Region:Asia

Author(s):Geetanshi

Product Code:KRAB2795

Pages:99

Published On:October 2025

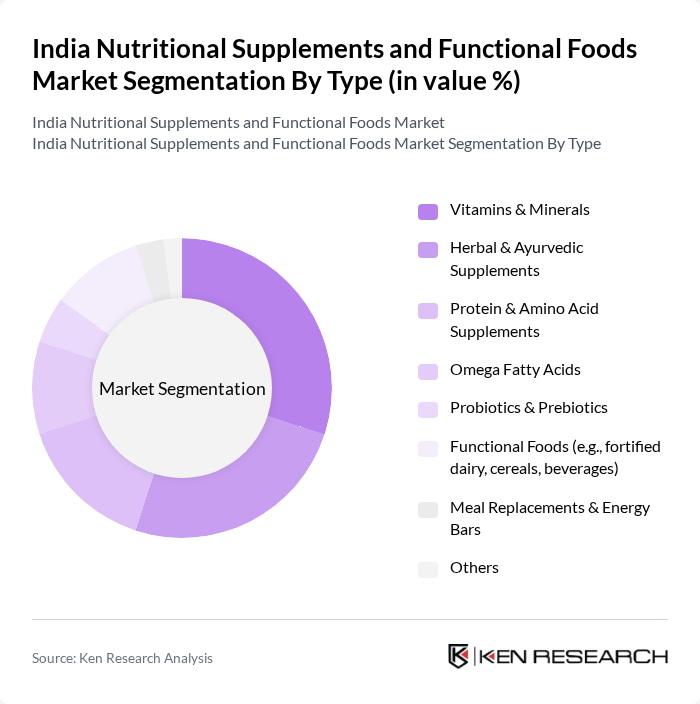

By Type:The market is segmented into various types of nutritional supplements and functional foods, including Vitamins & Minerals, Herbal & Ayurvedic Supplements, Protein & Amino Acid Supplements, Omega Fatty Acids, Probiotics & Prebiotics, Functional Foods (e.g., fortified dairy, cereals, beverages), Meal Replacements & Energy Bars, and Others. Among these, Vitamins & Minerals and Herbal & Ayurvedic Supplements are particularly popular due to their perceived health benefits and traditional usage in India. The growing acceptance of protein supplements among fitness enthusiasts and the rising demand for immunity-boosting and digestive health products are notable trends.

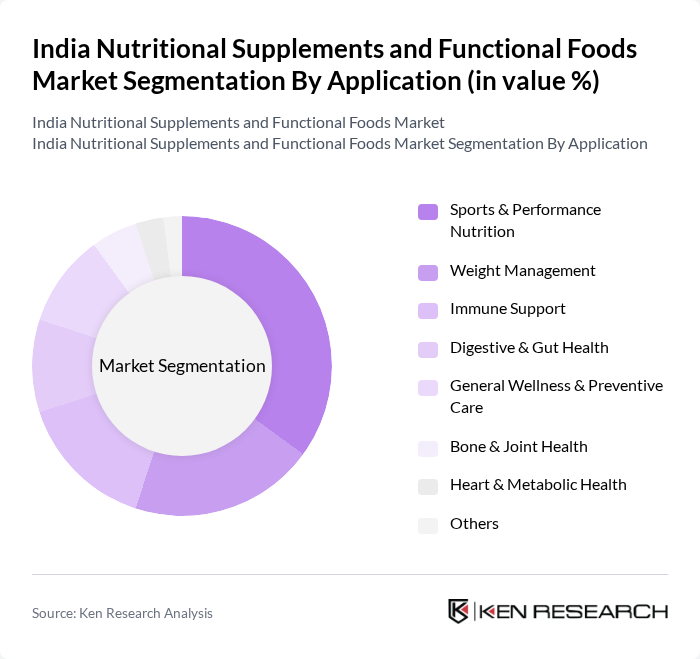

By Application:The applications of nutritional supplements and functional foods include Sports & Performance Nutrition, Weight Management, Immune Support, Digestive & Gut Health, General Wellness & Preventive Care, Bone & Joint Health, Heart & Metabolic Health, and Others. The Sports & Performance Nutrition segment is particularly dominant, driven by the increasing number of fitness enthusiasts and athletes seeking to enhance their performance and recovery. Weight management and immune support are also significant segments, reflecting broader consumer concerns about lifestyle diseases and overall wellness.

The India Nutritional Supplements and Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway India Enterprises Pvt. Ltd., GlaxoSmithKline Consumer Healthcare Ltd. (now Haleon India), Abbott India Ltd., Nestlé India Ltd., Himalaya Wellness Company, Danone India Pvt. Ltd., Patanjali Ayurved Ltd., Sun Pharmaceutical Industries Ltd., Cipla Health Ltd., Zydus Lifesciences Ltd., Mankind Pharma Ltd., Procter & Gamble Health Ltd., Reckitt Benckiser (India) Pvt. Ltd., Dabur India Ltd., Unilever (Horlicks, Boost), MuscleBlaze (Bright Lifecare Pvt. Ltd.), Britannia Industries Ltd., GNC India (Guardian Healthcare Services Pvt. Ltd.), Centrum (Pfizer India Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Nutritional Supplements and Functional Foods market appears promising, driven by a combination of health trends and technological advancements. As consumers increasingly prioritize preventive healthcare, the demand for personalized nutrition solutions is expected to rise. Additionally, the integration of functional foods into daily diets will likely gain traction, supported by ongoing research and development. Companies that adapt to these trends and invest in innovative product offerings will be well-positioned to capture market share in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins & Minerals Herbal & Ayurvedic Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Prebiotics Functional Foods (e.g., fortified dairy, cereals, beverages) Meal Replacements & Energy Bars Others |

| By Application | Sports & Performance Nutrition Weight Management Immune Support Digestive & Gut Health General Wellness & Preventive Care Bone & Joint Health Heart & Metabolic Health Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets & Hypermarkets Pharmacies & Drug Stores Health & Wellness Specialty Stores Direct Sales/MLM Others |

| By End-User | Athletes & Fitness Enthusiasts Elderly Population Children & Adolescents Pregnant & Lactating Women General Consumers Others |

| By Formulation | Tablets Capsules & Softgels Powders Liquids & Syrups Gummies & Chewables Bars & Ready-to-Drink (RTD) Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplements Retailers | 150 | Store Managers, Product Buyers |

| Functional Foods Manufacturers | 100 | Production Managers, Quality Assurance Heads |

| Health and Wellness Influencers | 80 | Nutritionists, Fitness Coaches |

| Consumers of Nutritional Products | 150 | Health-Conscious Individuals, Fitness Enthusiasts |

| Retail Chain Executives | 70 | Category Managers, Marketing Directors |

The India Nutritional Supplements and Functional Foods Market is valued at approximately USD 21 billion, reflecting significant growth driven by increasing health consciousness, rising disposable incomes, and a trend towards preventive healthcare among consumers.