Region:Asia

Author(s):Dev

Product Code:KRAA3549

Pages:92

Published On:September 2025

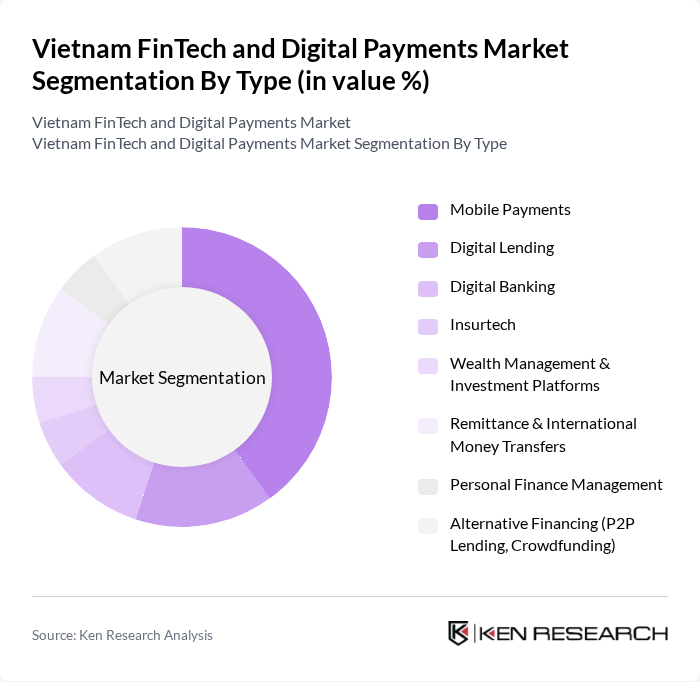

By Type:The market can be segmented into various types, including Mobile Payments, Digital Lending, Digital Banking, Insurtech, Wealth Management & Investment Platforms, Remittance & International Money Transfers, Personal Finance Management, and Alternative Financing (P2P Lending, Crowdfunding). Among these,Mobile Paymentsis the leading sub-segment, driven by the increasing use of smartphones, QR code-based payment systems, and the convenience of cashless transactions. The rise of e-wallets and contactless payments is reshaping consumer payment behavior, while P2P lending and digital banking are also gaining traction due to growing demand for accessible credit and online financial management .

By End-User:The market is segmented by end-users, including Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and the Unbanked/Underserved Population. TheIndividualssegment is the most significant, as the growing trend of digital payments among consumers is reshaping the financial landscape. SMEs are increasingly adopting digital payment and lending solutions, while efforts to reach the unbanked are expanding through mobile-first financial products and agent banking .

The Vietnam FinTech and Digital Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoMo, ZaloPay, ViettelPay, Payoo, VNPay, Timo, GrabPay by Moca, Moca, SmartPay, BankPlus, VTC Pay, FPT Pay, B?o Kim, ShopeePay, AirPay, Cake by VPBank, Kredivo Vietnam, Finhay, NextPay, and TPBank contribute to innovation, geographic expansion, and service delivery in this space .

The future of Vietnam's FinTech and digital payments market appears promising, driven by technological advancements and increasing consumer demand for convenient financial solutions. As the government continues to support digital transformation, innovations such as AI and blockchain are expected to reshape the financial landscape. Additionally, the rise of digital wallets and contactless payment methods will likely enhance user experience, making financial services more accessible to the unbanked population, thereby fostering greater financial inclusion.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Payments Digital Lending Digital Banking Insurtech Wealth Management & Investment Platforms Remittance & International Money Transfers Personal Finance Management Alternative Financing (P2P Lending, Crowdfunding) |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Unbanked/Underserved Population |

| By Application | E-commerce Transactions Bill Payments Fund Transfers In-store Payments Micro-lending |

| By Distribution Channel | Online Platforms Mobile Applications Agent Networks Retail Outlets |

| By Customer Segment | Retail Customers Corporate Clients Rural Customers Non-profit Organizations |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments QR Code Payments E-wallets |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Financial Inclusion Initiatives |

| By Region | Ho Chi Minh City Hanoi Southern Vietnam Other Provinces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Payment Adoption | 100 | General Consumers, Tech-Savvy Users |

| SME Digital Payment Integration | 60 | Business Owners, Financial Managers |

| Fintech Service Providers | 40 | Product Managers, Marketing Directors |

| Regulatory Impact Assessment | 40 | Policy Makers, Financial Regulators |

| Consumer Trust in Fintech Solutions | 80 | End Users, Financial Literacy Advocates |

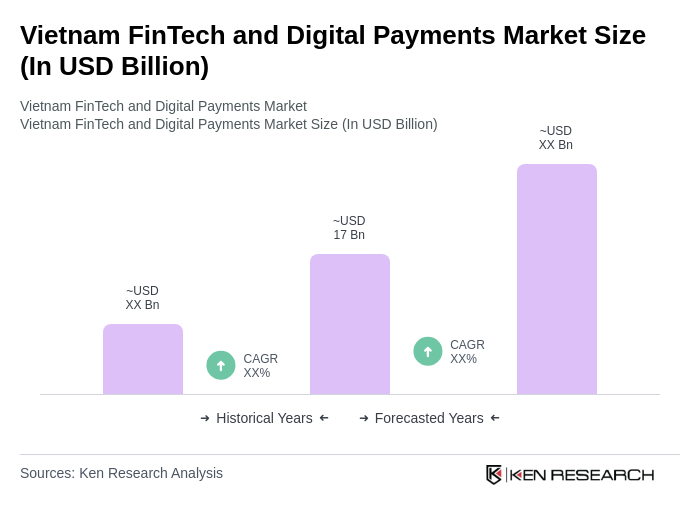

The Vietnam FinTech and Digital Payments Market is valued at approximately USD 17 billion, driven by the rapid adoption of digital technologies, increasing smartphone penetration, and a young, tech-savvy population eager for online financial services.