Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB1601

Pages:89

Published On:October 2025

By Product Type:The product type segmentation includes categories such as Sports Drinks, Sports Supplements, Sports Foods, Meal Replacement Products, and Weight Loss Products. Among these, Sports Drinks hold the largest revenue share, driven by their widespread consumption among athletes and fitness enthusiasts for hydration and energy. Sports Supplements, especially protein powders and amino acids, remain highly popular for performance enhancement and recovery. The rise of personalized nutrition and the growth of e-commerce have further accelerated demand for these products .

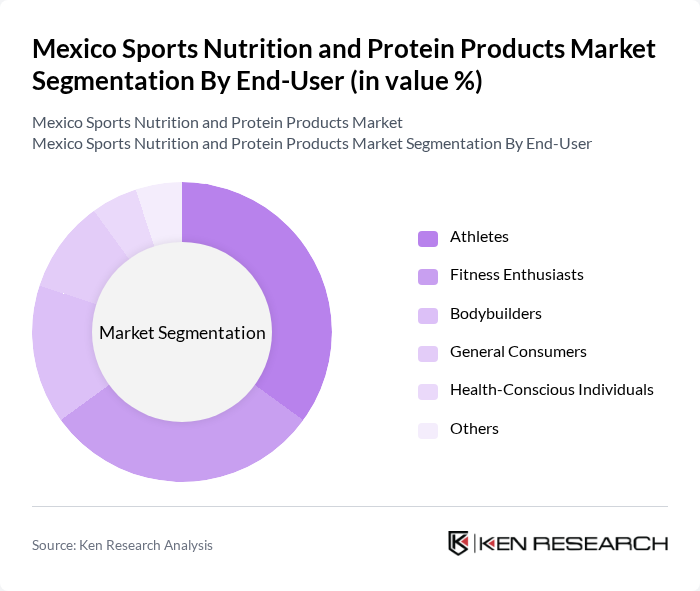

By End-User:The end-user segmentation includes Athletes (Professional & Semi-Professional), Fitness Enthusiasts, Bodybuilders, and General Consumers. Fitness Enthusiasts and Athletes represent the largest segments, driven by their need for specialized nutrition to enhance performance and recovery. The increasing participation in sports, fitness activities, and recreational exercise has led to a growing demand for tailored nutrition solutions, making these segments key drivers of market growth .

The Mexico Sports Nutrition and Protein Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition (Glanbia plc), MusclePharm Corporation, BSN (Bio-Engineered Supplements and Nutrition, Inc.), Dymatize Enterprises, LLC, Quest Nutrition (The Simply Good Foods Company), Isopure (Glanbia plc), GNC Holdings, LLC, Abbott Laboratories (Ensure, EAS), Myprotein (The Hut Group), Vega (Danone S.A.), Iovate Health Sciences International Inc. (MuscleTech, Six Star Pro Nutrition), PepsiCo, Inc. (Gatorade), The Coca-Cola Company (Powerade), Nutrisa S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports nutrition and protein products market in Mexico appears promising, driven by evolving consumer preferences and increasing health awareness. As more individuals adopt fitness-oriented lifestyles, the demand for innovative and personalized nutrition solutions is expected to rise. Additionally, the integration of technology in product development and marketing strategies will likely enhance consumer engagement, paving the way for sustained growth. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sports Drinks Sports Supplements (Protein Powders, Amino Acids, Creatine, Pre-Workout, Post-Workout, etc.) Sports Foods (Protein Bars, Energy Bars, Gels, etc.) Meal Replacement Products Weight Loss Products |

| By End-User | Athletes (Professional & Semi-Professional) Fitness Enthusiasts Bodybuilders General Consumers |

| By Distribution Channel | Specialty Fitness Stores Pharmacies E-commerce Platforms Supermarkets/Hypermarkets Convenience Stores |

| By Ingredient Source | Animal-Based Proteins Plant-Based Proteins Blended Proteins |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Single-Serve Packs Bulk Packaging Ready-to-Drink Containers |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fitness Enthusiasts | 120 | Athletes, Gym Members, Personal Trainers |

| Health and Nutrition Professionals | 60 | Nutritionists, Dietitians, Health Coaches |

| Retailers of Sports Nutrition Products | 40 | Store Managers, Product Buyers, E-commerce Managers |

| Manufacturers of Protein Products | 40 | Product Development Managers, Marketing Executives |

| Consumers of Protein Supplements | 100 | Regular Users, Occasional Users, New Users |

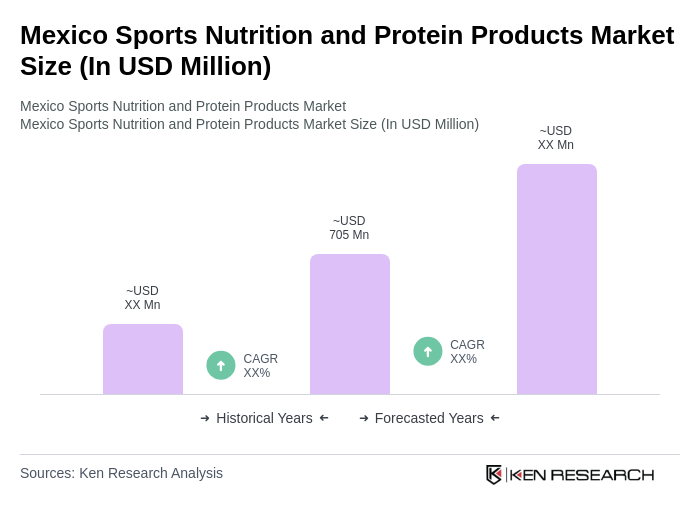

The Mexico Sports Nutrition and Protein Products Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by increasing health consciousness and the rise in fitness activities among consumers.