Region:Middle East

Author(s):Shubham

Product Code:KRAD1897

Pages:100

Published On:December 2025

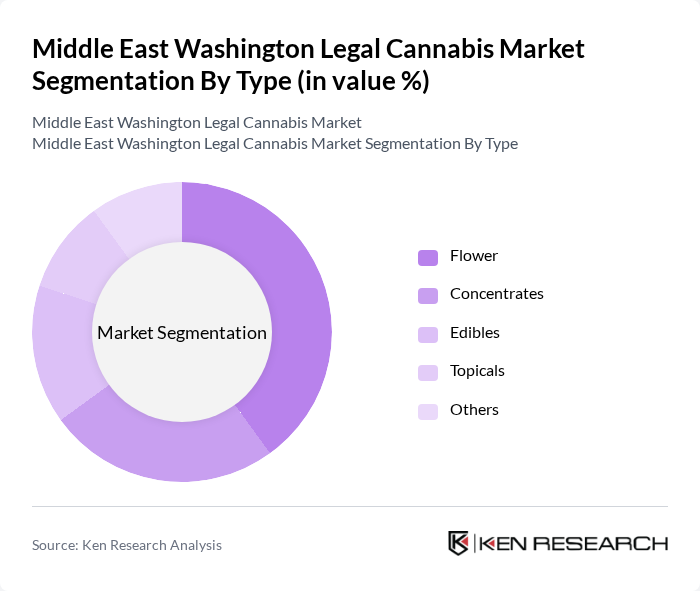

By Type:The market is segmented into various types, including Flower, Concentrates, Edibles, Topicals, and Others. Among these, the Flower segment is currently dominating the market due to its traditional use and high consumer preference for natural products. The increasing trend towards organic and natural remedies has further propelled the demand for flower products, making it a preferred choice among consumers seeking therapeutic benefits.

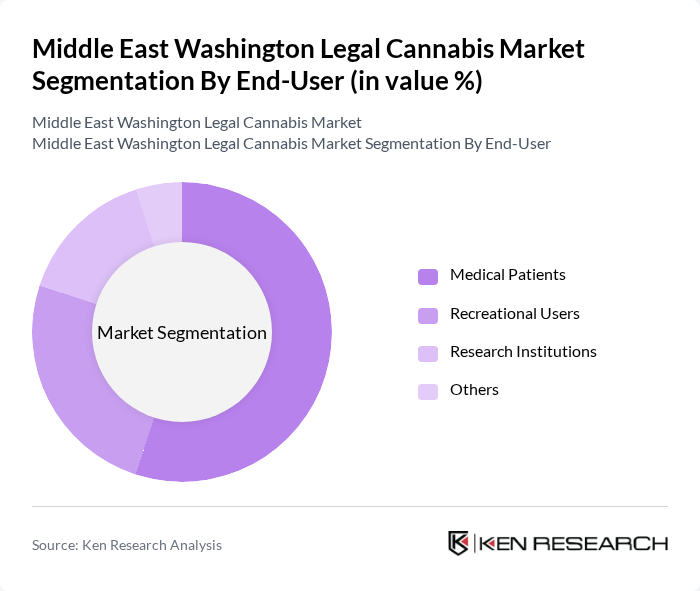

By End-User:The end-user segmentation includes Medical Patients, Recreational Users, Research Institutions, and Others. The Medical Patients segment is leading the market, driven by the increasing acceptance of cannabis for medical purposes and the growing number of patients seeking alternative therapies for chronic conditions. This segment's growth is supported by a rising number of clinical studies validating the therapeutic benefits of cannabis.

The Middle East Washington Legal Cannabis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canopy Growth Corporation, Aurora Cannabis Inc., Tilray Brands, Inc., Curaleaf Holdings, Inc., Trulieve Cannabis Corp., Green Thumb Industries Inc., Cresco Labs Inc., Hexo Corp., Organigram Holdings Inc., MedMen Enterprises Inc., Harvest Health & Recreation Inc., Aphria Inc., The Green Organic Dutchman Holdings Ltd., Acreage Holdings, Inc., Indus Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East Washington legal cannabis market appears promising, driven by advancements in cultivation and extraction technologies that enhance product diversity. The shift towards medical cannabis usage is expected to dominate consumption patterns, with increasing acceptance among healthcare providers. Additionally, the digital transformation of consumer engagement through online platforms and digital dispensaries will likely play a crucial role in shaping market dynamics, fostering growth and accessibility in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Flower Concentrates Edibles Topicals Others |

| By End-User | Medical Patients Recreational Users Research Institutions Others |

| By Distribution Channel | Retail Stores Online Sales Dispensaries Others |

| By Product Formulation | THC-Dominant CBD-Dominant Balanced THC/CBD Others |

| By Packaging Type | Resealable Bags Glass Containers Plastic Bottles Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Cannabis Patients | 150 | Patients with prescriptions, Healthcare Providers |

| Recreational Cannabis Users | 100 | Adult consumers, Retail Customers |

| Cannabis Retail Operators | 80 | Store Managers, Business Owners |

| Regulatory Authorities | 50 | Government Officials, Policy Makers |

| Cannabis Industry Experts | 70 | Market Analysts, Consultants |

The Middle East Washington Legal Cannabis Market is valued at approximately USD 1.85 billion, reflecting a significant growth trend driven by increasing acceptance of cannabis for medical, wellness, and industrial uses across the region.