Region:Europe

Author(s):Shubham

Product Code:KRAA3610

Pages:89

Published On:September 2025

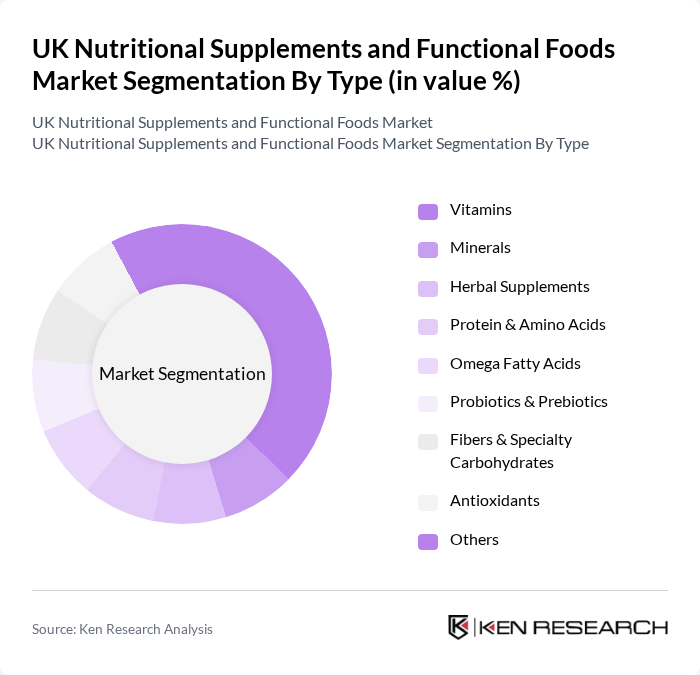

By Type:The market is segmented into various types of nutritional supplements and functional foods, including vitamins, minerals, herbal supplements, protein & amino acids, omega fatty acids, probiotics & prebiotics, fibers & specialty carbohydrates, antioxidants, and others. Among these, vitamins and protein & amino acids are particularly dominant due to their widespread use among health-conscious consumers and athletes. The increasing focus on fitness and wellness has led to a surge in demand for these products, making them key players in the market. The demand for products with protein & amino acids is expected to grow significantly, driven by the rise in gym memberships and at-home fitness routines.

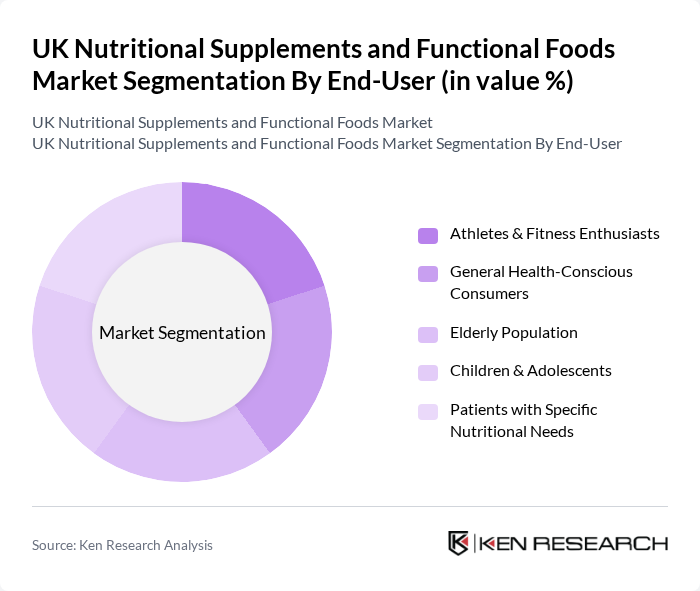

By End-User:The end-user segmentation includes athletes & fitness enthusiasts, general health-conscious consumers, the elderly population, children & adolescents, and patients with specific nutritional needs. Athletes & fitness enthusiasts represent a significant portion of the market, driven by their need for performance-enhancing supplements and recovery aids. This segment's growth is fueled by the increasing popularity of fitness activities and sports nutrition. The sports nutrition segment is particularly noted for its rapid growth in the broader nutritional supplements market.

The UK Nutritional Supplements and Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Holland & Barrett Retail Limited, Glanbia Performance Nutrition (UK) Ltd, Nestlé Health Science (UK) Ltd, Abbott Laboratories Ltd (UK), Danone Nutricia Early Life Nutrition, The Hut.com Limited (Myprotein), Vitabiotics Ltd, DSM Nutritional Products Ltd, Unilever PLC, Reckitt Benckiser Group plc, Procter & Gamble UK, Blackmores Limited, Swisse Wellness Pty Ltd, Nature's Way Products, LLC, Solgar UK Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK nutritional supplements and functional foods market appears promising, driven by ongoing trends in health consciousness and preventive healthcare. As the aging population continues to grow, there will be an increasing demand for products that address specific health concerns. Additionally, advancements in technology and personalized nutrition are expected to reshape product offerings, allowing companies to cater to individual health needs more effectively, thus enhancing consumer engagement and loyalty in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acids Omega Fatty Acids Probiotics & Prebiotics Fibers & Specialty Carbohydrates Antioxidants Others |

| By End-User | Athletes & Fitness Enthusiasts General Health-Conscious Consumers Elderly Population Children & Adolescents Patients with Specific Nutritional Needs |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies & Drugstores Direct-to-Consumer (DTC) |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Chewables |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Bottles Blister Packs Pouches Sachets |

| By Consumer Demographics | Gender Age Group Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Nutritional Supplements | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Functional Foods | 80 | Store Managers, Product Buyers |

| Healthcare Professionals' Perspectives | 60 | Dietitians, Nutritionists, General Practitioners |

| Market Trends in E-commerce for Supplements | 90 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Impact on Nutritional Products | 40 | Regulatory Affairs Specialists, Compliance Officers |

The UK Nutritional Supplements and Functional Foods Market is valued at approximately USD 15.45 billion, reflecting significant growth driven by increasing health awareness and a trend towards preventive healthcare among consumers.