Global Solvents Market Overview

- The Global Solvents Market is valued at USD 31 billion, based on a five-year historical analysis. Growth is primarily driven by increasing demand from end-use industries such as paints, coatings, pharmaceuticals, adhesives, and personal care products. The market is further propelled by the rising adoption of eco-friendly and bio-based solvents, supported by sustainability initiatives and technological advancements in manufacturing. Expansion in the automotive and construction sectors continues to boost solvent consumption for surface coatings and cleaning applications.

- Key players in this market include the United States, Germany, and China. The United States leads due to its advanced industrial base and significant consumption of solvents in manufacturing and pharmaceutical processes. Germany is recognized for its robust chemical production, while China’s rapid urbanization and industrialization drive strong growth, making these countries pivotal in the global solvents landscape. Asia Pacific currently holds the largest regional share, with China and India driving demand through expanding automotive and construction industries.

- The European Union’s REACH Regulation (Regulation (EC) No 1907/2006, issued by the European Parliament and Council in 2006, with ongoing amendments) mandates the registration, evaluation, and authorization of chemicals, including solvents. REACH requires manufacturers and importers to provide safety data, comply with usage thresholds, and obtain authorization for substances of very high concern, directly impacting the production and use of solvents across EU member states.

Global Solvents Market Segmentation

By Type:The solvents market is segmented into Alcohols, Ketones, Esters, Aromatic Hydrocarbons, Aliphatic Hydrocarbons, Chlorinated Solvents, Glycol Ethers, Bio-based Solvents, and Others. Alcohols and Ketones remain the most widely used types due to their versatility and effectiveness in paints, coatings, cleaning agents, and pharmaceuticals. Demand for bio-based solvents is increasing as industries prioritize sustainable practices and regulatory compliance, with innovations in green chemistry driving adoption.

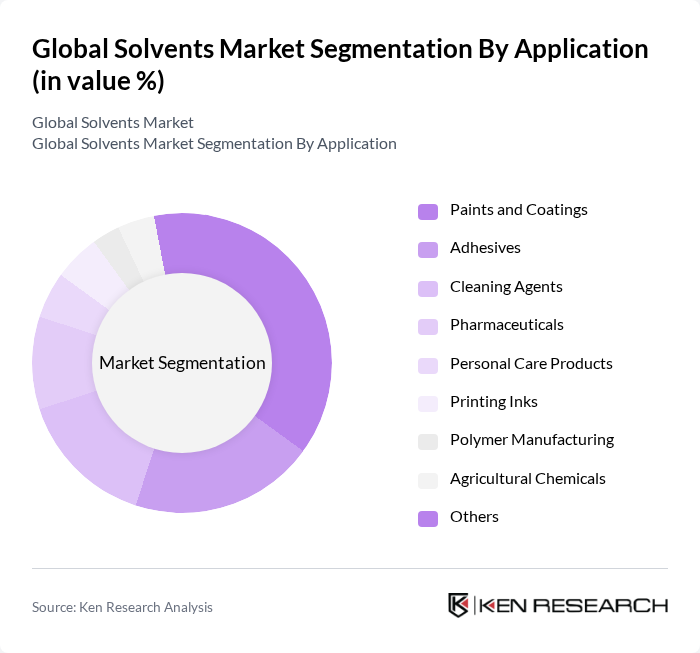

By Application:The solvents market is segmented by application into Paints and Coatings, Adhesives, Cleaning Agents, Pharmaceuticals, Personal Care Products, Printing Inks, Polymer Manufacturing, Agricultural Chemicals, and Others. Paints and Coatings represent the largest segment, driven by robust demand in construction and automotive industries. Pharmaceuticals, adhesives, and cleaning agents are also key growth areas, with increasing requirements for high-purity and specialty solvents in these sectors.

Global Solvents Market Competitive Landscape

The Global Solvents Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Inc., ExxonMobil Chemical Company, LyondellBasell Industries N.V., Eastman Chemical Company, Shell Chemicals, Huntsman Corporation, INEOS Group, Solvay S.A., Mitsubishi Chemical Corporation, AkzoNobel N.V., Clariant AG, Covestro AG, PPG Industries, Inc., Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

Global Solvents Market Industry Analysis

Growth Drivers

- Increasing Demand from End-User Industries:The global solvents market is significantly driven by the increasing demand from various end-user industries, particularly in paints, coatings, and adhesives. In future, the paints and coatings sector is projected to consume approximately 3.5 million tons of solvents, reflecting a growth rate of 4.2% from the previous year. This surge is attributed to the rising construction activities and automotive production, which are expected to reach $1.5 trillion and $3 trillion, respectively, bolstering solvent consumption.

- Technological Advancements in Solvent Production:Innovations in solvent production technologies are enhancing efficiency and reducing costs. For instance, the adoption of advanced distillation techniques has improved yield rates by 15%, allowing manufacturers to produce 2 million tons of solvents more efficiently in future. Additionally, the integration of automation in production processes is expected to reduce operational costs by 10%, further driving market growth as companies seek to optimize their production capabilities.

- Rising Environmental Regulations Favoring Eco-Friendly Solvents:The increasing stringency of environmental regulations is pushing industries towards eco-friendly solvents. In future, it is estimated that the market for bio-based solvents will reach $1.2 billion, growing at a rate of 5% annually. This shift is driven by regulations such as the EU's REACH, which mandates the reduction of volatile organic compounds (VOCs), prompting manufacturers to invest in sustainable alternatives that comply with these regulations.

Market Challenges

- Volatility in Raw Material Prices:The solvents market faces significant challenges due to the volatility in raw material prices, particularly for petrochemicals. In future, the price of key raw materials like benzene is projected to fluctuate between $800 and $1,200 per ton, impacting production costs. This unpredictability can lead to reduced profit margins for manufacturers, forcing them to either absorb costs or pass them onto consumers, which may hinder market growth.

- Health and Safety Concerns Related to Solvent Use:Health and safety concerns surrounding solvent use pose a considerable challenge to the market. In future, it is estimated that workplace incidents related to solvent exposure will cost the industry approximately $500 million in compliance and healthcare costs. These concerns are prompting stricter regulations and increased scrutiny from regulatory bodies, which may limit the use of certain solvents and affect overall market dynamics.

Global Solvents Market Future Outlook

The future of the solvents market appears promising, driven by the ongoing transition towards sustainable practices and the increasing demand from emerging economies. As industries adapt to stricter environmental regulations, the focus on bio-based and eco-friendly solvents is expected to intensify. Furthermore, advancements in production technologies will likely enhance efficiency and reduce costs, positioning the market for robust growth. The automotive and pharmaceutical sectors will continue to be key drivers, contributing to the overall expansion of the solvents market landscape.

Market Opportunities

- Growth in the Automotive Sector:The automotive sector presents a significant opportunity for solvent manufacturers, with an expected increase in solvent demand to support the production of coatings and adhesives. In future, the automotive industry is projected to utilize approximately 1.2 million tons of solvents, driven by the rise in electric vehicle production and the need for high-performance coatings.

- Development of Bio-based Solvents:The development of bio-based solvents is a burgeoning opportunity, as consumer preferences shift towards sustainable products. In future, the bio-based solvent market is anticipated to grow to $1.2 billion, driven by innovations in plant-based formulations. This trend aligns with global sustainability goals, providing manufacturers with a competitive edge in an increasingly eco-conscious market.