Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7138

Pages:89

Published On:December 2025

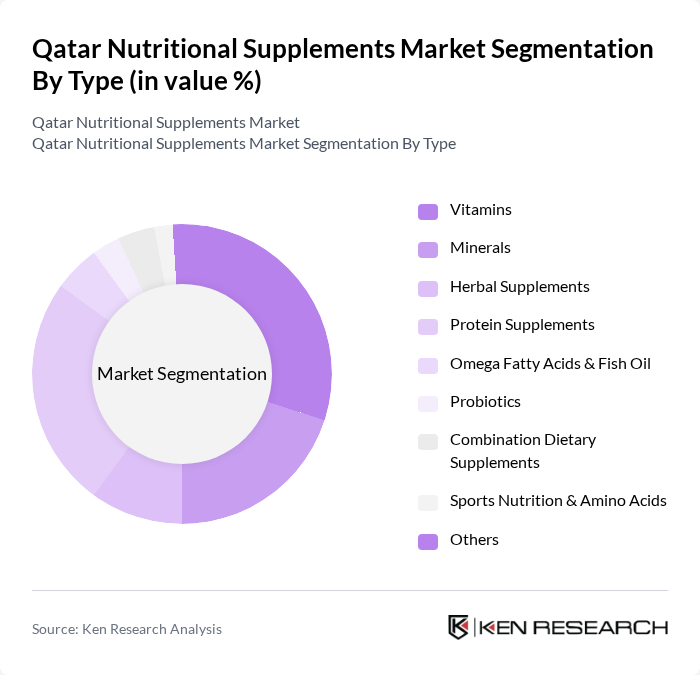

By Type:The nutritional supplements market can be segmented into various types, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids & fish oil, probiotics, combination dietary supplements, sports nutrition & amino acids, and others. Among these, vitamins and protein supplements are particularly popular due to their essential roles in immunity support, energy, and fitness, with vitamins identified as the largest and fastest-growing product category in Qatar’s dietary supplements market. The increasing awareness of the benefits of these supplements, combined with a growing interest in personalized nutrition, natural/herbal formulations, and products targeting specific conditions (such as bone and joint health, digestive health, and weight management), has led to a sustained surge in their consumption.

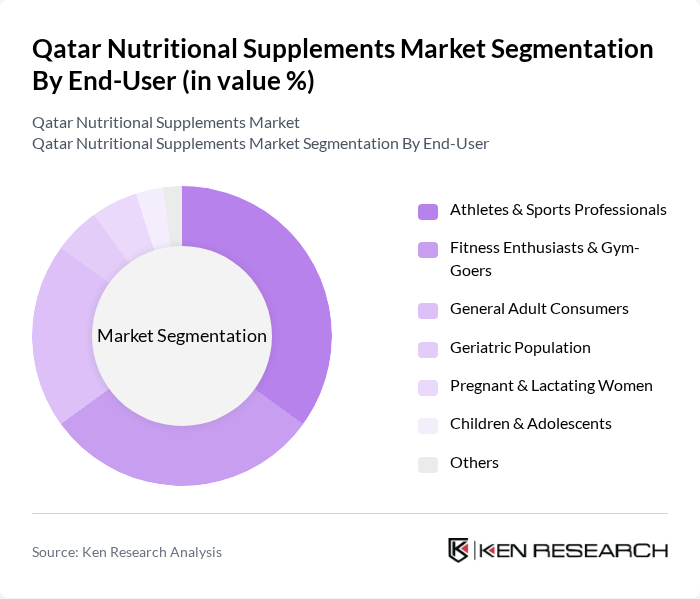

By End-User:The end-user segmentation includes athletes & sports professionals, fitness enthusiasts & gym-goers, general adult consumers, the geriatric population, pregnant & lactating women, children & adolescents, and others. Athletes and fitness enthusiasts are important consumer groups, reflecting Qatar’s growing gym culture and investment in sports infrastructure, while general adult consumers and older adults also represent a rising share of demand as they use supplements for immunity, cardiovascular health, bone and joint health, and energy and weight management. The growing trend of fitness and wellness among the wider population, combined with higher awareness among parents, pregnant women, and seniors of the role of micronutrients in long-term health, is supporting broader adoption of nutritional supplements across all age groups.

The Qatar Nutritional Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Pharma, Qatar Life Pharma, Qatar German Company for Medical Devices (QGMD), Imdad Medical Business Co. (Imdad Qatar), Alsaif Pharmacy Group, Kulud Pharmacies (Yateem Group Qatar), Wellcare Pharmacies Qatar, Allevia Medical Center & Pharmacy, LuLu Group (LuLu Hypermarket Qatar – Health & Nutrition Category), Carrefour Qatar (Majid Al Futtaim Retail – Health & Wellness Category), Herbalife Nutrition Ltd. (Qatar Operations), Amway Corporation (Qatar Presence via Direct Selling), GNC Holdings, LLC (franchises & store-in-store in Qatar), Abbott Laboratories (Ensure, Pediasure & other nutrition brands in Qatar), Nestlé Health Science (incl. Nestlé Middle East FZE – Qatar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar nutritional supplements market appears promising, driven by increasing health consciousness and a shift towards preventive healthcare. As the population becomes more aware of the benefits of supplements, brands are likely to innovate and diversify their product offerings. Additionally, the rise of e-commerce will continue to reshape consumer purchasing behaviors, making it essential for companies to adapt their strategies to meet evolving demands and preferences in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids & Fish Oil Probiotics Combination Dietary Supplements Sports Nutrition & Amino Acids Others |

| By End-User | Athletes & Sports Professionals Fitness Enthusiasts & Gym-Goers General Adult Consumers Geriatric Population Pregnant & Lactating Women Children & Adolescents Others |

| By Distribution Channel | Pharmacies & Drug Stores Supermarkets/Hypermarkets Health Food & Specialty Stores Online Retail & E-commerce Platforms Direct Sales & Multilevel Marketing Others |

| By Formulation | Tablets Capsules Powders Liquids Soft Gels Gummies & Chewables Others |

| By Age Group | Infants Children Adults Geriatric Others |

| By Health Benefit | General Health & Wellness Immune Support Digestive Health Energy & Weight Management Bone & Joint Health Heart & Cardiometabolic Health Sports Performance & Muscle Growth Beauty & Skin Health Others |

| By Packaging Type | Bottles Blister Packs Sachets & Pouches Jars & Tubs Stick Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutritional Supplement Sales | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Supplements | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 100 | Nutritionists, Dietitians, Physicians |

| Market Trends and Innovations | 80 | Product Developers, Marketing Managers |

| Distribution Channel Effectiveness | 120 | Logistics Managers, Supply Chain Analysts |

The Qatar Nutritional Supplements Market is valued at approximately USD 50 million, reflecting a significant growth trend driven by increasing health consciousness and a shift towards preventive healthcare among consumers.