Region:Europe

Author(s):Dev

Product Code:KRAB0922

Pages:90

Published On:October 2025

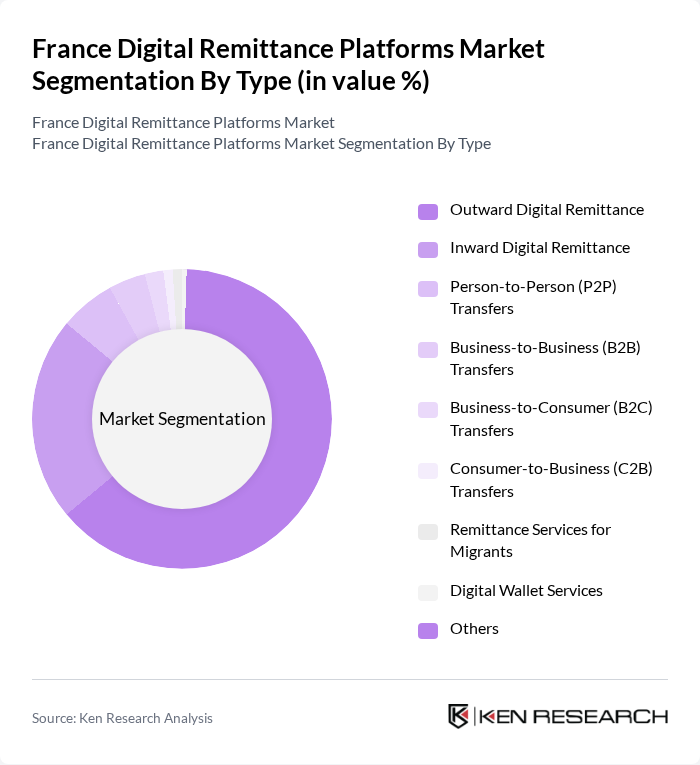

By Type:The market can be segmented into various types of digital remittance services, including Outward Digital Remittance, Inward Digital Remittance, Peer-to-Peer Transfers, Business-to-Business Transfers, Business-to-Consumer Transfers, Consumer-to-Business Transfers, Remittance Services for Migrants, Mobile Wallet Services, and Others. Outward Digital Remittance is the leading sub-segment, accounting for the majority of transaction value, driven by the high volume of funds sent by expatriates to their home countries. The ease of use, real-time processing, and competitive pricing of digital platforms have made them the preferred choice for consumers .

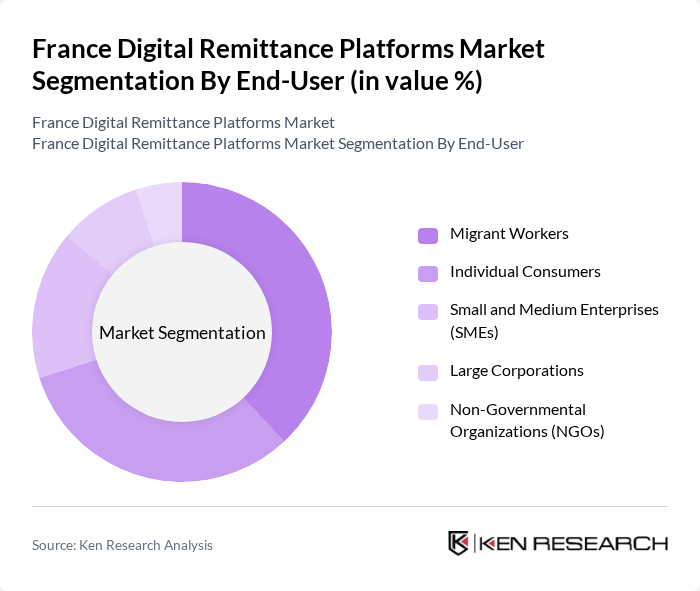

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers dominate this segment, representing the majority of users sending remittances for personal reasons such as family support and education. The increasing reliance on digital platforms for personal transactions has solidified their position as the leading end-user group .

The France Digital Remittance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wise Payments Ltd., Western Union Company, PayPal Holdings, Inc., Revolut Ltd., MoneyGram International, Inc., Remitly, Inc., WorldRemit Ltd., OFX Group Ltd., Azimo Ltd., Skrill Limited, Xoom Corporation, Ria Money Transfer, Payoneer Inc., Lydia Solutions, Orange Money, N26 GmbH, Société Générale (Filigrane Remittance), BNP Paribas (Hello Bank!) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance market in France appears promising, driven by technological advancements and evolving consumer preferences. As platforms increasingly adopt blockchain technology, transaction transparency and security will improve, attracting more users. Additionally, the shift towards mobile-first solutions will enhance accessibility, particularly among younger demographics. With the anticipated growth in smartphone penetration, digital remittance services are likely to become more integrated into everyday financial activities, fostering further market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Outward Digital Remittance Inward Digital Remittance Peer-to-Peer Transfers Business-to-Business Transfers Business-to-Consumer Transfers Consumer-to-Business Transfers Remittance Services for Migrants Mobile Wallet Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Credit/Debit Cards Mobile Payments Cash Pickup Services |

| By Currency Type | Euro US Dollar British Pound Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Distribution Channel | Online Platforms Mobile Applications Physical Outlets |

| By Customer Segment | Domestic Users International Users Corporate Clients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Users | 100 | International Workers, Students, and Professionals |

| Digital Remittance Platform Users | 90 | Frequent Users, Occasional Users, and New Users |

| Financial Service Providers | 60 | Product Managers, Marketing Directors, Compliance Officers |

| Regulatory Bodies | 40 | Policy Makers, Financial Analysts, Compliance Experts |

| Consumer Advocacy Groups | 50 | Consumer Rights Advocates, Financial Educators |

The France Digital Remittance Platforms Market is valued at approximately USD 290 million, reflecting significant growth driven by the increasing number of expatriates and the rapid adoption of digital payment solutions.