Region:Asia

Author(s):Rebecca

Product Code:KRAD2024

Pages:96

Published On:January 2026

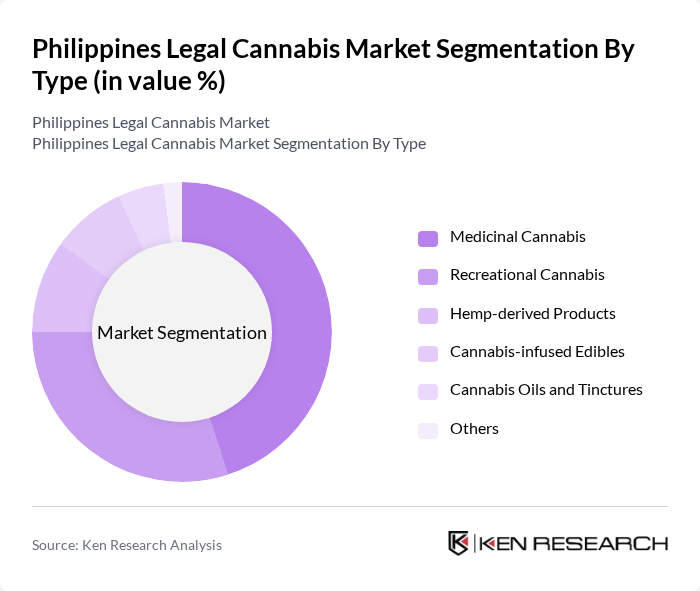

By Type:The market is segmented into various types, including Medicinal Cannabis, Recreational Cannabis, Hemp-derived Products, Cannabis-infused Edibles, Cannabis Oils and Tinctures, and Others. Among these, Medicinal Cannabis is the dominant segment, driven by increasing acceptance of cannabis for therapeutic purposes and a growing number of patients seeking alternative treatments for chronic conditions. The demand for Recreational Cannabis is also rising, particularly among younger demographics seeking legal access to cannabis products.

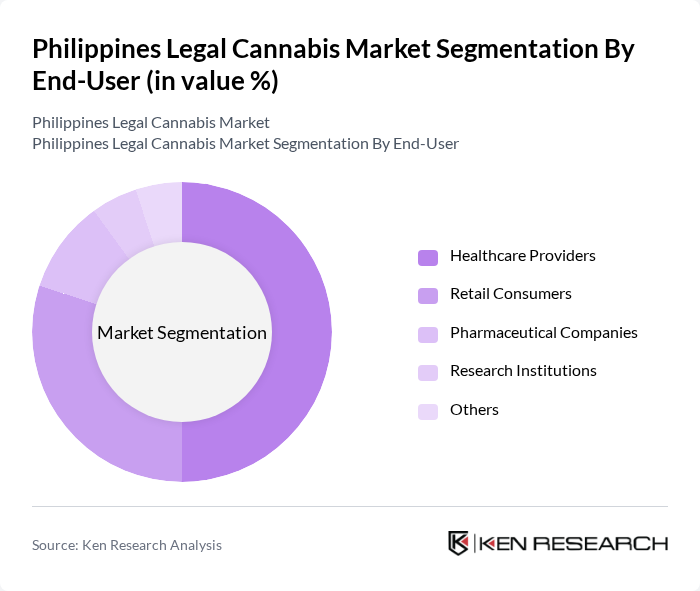

By End-User:The end-user segmentation includes Healthcare Providers, Retail Consumers, Pharmaceutical Companies, Research Institutions, and Others. Healthcare Providers are the leading segment, as they are increasingly prescribing cannabis for various medical conditions, thus driving demand. Retail Consumers are also significant, particularly as more individuals seek legal access to cannabis for personal use, reflecting changing societal attitudes towards cannabis consumption.

The Philippines Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Green Leaf Medical Cannabis, Philippine Cannabis Industry Association, Altus Cannabis, The Greenhouse Project, CannaPharma, Hemp Nation, CBD Oil Philippines, Philippine Hemp Company, Medical Cannabis Philippines, CannaCare, Leafy Greens, Pure Hemp, Green Minded, CannaBuds, Herbal Remedies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines legal cannabis market appears cautiously optimistic, driven by emerging policy discussions and a growing global acceptance of cannabis for therapeutic use. As the government explores the potential benefits of medical cannabis, there is a possibility for regulatory reforms that could facilitate market entry. Additionally, the ongoing digital transformation in healthcare may enhance access to cannabis-based treatments, creating a more favorable environment for future growth and investment in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Medicinal Cannabis Recreational Cannabis Hemp-derived Products Cannabis-infused Edibles Cannabis Oils and Tinctures Others |

| By End-User | Healthcare Providers Retail Consumers Pharmaceutical Companies Research Institutions Others |

| By Distribution Channel | Online Retail Physical Dispensaries Pharmacies Wholesale Distributors Others |

| By Product Form | Dried Flower Concentrates Edibles Topicals Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Geographic Location Others |

| By Regulatory Compliance | Fully Licensed Products Products in Regulatory Review Unregulated Products Others |

| By Market Maturity | Emerging Market Growth Market Established Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Acceptance of Legal Cannabis | 120 | General Public, Young Adults, Medical Patients |

| Regulatory Insights from Legal Experts | 30 | Lawyers, Policy Makers, Regulatory Authorities |

| Agricultural Stakeholders' Perspectives | 80 | Farmers, Agricultural Consultants, Distributors |

| Market Potential from Retailers | 60 | Retail Managers, Business Owners, Supply Chain Experts |

| Healthcare Professionals' Views on Medical Cannabis | 40 | Doctors, Pharmacists, Healthcare Administrators |

The Philippines legal cannabis market is valued at approximately USD 4.1 billion, driven by increasing interest in therapeutic applications and a developing regulatory framework that supports medical use.