Region:Middle East

Author(s):Geetanshi

Product Code:KRAA4763

Pages:96

Published On:September 2025

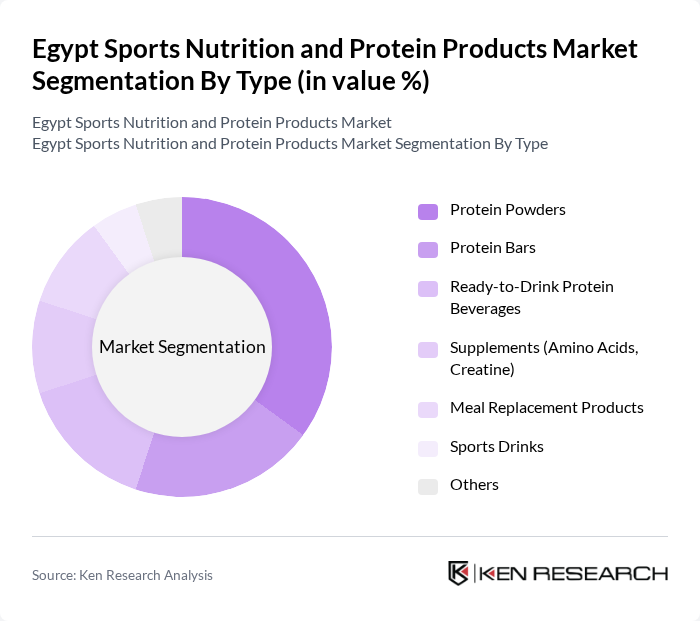

By Type:The market is segmented into various types of products, including Protein Powders, Protein Bars, Ready-to-Drink Protein Beverages, Supplements (Amino Acids, Creatine), Meal Replacement Products, Sports Drinks, and Others. Among these, Protein Powders dominate the market due to their versatility and high protein content, appealing to a wide range of consumers from athletes to casual gym-goers. The increasing trend of home workouts and the convenience of protein powders have further solidified their leading position in the market.

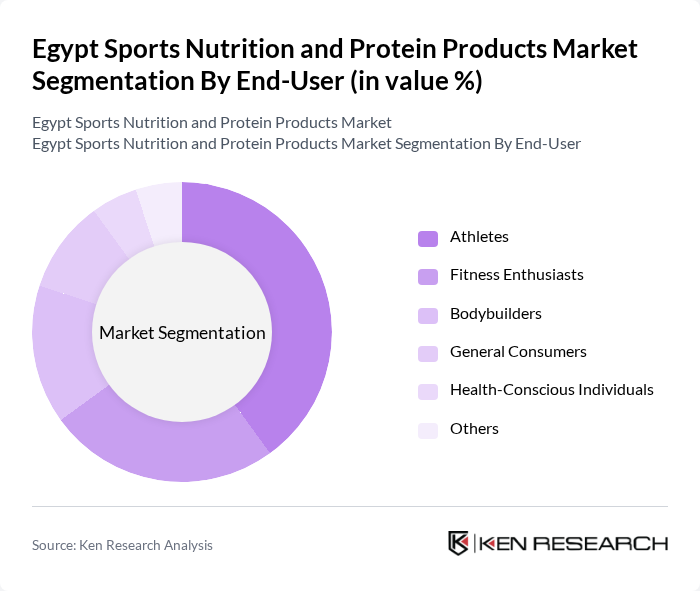

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, Bodybuilders, General Consumers, Health-Conscious Individuals, and Others. Athletes represent the largest segment, driven by their need for specialized nutrition to enhance performance and recovery. The growing fitness culture in Egypt has also led to an increase in the number of fitness enthusiasts who actively seek out sports nutrition products, further boosting this segment's prominence.

The Egypt Sports Nutrition and Protein Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, MyProtein, BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, Dymatize Nutrition, Quest Nutrition, EAS (Energy Athletic Science), Isopure, GNC Holdings, Inc., Bodybuilding.com, ProMix Nutrition, Vega, Kaged Muscle, RSP Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports nutrition and protein products market in Egypt appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with natural and functional ingredients. Additionally, the growth of e-commerce will facilitate broader market access, allowing companies to reach untapped demographics. The increasing popularity of personalized nutrition solutions will further enhance consumer engagement, creating a dynamic market landscape poised for expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders Protein Bars Ready-to-Drink Protein Beverages Supplements (Amino Acids, Creatine) Meal Replacement Products Sports Drinks Others |

| By End-User | Athletes Fitness Enthusiasts Bodybuilders General Consumers Health-Conscious Individuals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Health and Wellness Stores Gyms and Fitness Centers Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Packaging Type | Single-Serve Packs Bulk Packaging Ready-to-Drink Containers Sachets |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| By Nutritional Content | High-Protein Low-Carbohydrate Gluten-Free Vegan |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Protein Products | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Sports Nutrition | 200 | Athletes, Fitness Enthusiasts |

| Distribution Channels for Protein Supplements | 100 | Distributors, Wholesalers |

| Market Trends in Dietary Supplements | 80 | Nutritionists, Health Coaches |

| Impact of Social Media on Protein Product Choices | 120 | Social Media Influencers, Fitness Bloggers |

The Egypt Sports Nutrition and Protein Products Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased health awareness and a rising number of fitness enthusiasts in the country.