Region:Europe

Author(s):Geetanshi

Product Code:KRAB5769

Pages:100

Published On:October 2025

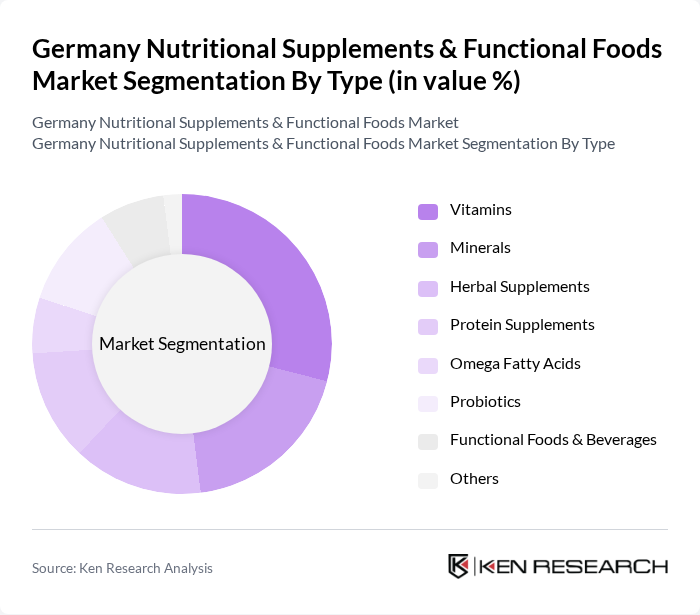

By Type:The market is segmented into various types of nutritional supplements and functional foods, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, functional foods & beverages, and others. Each of these subsegments caters to specific consumer needs and preferences. Vitamins and protein supplements are particularly popular due to their perceived health benefits, with vitamins leading the market owing to widespread micronutrient deficiencies and increased preventive health awareness. Protein supplements are also experiencing strong growth, driven by sports nutrition trends and the adoption of plant-based diets .

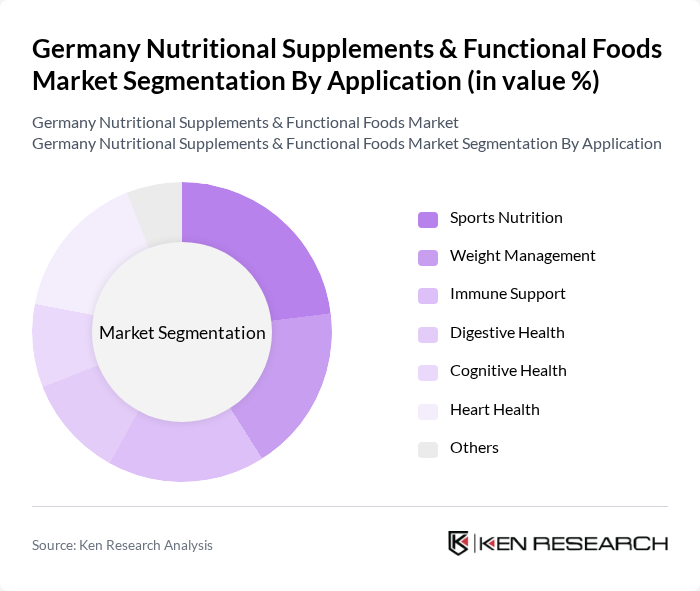

By Application:The applications of nutritional supplements and functional foods include sports nutrition, weight management, immune support, digestive health, cognitive health, heart health, and others. Sports nutrition and weight management remain significant due to the rising number of health-conscious consumers and fitness enthusiasts. Immune support has gained particular prominence post-pandemic, with consumers seeking products containing vitamin C, zinc, and probiotics. Digestive and cognitive health applications are also expanding, reflecting broader wellness trends .

The Germany Nutritional Supplements & Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bayer AG, Queisser Pharma GmbH & Co. KG, Orthomol pharmazeutische Vertriebs GmbH, DMK Group (Deutsches Milchkontor GmbH), Nestlé S.A., Danone S.A., Dr. B. Scheffler Nachfolger GmbH & Co. KG, ZeinPharma Germany GmbH, Pascoe Naturmedizin, Denk Pharma GmbH & Co. KG, Ayanda GmbH, Sabinsa Europe GmbH, Pamex Pharmaceuticals GmbH, Glanbia plc, Herbalife Nutrition Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the nutritional supplements and functional foods market in Germany appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, companies are likely to innovate with clean label products and personalized nutrition solutions. Additionally, the integration of digital platforms for marketing and sales will enhance consumer engagement. The focus on sustainability and ethical sourcing will also shape product offerings, aligning with the values of environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Functional Foods & Beverages Others |

| By Application | Sports Nutrition Weight Management Immune Support Digestive Health Cognitive Health Heart Health Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Online Retail Pharmacies/Drugstores Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) Income Level (Low, Middle, High) |

| By Formulation | Tablets Capsules Powders Liquids Gummies Others |

| By Packaging Type | Bottles Blister Packs Pouches Jars Sachets Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplements Retailers | 100 | Store Managers, Product Buyers |

| Health and Wellness Consumers | 150 | Health-Conscious Individuals, Fitness Enthusiasts |

| Functional Foods Manufacturers | 80 | Product Development Managers, Marketing Directors |

| Healthcare Professionals | 40 | Nutritionists, Dietitians |

| Market Analysts and Researchers | 40 | Market Research Analysts, Industry Experts |

The Germany Nutritional Supplements & Functional Foods Market is valued at approximately EUR 7.8 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for preventive healthcare among consumers.