Region:Global

Author(s):Geetanshi

Product Code:KRAA2282

Pages:96

Published On:August 2025

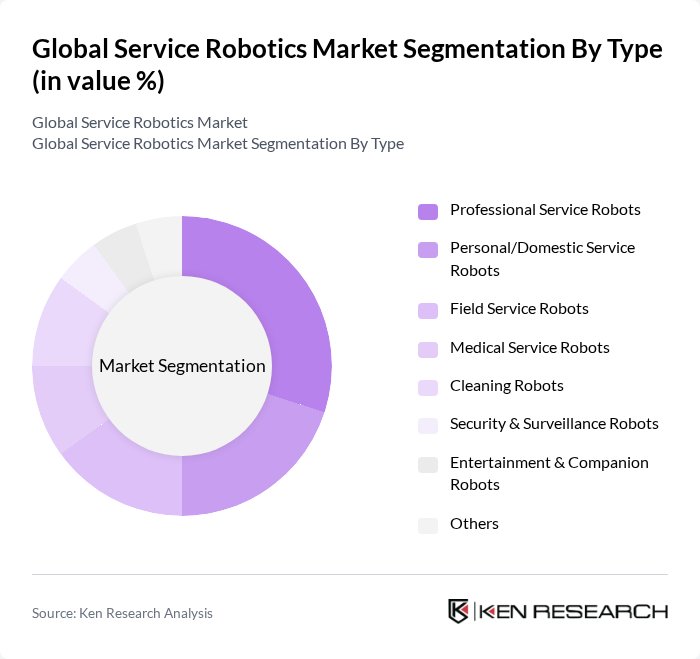

By Type:The service robotics market is segmented into various types, including Professional Service Robots, Personal/Domestic Service Robots, Field Service Robots, Medical Service Robots, Cleaning Robots, Security & Surveillance Robots, Entertainment & Companion Robots, and Others. Among these, Professional Service Robots are gaining traction due to their application in sectors like healthcare, logistics, and manufacturing, where they drive operational efficiency, reduce labor costs, and support advanced automation initiatives. The adoption of AI-powered and collaborative robots is a notable trend, especially in logistics and medical environments .

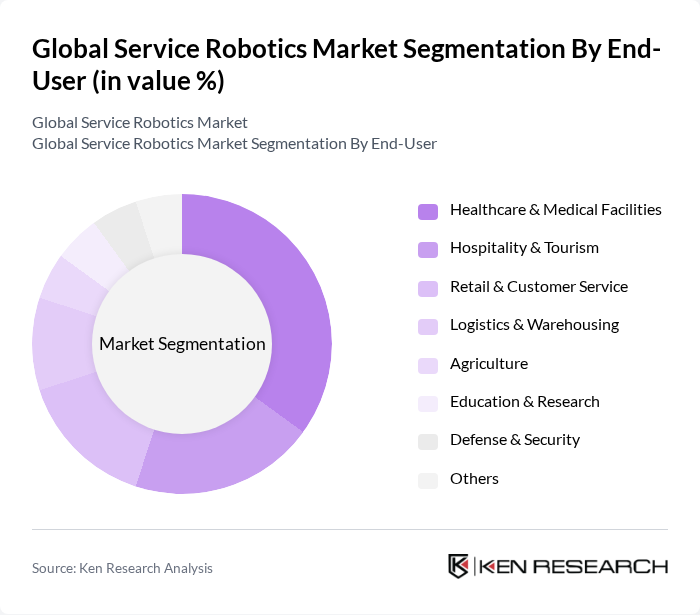

By End-User:The end-user segmentation includes Healthcare & Medical Facilities, Hospitality & Tourism, Retail & Customer Service, Logistics & Warehousing, Agriculture, Education & Research, Defense & Security, and Others. The healthcare sector remains the leading end-user, driven by the widespread adoption of robotic surgery systems, patient care robots, and automated disinfection solutions, all of which enhance precision, safety, and patient outcomes. Logistics and warehousing are also experiencing rapid growth due to the integration of autonomous mobile robots for inventory management and order fulfillment .

The Global Service Robotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as iRobot Corporation, Intuitive Surgical, Inc., ABB Ltd., Fanuc Corporation, KUKA AG, Yaskawa Electric Corporation, SoftBank Robotics Group Corp., Boston Dynamics, Inc., Clearpath Robotics Inc., Savioke, Inc., Fetch Robotics, Inc., DJI Technology Co., Ltd., Universal Robots A/S, Cyberdyne Inc., and Blue Ocean Robotics ApS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the service robotics market appears promising, driven by technological advancements and increasing automation across various sectors. In future, the integration of robotics with IoT is expected to enhance operational efficiencies, leading to smarter, more connected systems. Additionally, the focus on sustainability will likely drive innovations in energy-efficient robotics, aligning with global environmental goals. As industries adapt, the demand for customized robotic solutions will further shape the market landscape, fostering growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Professional Service Robots Personal/Domestic Service Robots Field Service Robots Medical Service Robots Cleaning Robots Security & Surveillance Robots Entertainment & Companion Robots Others |

| By End-User | Healthcare & Medical Facilities Hospitality & Tourism Retail & Customer Service Logistics & Warehousing Agriculture Education & Research Defense & Security Others |

| By Application | Delivery & Transportation Services Surveillance and Security Cleaning and Maintenance Healthcare Assistance & Surgery Customer Interaction & Service Entertainment & Education Agricultural Operations Others |

| By Component | Hardware (Sensors, Actuators, Controllers, Power Supply, etc.) Software (AI, Navigation, Control, etc.) Services (Maintenance, Integration, Training, etc.) |

| By Distribution Channel | Direct Sales Online Retail Distributors & System Integrators Others |

| By Price Range | Low-End Mid-Range High-End |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Robotics | 100 | Healthcare Administrators, Robotics Engineers |

| Logistics Automation | 80 | Warehouse Managers, Supply Chain Analysts |

| Hospitality Service Robots | 70 | Hotel Operations Managers, Customer Experience Directors |

| Agricultural Robotics | 50 | Agricultural Managers, Farm Equipment Managers |

| Retail Robotics Solutions | 90 | Retail Managers, Technology Integration Specialists |

The Global Service Robotics Market is valued at approximately USD 47 billion, driven by advancements in artificial intelligence, IoT integration, and increasing automation demand across sectors like healthcare, logistics, and hospitality.