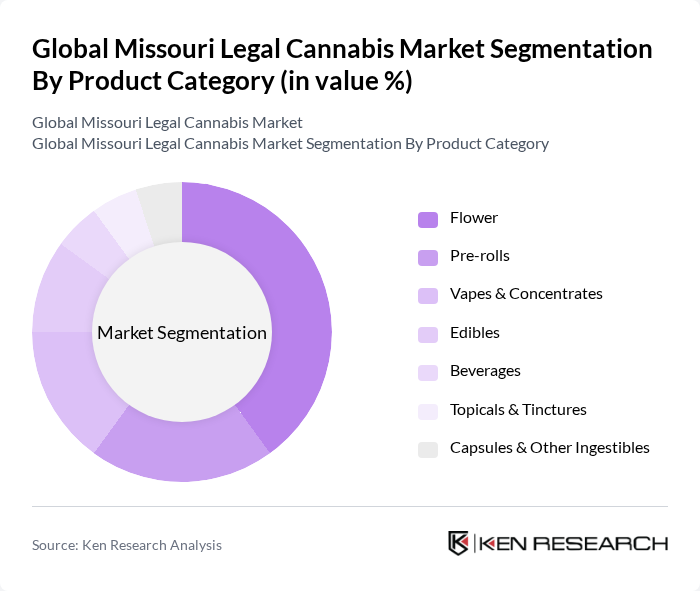

By Product Category:The product category segmentation includes various forms of cannabis products that cater to different consumer preferences. The dominant sub-segment in this category is Flower, which remains the largest category by sales, although its share is gradually eroding as consumers diversify into other formats. Pre-rolls and Vapes & Concentrates are also gaining strong traction, particularly among younger and more experienced consumers who prefer convenience, portability, and discretion, with pre-rolls showing some of the fastest year-over-year growth in the market. Edibles and Beverages are emerging segments, appealing to those seeking alternative, dose-controlled consumption methods, and benefiting from broader product innovation in gummies, chocolates, and ready-to-drink infused beverages. Overall, the product category segmentation reflects a diverse and maturing market catering to a wide range of consumer preferences, from value-oriented flower to premium infused pre-rolls and ingestible formats.

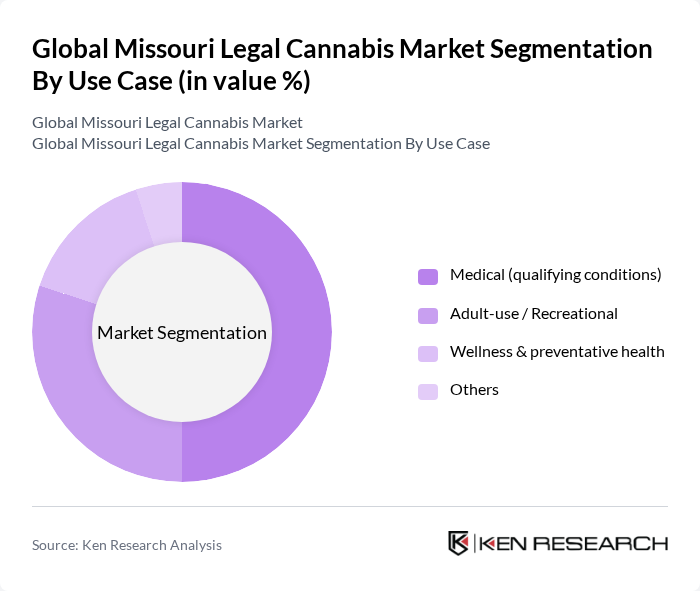

By Use Case:The use case segmentation highlights the various applications of cannabis products, with Medical use remaining a material sub-segment but declining in relative share as many former patients migrate to the adult-use channel following broader legalization. This is driven by the continued recognition of cannabis as a viable option for various qualifying medical conditions, including chronic pain and anxiety, supported by a regulated medical program and physician certifications. Adult-use or Recreational consumption is now the primary growth engine of the market, reflecting changing societal attitudes towards cannabis, normalization of use, and strong per-capita spending levels in Missouri. Wellness and preventative health applications are gaining popularity as consumers seek natural alternatives for sleep, stress management, and general well-being, often through low-dose edibles, tinctures, and other ingestibles. This segmentation underscores the diverse motivations behind cannabis consumption, spanning regulated medical treatments, adult-use experiences, and broader wellness-oriented use cases.

The Global Missouri Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Good Day Farm Missouri, Illicit / Illicit Gardens, Greenlight Dispensary, Proper Cannabis, Heya Wellness, Flora Farms, CLOVR, Hippos Marijuana, Vibe Cannabis, Robust Missouri Dispensary, Organic Remedies Missouri, Kansas City Cannabis Company, From The Earth Missouri, Local MSO-affiliated operators (Curaleaf, Columbia Care, etc.), Emerging craft and micro-license operators contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Missouri legal cannabis market appears promising, driven by ongoing legislative support and increasing consumer acceptance. As more states consider legalization, Missouri could become a regional hub for cannabis innovation and tourism. The anticipated growth in the wellness sector, particularly with CBD products, will likely attract new consumers. Additionally, advancements in cultivation technology may enhance product quality and yield, further solidifying Missouri's position in the evolving cannabis landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Flower Pre-rolls Vapes & Concentrates Edibles Beverages Topicals & Tinctures Capsules & Other Ingestibles |

| By Use Case | Medical (qualifying conditions) Adult-use / Recreational Wellness & preventative health Others |

| By Cannabinoid Profile | THC-dominant CBD-dominant Balanced THC/CBD Minor cannabinoid-focused (CBG, CBN, etc.) |

| By Sales Channel | Licensed medical dispensaries Adult-use dispensaries Hybrid (medical + adult-use) outlets Delivery & click-and-collect Others |

| By Consumer Segment | Patient users (chronic & acute conditions) Regular adult-use consumers Occasional / experimental users Tourist & cross-border shoppers Others |

| By Price Tier | Value Mainstream Premium Ultra-premium / connoisseur |

| By License Type (Supply Side) | Cultivators Manufacturers / processors Dispensaries / retailers Vertically integrated operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dispensary Operations | 90 | Dispensary Owners, Store Managers |

| Cannabis Product Manufacturing | 70 | Product Development Managers, Quality Assurance Leads |

| Consumer Purchasing Behavior | 140 | Cannabis Consumers, Potential Users |

| Regulatory Compliance Insights | 50 | Legal Advisors, Compliance Officers |

| Market Trends and Innovations | 60 | Industry Analysts, Market Researchers |

The Global Missouri Legal Cannabis Market is valued at approximately USD 1.4 billion, reflecting a significant growth driven by increased acceptance of cannabis for medical and recreational use, alongside a robust regulatory framework supporting legal sales.