Region:Africa

Author(s):Shubham

Product Code:KRAB1158

Pages:98

Published On:October 2025

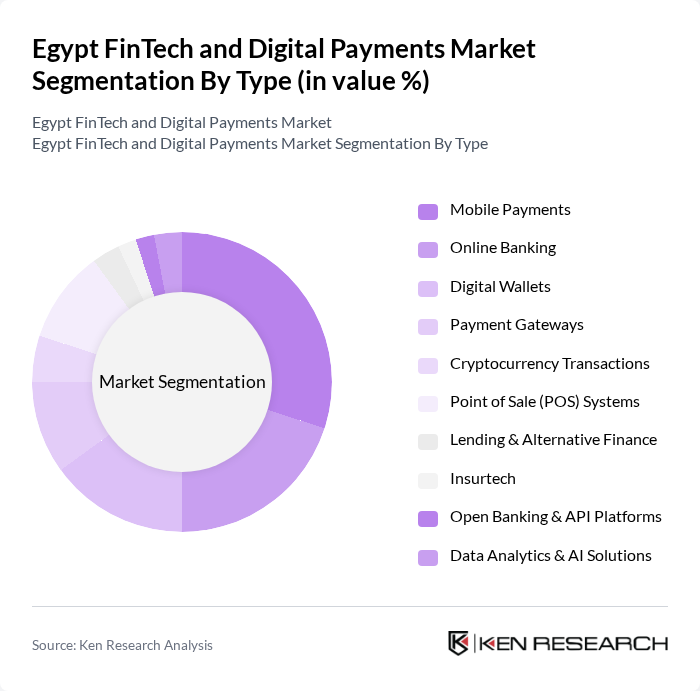

By Type:The market is segmented into Mobile Payments, Online Banking, Digital Wallets, Payment Gateways, Cryptocurrency Transactions, Point of Sale (POS) Systems, Lending & Alternative Finance, Insurtech, Open Banking & API Platforms, and Data Analytics & AI Solutions. Mobile Payments and Digital Wallets are the most widely adopted segments, driven by consumer demand for convenience and security. Payment Gateways and POS Systems are critical for enabling e-commerce and retail transactions, while Lending & Alternative Finance and Insurtech are gaining traction as financial inclusion deepens. Open Banking, API Platforms, and Data Analytics & AI Solutions are increasingly important for innovation and personalized financial services .

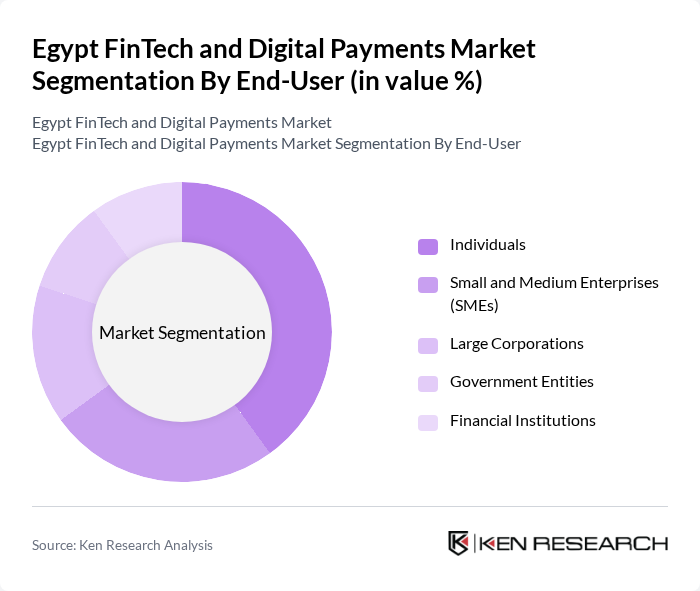

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, Government Entities, and Financial Institutions. Individuals are the primary adopters, leveraging digital payments for daily transactions and remittances. SMEs and Large Corporations increasingly use digital platforms for efficiency and transparency, while Government Entities and Financial Institutions focus on digital transformation to enhance service delivery and compliance .

The Egypt FinTech and Digital Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology Services, Paymob, EFG Hermes, Vodafone Cash, Orange Money, CIB (Commercial International Bank), Banque Misr, National Bank of Egypt, Aman for E-Payments, Masary, MNT-Halan, Khazna, valU, QNB Alahli, Instapay contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's FinTech and digital payments market appears promising, driven by technological advancements and increasing consumer acceptance of digital solutions. With the government's commitment to fostering a cashless economy, the integration of AI and blockchain technologies is expected to enhance transaction security and efficiency. Additionally, the rise of digital wallets and peer-to-peer lending platforms will likely reshape the financial landscape, making it more accessible and user-friendly for the Egyptian population.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Payments Online Banking Digital Wallets Payment Gateways Cryptocurrency Transactions Point of Sale (POS) Systems Lending & Alternative Finance Insurtech Open Banking & API Platforms Data Analytics & AI Solutions |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities Financial Institutions |

| By Application | E-commerce Transactions Bill Payments Remittances In-store Payments Peer-to-Peer Transfers Micro-lending |

| By Distribution Channel | Direct Sales Online Platforms Retail Partnerships Telecom Partnerships |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Money Cash on Delivery Prepaid Cards |

| By Customer Segment | Retail Customers Corporate Clients Non-profit Organizations Unbanked & Underbanked Populations |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Payment Usage | 120 | End-users, Mobile Wallet Users |

| Merchant Adoption of FinTech Solutions | 80 | Small Business Owners, Retail Managers |

| Banking Sector Insights | 60 | Bank Executives, Product Managers |

| Regulatory Perspectives | 40 | Regulatory Officials, Policy Makers |

| FinTech Startup Ecosystem | 50 | Founders, CTOs of FinTech Startups |

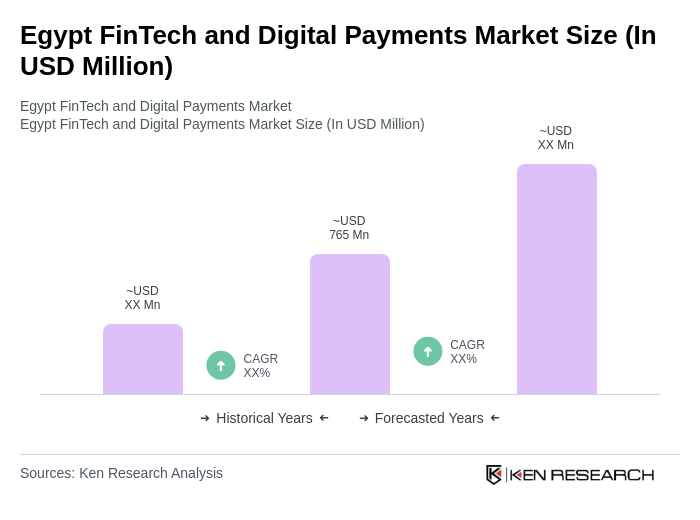

The Egypt FinTech and Digital Payments Market is valued at approximately USD 765 million, reflecting significant growth driven by the expansion of digital payment solutions, increased e-commerce activities, and government initiatives aimed at enhancing financial inclusion.