Region:Asia

Author(s):Rebecca

Product Code:KRAB2044

Pages:97

Published On:January 2026

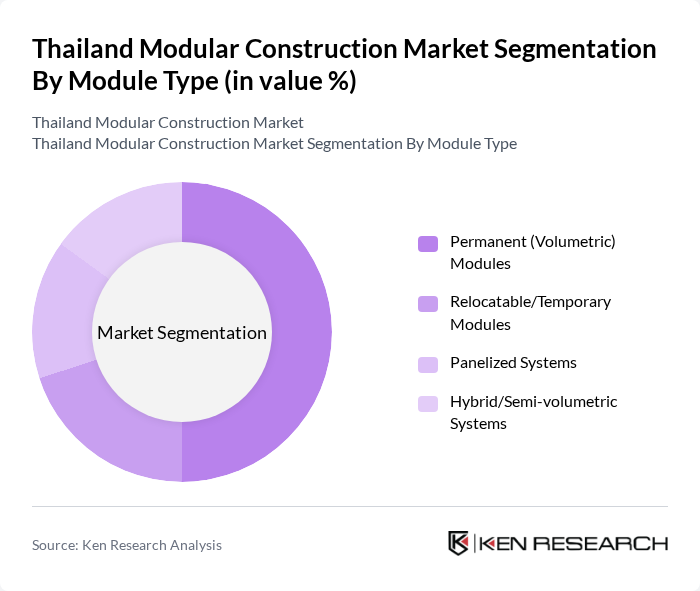

By Module Type:The modular construction market can be segmented into four main types: Permanent (Volumetric) Modules, Relocatable/Temporary Modules, Panelized Systems, and Hybrid/Semi-volumetric Systems. Each of these subsegments serves different construction needs, with Permanent Modules being the most widely adopted for multi-storey residential, hospitality, and commercial buildings due to their durability, structural integrity, and suitability for long-term use, while panelized and hybrid systems are increasingly used for mid-rise housing and institutional buildings where faster on-site assembly and flexibility in design are required.

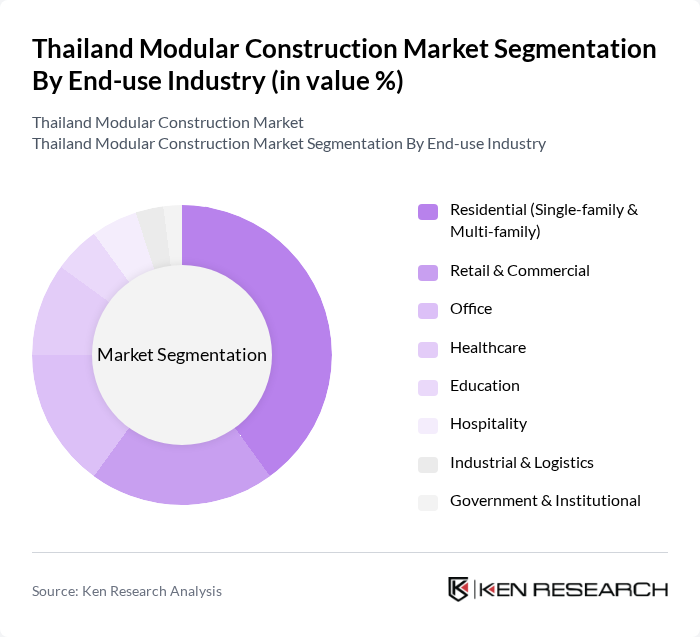

By End-use Industry:The end-use industry segmentation includes Residential (Single-family & Multi-family), Retail & Commercial, Office, Healthcare, Education, Hospitality, Industrial & Logistics, and Government & Institutional, consistent with the breakdown commonly used for Thailand’s prefabricated construction market. The Residential segment is currently leading the market as prefabrication has been increasingly adopted in affordable housing and mass housing schemes to reduce construction time and labor requirements, while commercial, office, and hospitality projects are using modular techniques to accelerate delivery and improve quality control.

The Thailand Modular Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as SCG Modular Building Solutions (Siam Cement Group), Pruksa Prefab / Pruksa Real Estate Public Company Limited, Italian-Thai Development Public Company Limited (Modular & Prefab Division), Pre-Built Public Company Limited, Sino-Thai Engineering & Construction Public Company Limited, Christiani & Nielsen (Thai) Public Company Limited, Powerline Engineering Public Company Limited, Team Prefab Co., Ltd., Modular Tech (Thailand) Co., Ltd., Thai Obayashi Corporation Ltd. (Industrialized & Modular Solutions), RITTA Co., Ltd. (Prefabricated & Modular Projects), Bouygues-Thai Ltd. (Off-site & Modular Construction), L&T Construction (Thailand Operations – Modular / Prefab Projects), Charoen Pokphand Group – Real Estate & Modular Housing Initiatives, and Emerging Local Modular Start-ups and SMEs contribute to innovation, geographic expansion, and service delivery in this space, with several firms investing in automated precast plants, steel modular systems, and integrated design–build capabilities to support the rising demand for prefabricated solutions.

The future of the modular construction market in Thailand appears promising, driven by urbanization and government support for infrastructure development. As awareness of modular benefits grows, more stakeholders are likely to adopt these methods. Additionally, the integration of smart technologies and sustainable practices will further enhance the appeal of modular construction. In future, the market is expected to see significant advancements, particularly in energy efficiency and design innovation, positioning Thailand as a leader in modern construction practices in Southeast Asia.

| Segment | Sub-Segments |

|---|---|

| By Module Type | Permanent (Volumetric) Modules Relocatable/Temporary Modules Panelized Systems Hybrid/Semi-volumetric Systems |

| By End-use Industry | Residential (Single-family & Multi-family) Retail & Commercial Office Healthcare Education Hospitality Industrial & Logistics Government & Institutional |

| By Construction Method | Fully Off-site Modular Construction Partially Off-site / Hybrid Construction On-site Modular Assembly |

| By Material | Steel Concrete Wood Other Materials (Aluminium, Composites, etc.) |

| By Application | Building Superstructure Roof & Floor Systems Interior Room Modules Exterior Walls, Columns & Beams |

| By Project Size | Small Projects (< THB 50 million) Medium Projects (THB 50–250 million) Large Projects (> THB 250 million) |

| By Region | Bangkok Metropolitan Region Central Thailand (Excl. BMR) Northern Thailand Northeastern Thailand Southern Thailand |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Modular Projects | 100 | Architects, Home Builders, Project Managers |

| Commercial Modular Developments | 80 | Real Estate Developers, Construction Managers |

| Industrial Modular Solutions | 70 | Facility Managers, Operations Directors |

| Regulatory Compliance in Modular Construction | 60 | Policymakers, Regulatory Affairs Specialists |

| Technological Innovations in Modular Construction | 90 | R&D Managers, Technology Consultants |

The Thailand Modular Construction Market is valued at approximately THB 23 billion, driven by urbanization, government initiatives for sustainable building, and the demand for affordable housing solutions. This market is part of the broader prefabricated construction sector in Thailand.