Region:North America

Author(s):Geetanshi

Product Code:KRAA7147

Pages:87

Published On:January 2026

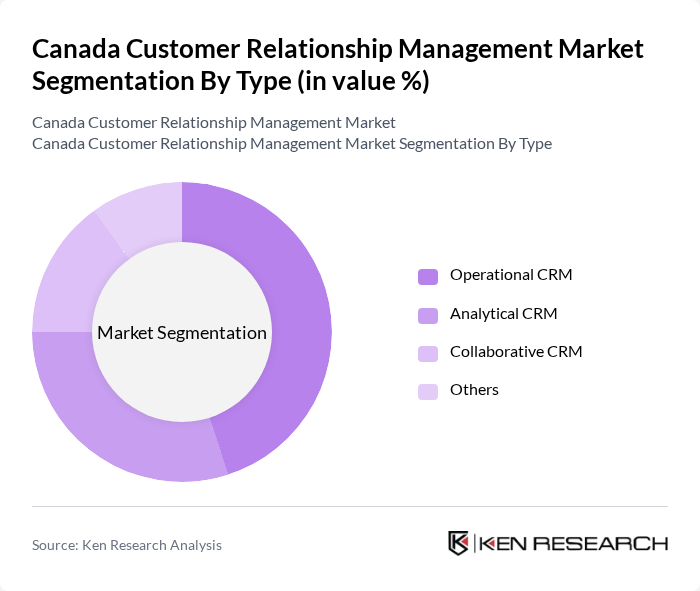

By Type:The market is segmented into Operational CRM, Analytical CRM, Collaborative CRM, and Others. Among these, Operational CRM is the leading sub-segment, driven by its ability to streamline business processes and enhance customer interactions. Companies are increasingly adopting operational CRM solutions to automate sales, marketing, and customer service functions, leading to improved efficiency and customer satisfaction.

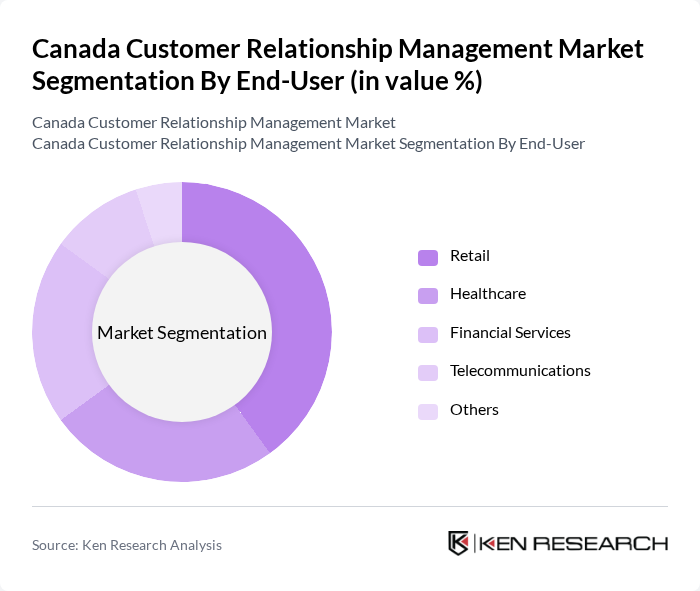

By End-User:The end-user segmentation includes Retail, Healthcare, Financial Services, Telecommunications, and Others. The retail sector is the dominant end-user, as businesses increasingly rely on CRM systems to manage customer relationships and enhance sales strategies. The growing trend of e-commerce and personalized marketing in retail has further fueled the demand for CRM solutions tailored to this sector.

The Canada Customer Relationship Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, HubSpot, Microsoft Dynamics 365, Zoho CRM, SAP Customer Experience, Oracle CRM, Freshworks CRM, Pipedrive, SugarCRM, Insightly, Nimble, Keap, Close.io, Copper, and Monday.com contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canadian CRM market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize customer experience, the integration of advanced analytics and AI will become essential for effective customer engagement. Moreover, the rise of remote work is likely to accelerate the adoption of mobile CRM solutions, enabling organizations to maintain strong customer relationships regardless of location. This trend will foster innovation and adaptability within the CRM landscape, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Operational CRM Analytical CRM Collaborative CRM Others |

| By End-User | Retail Healthcare Financial Services Telecommunications Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | Manufacturing Education Travel and Hospitality Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Region | Ontario Quebec British Columbia Alberta Others |

| By Customer Engagement Channel | Social Media Phone Live Chat Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail CRM Usage | 120 | Marketing Managers, Customer Experience Directors |

| Financial Services CRM Implementation | 100 | IT Managers, Compliance Officers |

| Healthcare CRM Solutions | 80 | Practice Managers, IT Directors |

| Telecommunications Customer Management | 70 | Customer Service Managers, Product Development Leads |

| SME CRM Adoption Trends | 90 | Business Owners, Operations Managers |

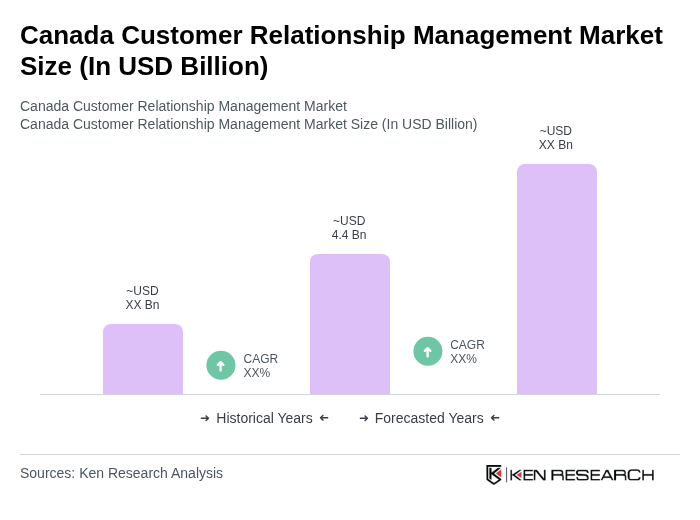

The Canada Customer Relationship Management market is valued at approximately USD 4.4 billion. This growth is driven by the increasing adoption of digital transformation strategies among businesses, enhancing customer engagement and retention.