Region:Asia

Author(s):Geetanshi

Product Code:KRAB2812

Pages:98

Published On:October 2025

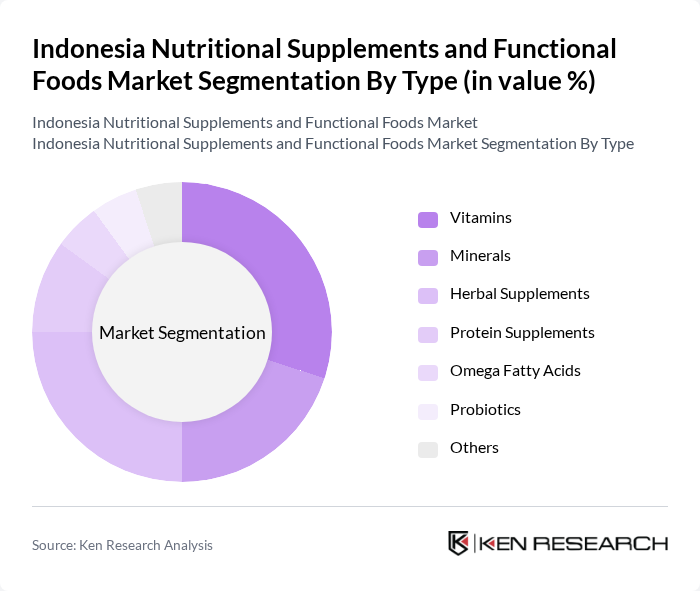

By Type:The market is segmented into various types of nutritional supplements and functional foods, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Among these, vitamins and herbal supplements are particularly popular due to their perceived health benefits and natural origins. The increasing consumer preference for natural and organic products has significantly influenced the demand for herbal supplements, while vitamins remain a staple for daily health maintenance. Innovation in product formulations and packaging, as well as the influence of traditional remedies such as jamu, continue to shape consumer choices .

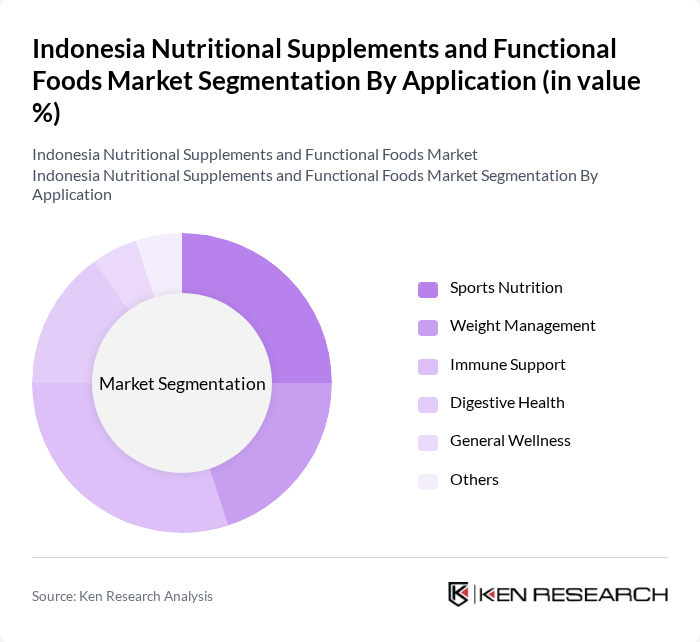

By Application:The applications of nutritional supplements and functional foods include sports nutrition, weight management, immune support, digestive health, general wellness, and others. Sports nutrition is gaining traction among fitness enthusiasts and athletes, while immune support products have seen a surge in demand due to heightened health awareness. The general wellness segment remains strong as consumers increasingly seek products that promote overall health and vitality. The expansion of digital health platforms and increased marketing through social media have also contributed to the growth of these application segments .

The Indonesia Nutritional Supplements and Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Sido Muncul Tbk, PT Unilever Indonesia Tbk, PT Nutrifood Indonesia, PT Amerta Indah Otsuka, PT Deltomed Laboratories, PT Darya-Varia Laboratoria Tbk, PT Haldin Pacific Semesta, PT Duta Nutrisi, PT Bifarma Adiluhung, PT Deltomed Laboratories, PT Sarihusada Generasi Mahardhika, PT Mandom Indonesia Tbk, PT Bintang Toedjoe, PT Sari Roti contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nutritional supplements and functional foods market in Indonesia appears promising, driven by increasing health awareness and technological advancements. As consumers prioritize preventive healthcare, the demand for innovative products that cater to specific health needs is expected to rise. Additionally, the integration of digital platforms for personalized nutrition solutions will likely enhance consumer engagement, making it easier for individuals to access tailored health products that meet their unique dietary requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By Application | Sports Nutrition Weight Management Immune Support Digestive Health General Wellness Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Food Stores Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) Income Level (Low, Middle, High) |

| By Packaging Type | Bottles Sachets Blister Packs Tubs |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers First-Time Buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplements Retailers | 100 | Store Managers, Product Buyers |

| Functional Foods Manufacturers | 80 | Production Managers, Quality Control Officers |

| Health and Wellness Influencers | 60 | Nutritionists, Fitness Coaches |

| Consumer Health Survey | 120 | Health-Conscious Consumers, Dietary Supplement Users |

| Retail Distribution Channels | 70 | Logistics Managers, Supply Chain Coordinators |

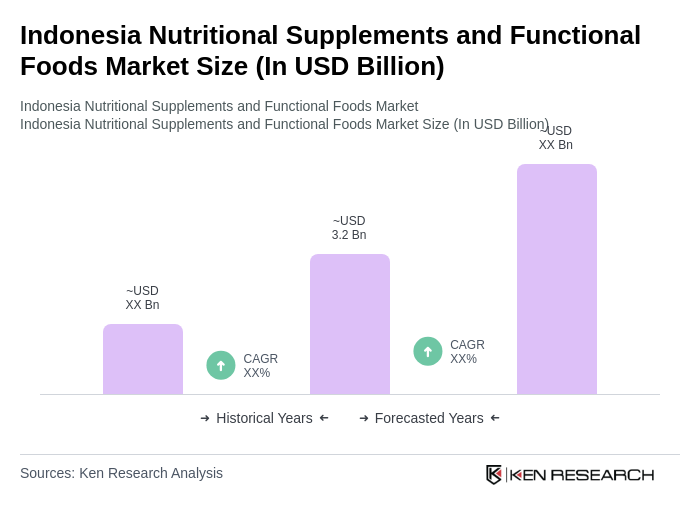

The Indonesia Nutritional Supplements and Functional Foods Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increasing health awareness, rising disposable incomes, and a trend towards preventive healthcare among consumers.