Region:Asia

Author(s):Shubham

Product Code:KRAA6448

Pages:81

Published On:January 2026

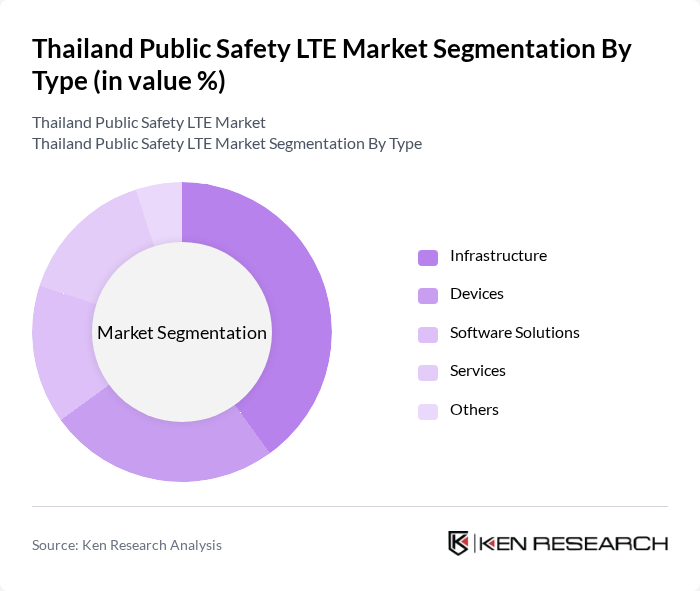

By Type:The market is segmented into Infrastructure, Devices, Software Solutions, Services, and Others. Each sub-segment plays a crucial role in the overall ecosystem, with infrastructure being the backbone that supports all other components. The increasing demand for reliable communication systems has led to significant investments in infrastructure development, while devices and software solutions are essential for operational efficiency.

By End-User:The end-user segmentation includes Government Agencies, Emergency Services, Transportation Sector, Utilities, and Others. Government agencies and emergency services are the primary users of public safety LTE solutions, driven by the need for effective communication during crises. The transportation sector also increasingly relies on these technologies to enhance safety and operational efficiency.

The Thailand Public Safety LTE Market is characterized by a dynamic mix of regional and international players. Leading participants such as True Corporation, AIS (Advanced Info Service), TOT Public Company Limited, CAT Telecom, Huawei Technologies (Thailand), Ericsson Thailand, Nokia Thailand, Motorola Solutions Thailand, ZTE Corporation, Samsung Electronics (Thailand), Cisco Systems Thailand, NEC Corporation Thailand, Siemens Thailand, Thales Group Thailand, Avaya Thailand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand Public Safety LTE market appears promising, driven by ongoing government initiatives and technological advancements. As the country continues to invest in smart city projects, the integration of LTE with IoT technologies will enhance public safety measures. Additionally, the increasing focus on cybersecurity will shape the development of communication systems, ensuring that they are resilient against potential threats. Overall, these trends indicate a robust growth trajectory for the market in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Infrastructure Devices Software Solutions Services Others |

| By End-User | Government Agencies Emergency Services Transportation Sector Utilities Others |

| By Application | Disaster Management Crime Prevention Traffic Management Public Health Others |

| By Technology | LTE Advanced G Integration Network Slicing Cloud-Based Solutions Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Northeastern Thailand Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Law Enforcement Agencies | 120 | Police Chiefs, IT Managers |

| Emergency Medical Services | 100 | EMS Directors, Operations Supervisors |

| Fire Services | 90 | Fire Chiefs, Communications Officers |

| Telecommunications Providers | 110 | Network Engineers, Business Development Managers |

| Public Safety Technology Consultants | 80 | Consultants, Policy Advisors |

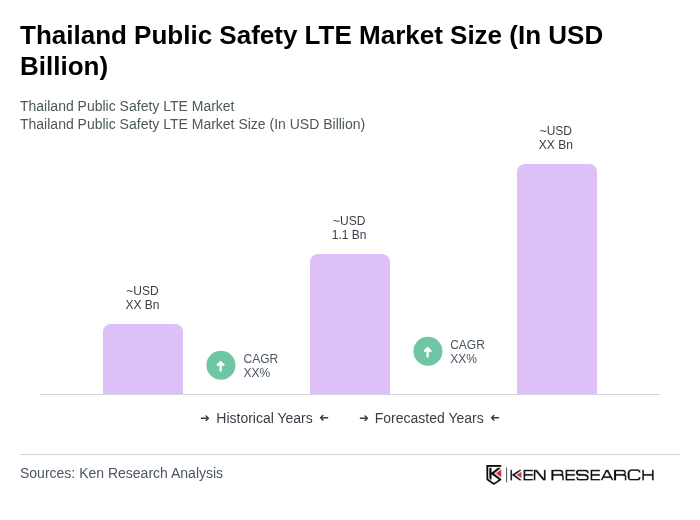

The Thailand Public Safety LTE market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing demand for reliable communication systems among public safety agencies and the adoption of advanced technologies like LTE and 5G.