Region:Europe

Author(s):Dev

Product Code:KRAA7248

Pages:87

Published On:September 2025

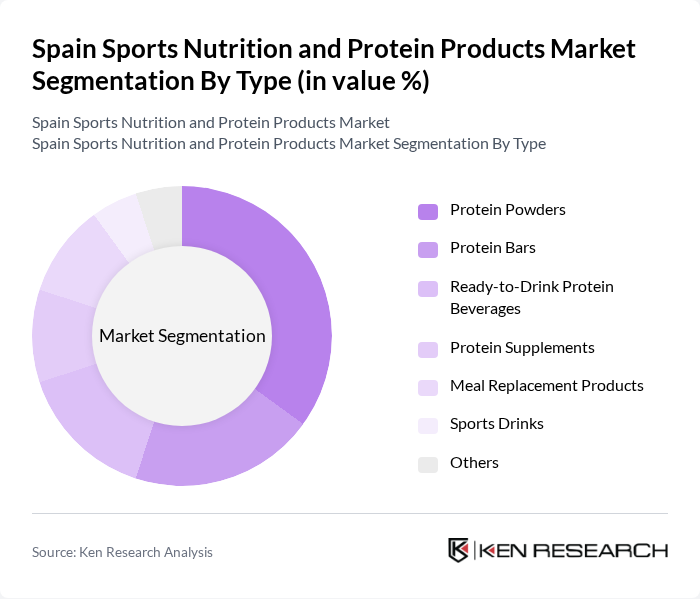

By Type:The market is segmented into various types of products, including Protein Powders, Protein Bars, Ready-to-Drink Protein Beverages, Protein Supplements, Meal Replacement Products, Sports Drinks, and Others. Among these, Protein Powders are the most dominant segment, driven by their versatility and effectiveness in muscle recovery and growth. The increasing trend of home workouts and the convenience of protein powders have made them a preferred choice among consumers.

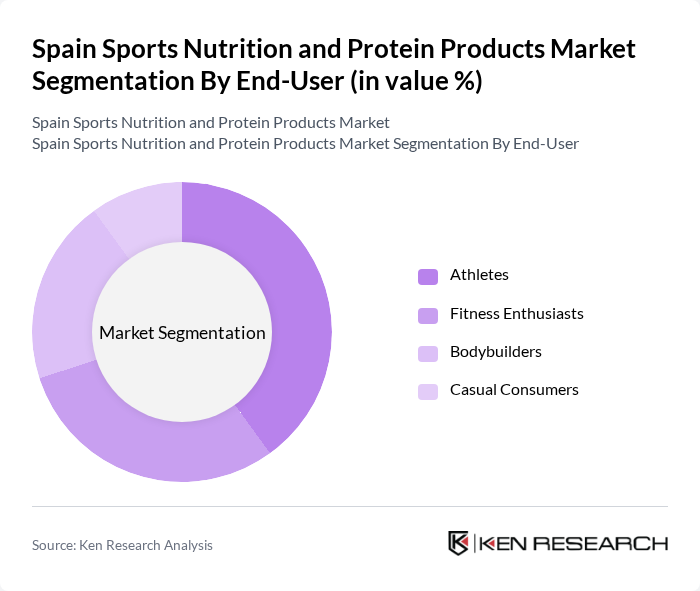

By End-User:The end-user segmentation includes Athletes, Fitness Enthusiasts, Bodybuilders, and Casual Consumers. Athletes represent the largest segment, as they require specialized nutrition to enhance performance and recovery. The growing participation in competitive sports and fitness events has led to an increased demand for tailored nutrition solutions among this group.

The Spain Sports Nutrition and Protein Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Optimum Nutrition, MyProtein, BSN (Bio-Engineered Supplements and Nutrition), MusclePharm Corporation, Quest Nutrition, Dymatize Enterprises, Isopure, Scitec Nutrition, EAS (Energy Athletic Supplements), ProMix Nutrition, Vega, GNC Holdings, Inc., Bodybuilding.com, NutraBio Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports nutrition and protein products market in Spain appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to focus on innovative formulations that cater to specific dietary needs. Additionally, the integration of digital marketing strategies and partnerships with fitness influencers will enhance brand visibility and consumer engagement, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders Protein Bars Ready-to-Drink Protein Beverages Protein Supplements Meal Replacement Products Sports Drinks Others |

| By End-User | Athletes Fitness Enthusiasts Bodybuilders Casual Consumers |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Health and Wellness Stores |

| By Ingredient Source | Animal-Based Plant-Based Blended |

| By Price Range | Premium Mid-Range Budget |

| By Packaging Type | Bottles Tubs Sachets |

| By Brand Loyalty | Brand Loyal Consumers Brand Switchers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Protein Products | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Sports Nutrition | 200 | Athletes, Fitness Enthusiasts |

| Trends in Protein Supplement Usage | 100 | Nutritionists, Dietitians |

| Market Insights from Fitness Centers | 80 | Gym Owners, Personal Trainers |

| Impact of Marketing on Protein Product Sales | 120 | Marketing Managers, Brand Strategists |

The Spain Sports Nutrition and Protein Products Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness and the rise in fitness activities among consumers.