Region:Asia

Author(s):Shubham

Product Code:KRAB1295

Pages:92

Published On:October 2025

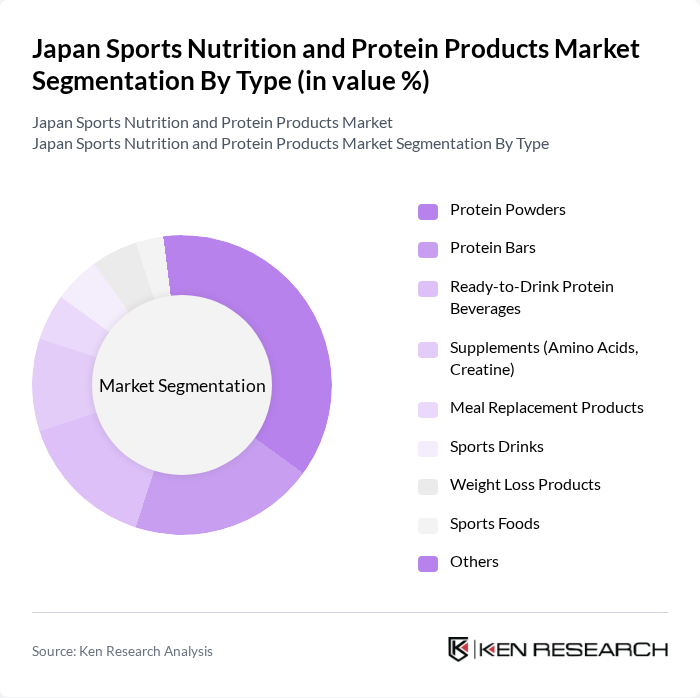

By Type:The market is segmented into various types of products, including protein powders, protein bars, ready-to-drink protein beverages, supplements (amino acids, creatine), meal replacement products, sports drinks, weight loss products, sports foods, and others. Sports supplements represent the largest segment with over 50% market share, driven by their versatility and effectiveness in muscle recovery and growth. The increasing trend of home workouts and fitness regimes has further propelled demand, with ready-to-drink formats and convenient multipacks offering usage opportunities beyond gyms into commuting and workplace routines.

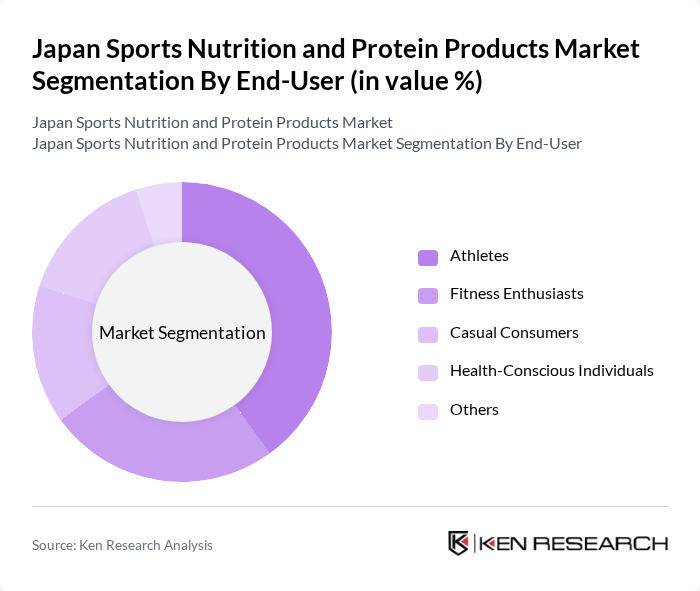

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, casual consumers, health-conscious individuals, and others. Athletes represent the largest segment, as they require specialized nutrition to enhance performance and recovery. The growing trend of fitness among the general population has also led to an increase in demand from fitness enthusiasts and health-conscious individuals, who seek to improve their physical health and appearance. The COVID-19 pandemic has significantly increased health awareness and importance of supplements, with Japanese women increasingly preferring athletic physiques.

The Japan Sports Nutrition and Protein Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asahi Group Holdings, Ltd., Meiji Holdings Co., Ltd., Otsuka Pharmaceutical Co., Ltd., Kirin Holdings Company, Limited, Suntory Holdings Limited, Glico Group, Ajinomoto Co., Inc., Morinaga Milk Industry Co., Ltd., Rohto Pharmaceutical Co., Ltd., DAIWA Foods Co., Ltd., Yakult Honsha Co., Ltd., Nissin Foods Holdings Co., Ltd., Calpis Co., Ltd., Fonterra Co-operative Group Limited, Nestlé Japan Ltd., Takeda Pharmaceutical Company Limited, Kewpie Corporation, Fancl Corporation, Nisshin Seifun Group Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan sports nutrition market appears promising, driven by evolving consumer preferences and technological advancements. As personalization in nutrition becomes more prevalent, brands are likely to invest in tailored products that meet individual dietary needs. Additionally, the integration of technology in product development, such as using AI for formulation, will enhance product efficacy and consumer engagement, positioning companies for sustained growth in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Protein Powders Protein Bars Ready-to-Drink Protein Beverages Supplements (Amino Acids, Creatine) Meal Replacement Products Sports Drinks Weight Loss Products Sports Foods Others |

| By End-User | Athletes Fitness Enthusiasts Casual Consumers Health-Conscious Individuals Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Health and Wellness Stores Gyms and Fitness Centers Convenience Stores Drug Stores and Pharmacies Others |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Bottles Pouches Tubs Sachets |

| By Ingredient Source | Animal-Based Plant-Based Blends |

| By Product Form | Powder Liquid Solid Others |

| By Region | Kanto Region Kansai/Kinki Region Central/Chubu Region Kyushu-Okinawa Region Tohoku Region Chugoku Region Hokkaido Region Shikoku Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Professional Athletes | 60 | Elite athletes across various sports disciplines |

| Fitness Enthusiasts | 100 | Regular gym-goers and fitness program participants |

| Nutrition Experts | 40 | Registered dietitians and sports nutritionists |

| Retailers of Sports Nutrition Products | 50 | Store managers and buyers from health food stores and gyms |

| Online Consumers of Protein Products | 80 | Individuals purchasing protein products through e-commerce platforms |

The Japan Sports Nutrition and Protein Products Market is valued at approximately USD 2.7 billion, reflecting a significant growth driven by increasing health consciousness, fitness activities, and the demand for protein-rich products among consumers.