Region:Africa

Author(s):Geetanshi

Product Code:KRAB2788

Pages:98

Published On:October 2025

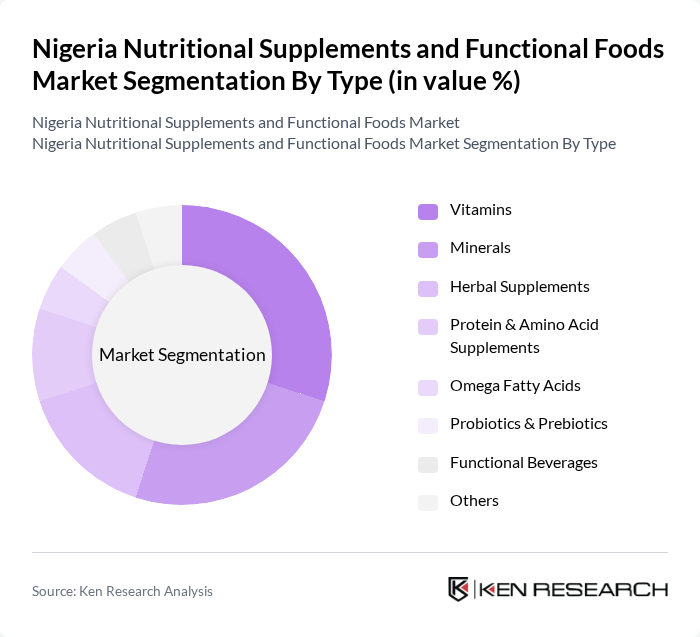

By Type:The market is segmented into various types of nutritional supplements and functional foods, including vitamins, minerals, herbal supplements, protein & amino acid supplements, omega fatty acids, probiotics & prebiotics, functional beverages, and others. Among these, vitamins and minerals are the most popular due to their essential role in daily health maintenance and disease prevention. The increasing awareness of the benefits of these supplements has led to a significant rise in consumer demand, particularly among health-conscious individuals and those with specific dietary needs.

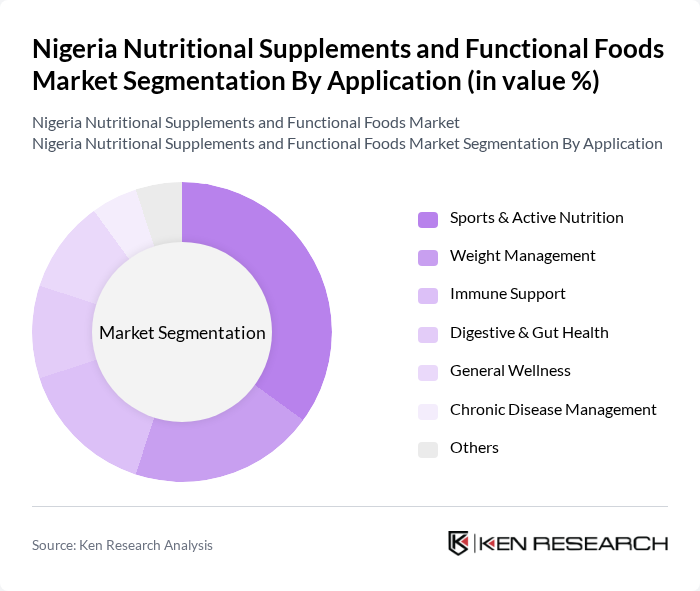

By Application:The applications of nutritional supplements and functional foods include sports & active nutrition, weight management, immune support, digestive & gut health, general wellness, chronic disease management, and others. The sports & active nutrition segment is currently leading the market, driven by the increasing number of fitness enthusiasts and athletes seeking to enhance their performance and recovery through specialized nutritional products. This trend is further supported by the growing popularity of fitness centers and health clubs across Nigeria.

The Nigeria Nutritional Supplements and Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nestlé Nigeria Plc, GlaxoSmithKline Consumer Nigeria Plc, FrieslandCampina WAMCO Nigeria Plc, Herbalife Nutrition Ltd., Fidson Healthcare Plc, Swiss Pharma Nigeria Ltd (Swipha), Neimeth International Pharmaceuticals Plc, Dufil Prima Foods Plc, Unilever Nigeria Plc, Promasidor Nigeria Ltd., May & Baker Nigeria Plc, Biofem Pharmaceuticals Ltd., Greenlife Pharmaceuticals Ltd., HealthPlus Limited, Ziva Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigerian nutritional supplements and functional foods market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, the demand for innovative and personalized nutrition solutions is expected to grow. Additionally, the expansion of digital platforms will facilitate greater access to products, enhancing consumer engagement. Companies that adapt to these trends and invest in research and development will likely capture significant market share in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Prebiotics Functional Beverages Others |

| By Application | Sports & Active Nutrition Weight Management Immune Support Digestive & Gut Health General Wellness Chronic Disease Management Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Pharmacies & Drugstores Online Retail/E-commerce Direct Sales & MLM Hospitals & Clinics Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Income Level (Low, Middle, High) Urban vs Rural |

| By Packaging Type | Bottles Sachets Blister Packs Bulk Packaging Stick Packs |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Nutritional Supplements | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Channels for Functional Foods | 60 | Retail Managers, Store Owners |

| Healthcare Professionals' Insights on Supplements | 50 | Doctors, Nutritionists, Pharmacists |

| Market Trends in Herbal Supplements | 40 | Herbal Product Manufacturers, Distributors |

| Impact of Regulatory Policies on Market | 40 | Regulatory Affairs Specialists, Policy Makers |

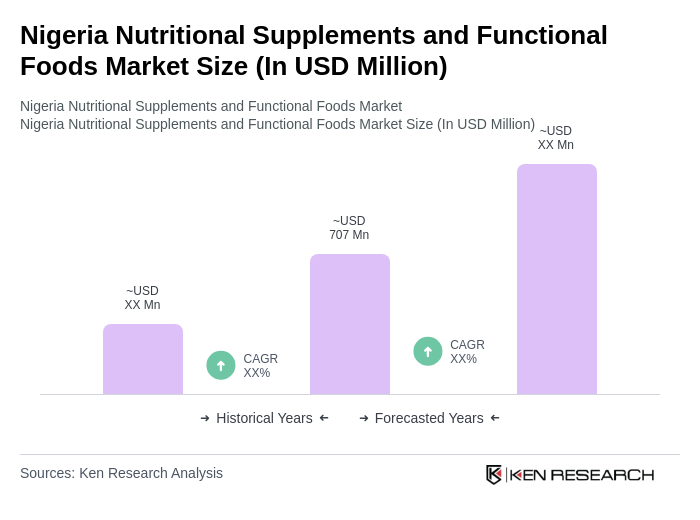

The Nigeria Nutritional Supplements and Functional Foods Market is valued at approximately USD 707 million, reflecting significant growth driven by increasing health awareness and rising disposable incomes among consumers seeking preventive healthcare solutions.