Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3141

Pages:85

Published On:October 2025

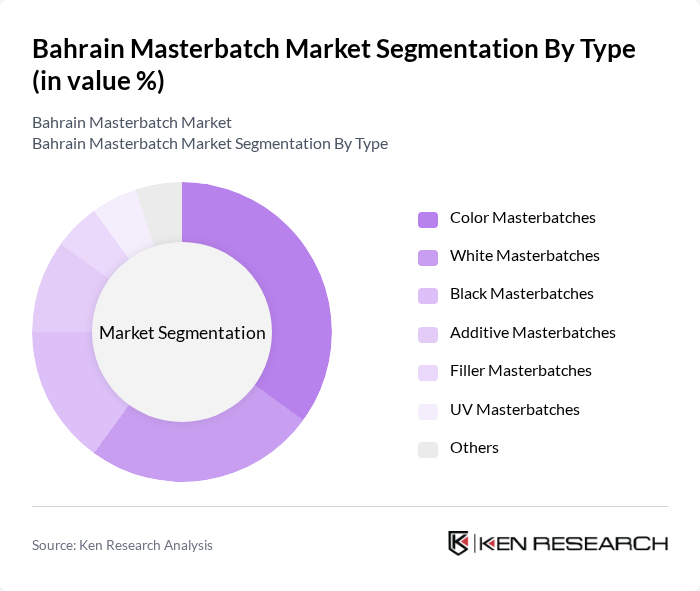

By Type:The masterbatch market in Bahrain is segmented into Color Masterbatches, White Masterbatches, Black Masterbatches, Additive Masterbatches, Filler Masterbatches, UV Masterbatches, and Others.Color Masterbatchesmaintain the largest share, driven by their extensive use in packaging and consumer goods, where vibrant coloration is critical for branding and product differentiation. The shift toward visually appealing and customized products continues to fuel demand for color masterbatches .

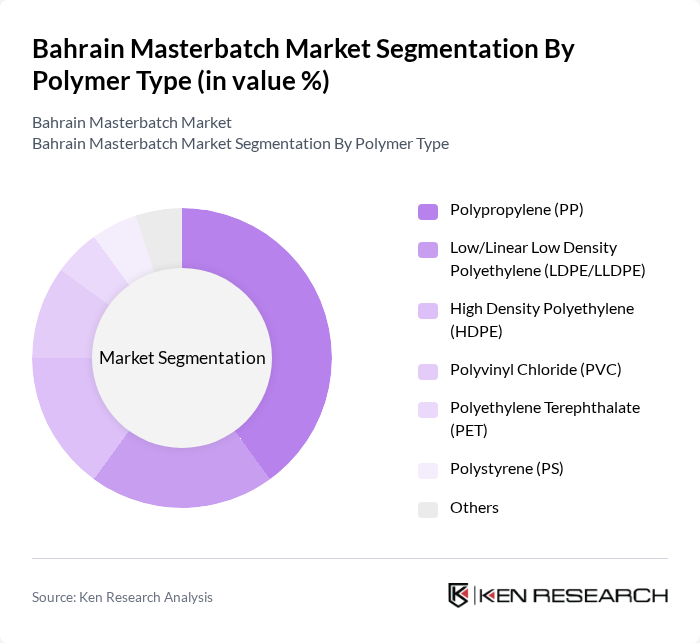

By Polymer Type:Segmentation by polymer type includes Polypropylene (PP), Low/Linear Low Density Polyethylene (LDPE/LLDPE), High Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Polystyrene (PS), and Others.Polypropylene (PP)leads the market due to its versatility, cost efficiency, and strong mechanical properties, making it the preferred choice for packaging, automotive, and consumer goods applications. The increasing use of PP in high-volume sectors continues to reinforce its dominant market position .

The Bahrain Masterbatch Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Ampacet Corporation, Avient Corporation, Tosaf Compounds Ltd., Polyplastics Middle East W.L.L., Al Suwaidi Plastic Factory, Astra Polymers Compounding Co. Ltd., Al Watania Plastics, Riyadh Plastic Factory, Plastiblends India Ltd., Kafrit Industries Ltd., DIC Corporation, Sudarshan Chemical Industries Ltd., RTP Company contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain masterbatch market is poised for significant transformation, driven by increasing environmental awareness and technological innovations. As manufacturers adapt to stringent regulations, the shift towards sustainable and eco-friendly solutions will become more pronounced. Additionally, the integration of digital technologies in production processes is expected to enhance efficiency and reduce costs. These trends will likely create a more competitive landscape, encouraging companies to innovate and expand their product offerings to meet evolving consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Color Masterbatches White Masterbatches Black Masterbatches Additive Masterbatches Filler Masterbatches UV Masterbatches Others |

| By Polymer Type | Polypropylene (PP) Low/Linear Low Density Polyethylene (LDPE/LLDPE) High Density Polyethylene (HDPE) Polyvinyl Chloride (PVC) Polyethylene Terephthalate (PET) Polystyrene (PS) Others |

| By Application | Packaging Building & Construction Automotive Consumer Goods Textile Agriculture Others |

| By Processing Technology | Injection Molding Blow Molding Film Extrusion Sheet Extrusion Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Price Range | Economy Mid-range Premium |

| By Region | Capital Governorate Northern Governorate Southern Governorate Muharraq Governorate |

| By Policy Support | Subsidies for Sustainable Practices Tax Incentives for Manufacturers Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Masterbatch Usage | 45 | Production Managers, Quality Control Supervisors |

| Automotive Sector Color Masterbatch Demand | 40 | Design Engineers, Procurement Specialists |

| Consumer Goods Plastic Applications | 40 | Product Development Managers, Marketing Directors |

| Construction Materials Masterbatch Integration | 40 | Project Managers, Technical Sales Representatives |

| Recycling and Sustainability Initiatives | 45 | Sustainability Officers, Operations Managers |

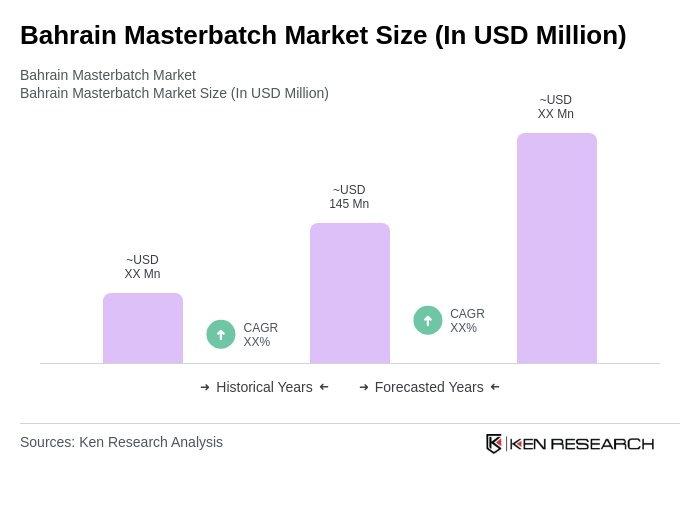

The Bahrain Masterbatch Market is valued at approximately USD 145 million, driven by increasing demand for plastic products in sectors such as packaging, automotive, and construction, along with a growing interest in sustainable masterbatch solutions.