France FinTech and Digital Payments Market Overview

- The France FinTech and Digital Payments Market is valued at USD 10 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital payment solutions, the rise of e-commerce, and the growing demand for seamless and secure payment methods among consumers and businesses alike.

- Key cities such as Paris, Lyon, and Marseille dominate the market due to their robust financial ecosystems, high population density, and a strong presence of tech-savvy consumers. These urban centers are also home to numerous startups and established financial institutions that foster innovation in the FinTech sector.

- In 2023, the French government implemented the Digital Payment Services Act, which aims to enhance consumer protection and promote competition among payment service providers. This regulation mandates transparency in fees and encourages the use of secure payment technologies, thereby fostering a more robust digital payments landscape.

France FinTech and Digital Payments Market Segmentation

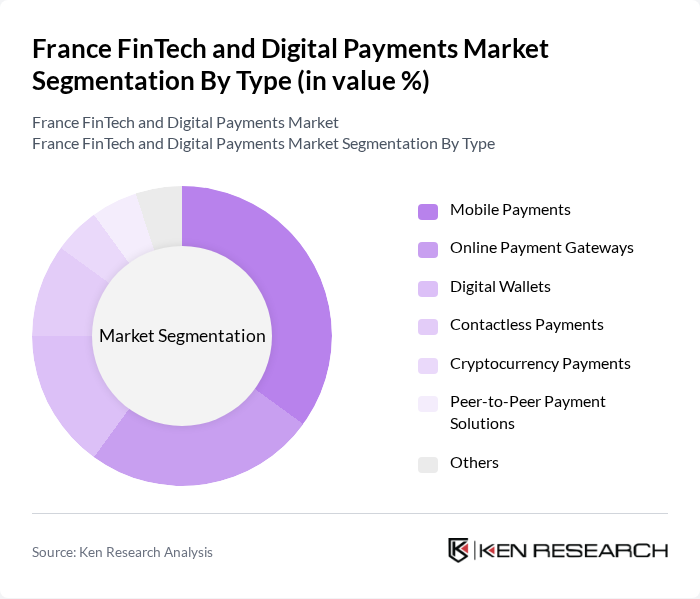

By Type:The market is segmented into various types, including Mobile Payments, Online Payment Gateways, Digital Wallets, Contactless Payments, Cryptocurrency Payments, Peer-to-Peer Payment Solutions, and Others. Among these, Mobile Payments have emerged as the leading sub-segment, driven by the widespread use of smartphones and the convenience they offer to consumers. The increasing integration of mobile payment solutions in retail and e-commerce platforms has further solidified their dominance.

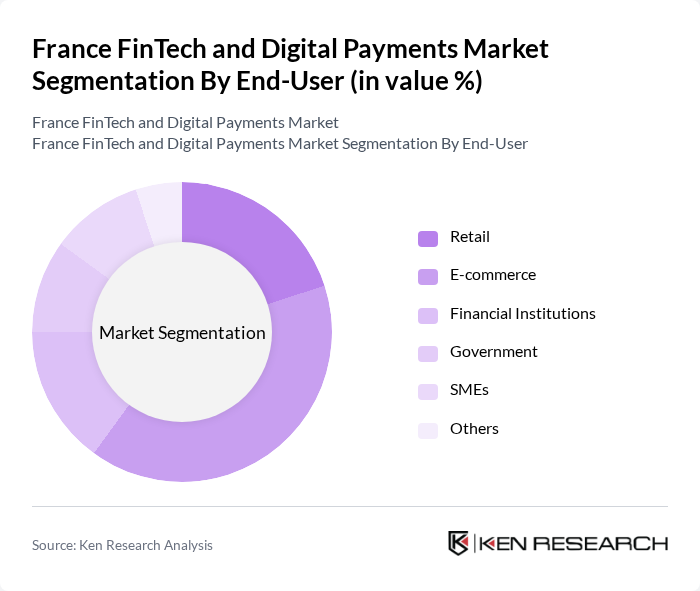

By End-User:The market is segmented by end-users, including Retail, E-commerce, Financial Institutions, Government, SMEs, and Others. The E-commerce sector is the dominant end-user, as the rapid growth of online shopping has led to an increased demand for efficient and secure payment solutions. Retailers are increasingly adopting digital payment methods to enhance customer experience and streamline transactions.

France FinTech and Digital Payments Market Competitive Landscape

The France FinTech and Digital Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Stripe, Inc., Adyen N.V., Worldline S.A., Ingenico Group S.A., BNP Paribas S.A., Orange S.A., Lydia Solutions, Revolut Ltd., N26 GmbH, Klarna AB, Wise PLC, Mollie B.V., Cash App (Square, Inc.), Trustly Group AB contribute to innovation, geographic expansion, and service delivery in this space.

France FinTech and Digital Payments Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:As of future, France boasts a smartphone penetration rate of approximately 85%, translating to around 58 million users. This widespread adoption facilitates mobile payment solutions, driving the digital payments market. The rise in mobile internet usage, which reached 82% of the population, further supports this trend, enabling consumers to engage in seamless transactions. Enhanced connectivity and user-friendly applications are pivotal in fostering a cashless society, thereby propelling the FinTech sector forward.

- Rise in E-commerce Transactions:E-commerce sales in France are projected to exceed €160 billion in future, reflecting a significant increase from previous years. This surge is driven by changing consumer behaviors, with 75% of the population shopping online regularly. The convenience of digital payments is crucial in this growth, as consumers prefer quick and secure payment methods. Consequently, the FinTech sector is experiencing heightened demand for innovative payment solutions that cater to the evolving e-commerce landscape.

- Demand for Contactless Payment Solutions:In future, contactless payments are expected to account for over 55% of all card transactions in France, driven by consumer preferences for speed and convenience. The COVID-19 pandemic accelerated this trend, with a 35% increase in contactless transactions reported in the previous year. Retailers are increasingly adopting contactless technology, enhancing customer experiences and reducing transaction times. This shift is pivotal in shaping the future of payments, as consumers seek safer and more efficient transaction methods.

Market Challenges

- Cybersecurity Threats:The FinTech sector in France faces significant cybersecurity challenges, with cyberattacks increasing by 45% in the previous year. Financial institutions reported losses exceeding €1.2 billion due to fraud and data breaches. As digital transactions rise, so do the risks associated with them, prompting companies to invest heavily in cybersecurity measures. The need for robust security protocols is critical to maintaining consumer trust and ensuring the integrity of digital payment systems in an increasingly hostile cyber environment.

- Regulatory Compliance Complexities:The regulatory landscape for FinTech in France is intricate, with compliance costs estimated at €550 million annually for major players. The implementation of regulations such as PSD2 and GDPR has increased operational burdens, particularly for startups. Navigating these regulations requires significant resources and expertise, which can hinder innovation and market entry for smaller firms. As compliance demands grow, companies must balance regulatory adherence with the need for agility in a competitive market.

France FinTech and Digital Payments Market Future Outlook

The future of the France FinTech and digital payments market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security. Additionally, the shift towards open banking will foster innovation, allowing consumers to access a broader range of financial services. As the market matures, collaboration between traditional banks and FinTech firms will likely become more prevalent, creating a more dynamic financial ecosystem that prioritizes customer experience.

Market Opportunities

- Expansion of Digital Wallets:The digital wallet market in France is projected to grow significantly, with user adoption expected to reach 32 million in future. This growth presents opportunities for FinTech companies to innovate and offer tailored solutions that enhance user experience. As consumers increasingly prefer digital wallets for their convenience and security, businesses can capitalize on this trend by integrating advanced features and partnerships with retailers to drive usage.

- Growth in Cross-Border Payments:Cross-border payment transactions in France are anticipated to exceed €55 billion in future, driven by globalization and increased international trade. This growth presents opportunities for FinTech firms to develop solutions that streamline these transactions, reduce costs, and enhance speed. By addressing the complexities of currency exchange and regulatory compliance, companies can position themselves as leaders in the evolving landscape of international payments.