Region:Europe

Author(s):Geetanshi

Product Code:KRAB2830

Pages:88

Published On:October 2025

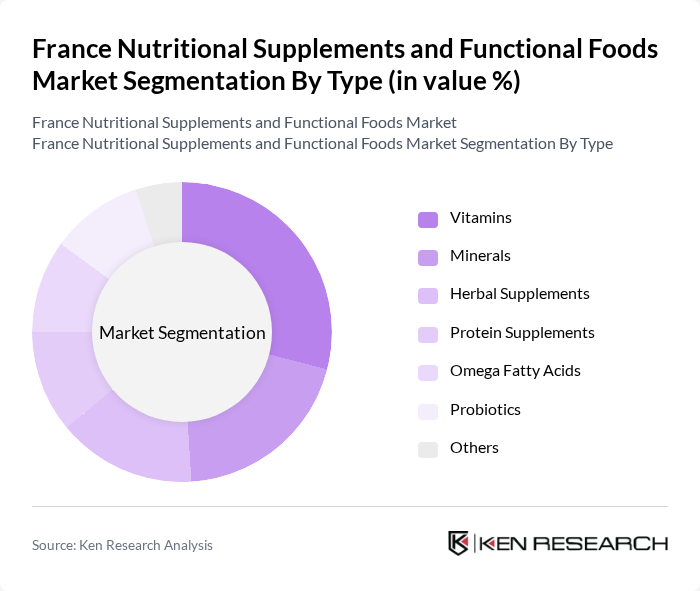

By Type:The market is segmented into various types of nutritional supplements and functional foods, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Each of these sub-segments caters to specific consumer needs and preferences, reflecting the diverse landscape of health and wellness products available in France. The vitamins segment holds the largest share, driven by demand for immunity and energy support, while protein and probiotic supplements are gaining traction due to rising interest in sports nutrition and digestive health .

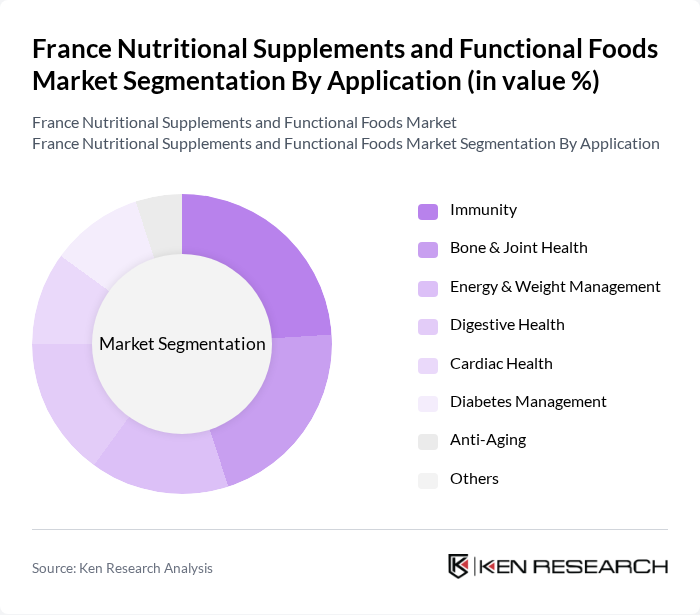

By Application:The application segment includes various health-focused categories such as immunity, bone & joint health, energy & weight management, digestive health, cardiac health, diabetes management, anti-aging, and others. This segmentation highlights the specific health benefits that consumers seek from nutritional supplements and functional foods. Bone & joint health and immunity are leading application areas, reflecting the aging population and heightened focus on preventive health .

The France Nutritional Supplements and Functional Foods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arkopharma Laboratoires Pharmaceutiques, Laboratoire Nutergia, PiLeJe Laboratoire, Les Laboratoires Vitarmonyl, NHCO Nutrition, Nutrisanté, Laboratoires Juva Santé, Laboratoires Forté Pharma, Nestlé Health Science, Danone S.A., Herbalife Nutrition Ltd., DSM-Firmenich, Solgar Inc., Nature's Way Products, LLC, Swisse Wellness Pty Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France nutritional supplements and functional foods market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, the demand for innovative and personalized nutrition solutions is expected to grow. Additionally, the integration of digital platforms for marketing and sales will enhance consumer engagement, while sustainability trends will shape product development. Companies that adapt to these changes will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By Application | Immunity Bone & Joint Health Energy & Weight Management Digestive Health Cardiac Health Diabetes Management Anti-Aging Others |

| By Distribution Channel | Pharmacies & Drug Stores Supermarkets/Hypermarkets Health Food Stores Online Retailers Direct Sales Others |

| By End-User | Adults (24–45 Years) Elderly Population (60+ Years) Children & Adolescents Pregnant & Lactating Women Athletes & Fitness Enthusiasts General Health-Conscious Individuals Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Jellies Softgels Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand Type | National Brands Private Labels Generic Brands |

| By Packaging Type | Bottles Blister Packs Pouches Sachets Others |

| By Product Nature | Conventional Organic/Natural |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplements Usage | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Functional Foods Awareness | 60 | Dietitians, Nutritionists, Health Coaches |

| Market Trends in Dietary Supplements | 50 | Retail Managers, Product Development Specialists |

| Consumer Preferences in Health Products | 40 | General Consumers, Wellness Bloggers |

| Impact of Marketing on Supplement Choices | 50 | Marketing Professionals, Brand Managers |

The France Nutritional Supplements and Functional Foods Market is valued at approximately USD 5.3 billion, reflecting a significant growth trend driven by increasing health consciousness and preventive healthcare measures among consumers.