Region:Europe

Author(s):Geetanshi

Product Code:KRAA5520

Pages:83

Published On:September 2025

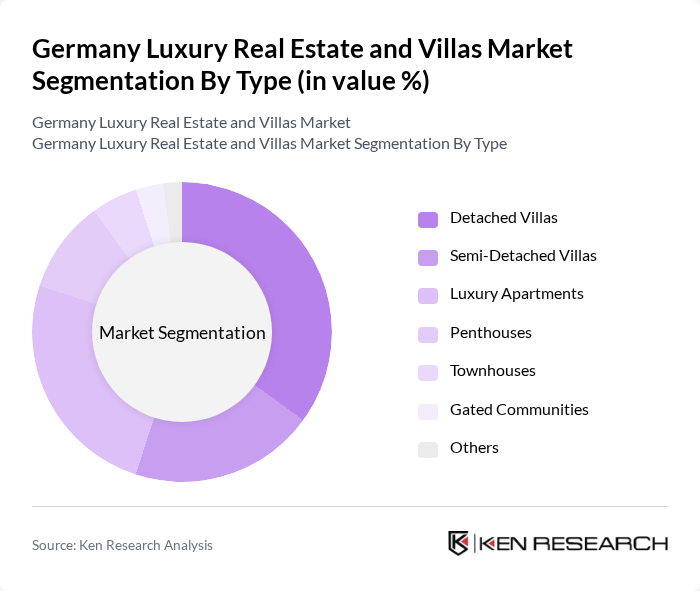

By Type:The luxury real estate market in Germany is segmented into various types, including detached villas, semi-detached villas, luxury apartments, penthouses, townhouses, gated communities, and others. Each type caters to different consumer preferences and lifestyle choices, with detached villas often being the most sought after due to their exclusivity and spaciousness. Luxury apartments and penthouses are also popular, particularly in urban areas where space is at a premium.

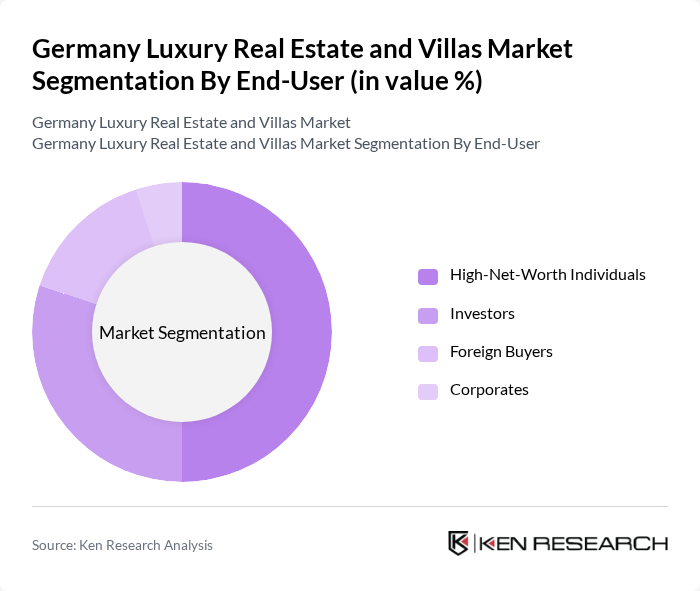

By End-User:The end-user segmentation of the luxury real estate market includes high-net-worth individuals, investors, foreign buyers, and corporates. High-net-worth individuals represent the largest segment, driven by their desire for exclusive properties and investment opportunities. Investors are increasingly looking for properties that offer rental income potential, while foreign buyers are attracted to Germany's stable economy and favorable investment climate.

The Germany Luxury Real Estate and Villas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Engel & Völkers, Sotheby's International Realty, Jones Lang LaSalle (JLL), CBRE Group, Knight Frank, RE/MAX, LuxuryEstate.com, ImmobilienScout24, Von Poll Immobilien, Drees & Sommer, Berenberg Bank, TLG Immobilien AG, Ziegert Immobilien, AENGEVELT, BGP Immobilien contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury real estate market in Germany appears promising, driven by ongoing urbanization and a growing emphasis on sustainable living. As affluent buyers increasingly prioritize eco-friendly properties, developers are likely to focus on green building practices. Additionally, the integration of smart home technologies is expected to enhance property appeal, attracting tech-savvy buyers. The influx of international investors seeking stable markets will further stimulate demand, particularly in major cities, ensuring continued growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Detached Villas Semi-Detached Villas Luxury Apartments Penthouses Townhouses Gated Communities Others |

| By End-User | High-Net-Worth Individuals Investors Foreign Buyers Corporates |

| By Price Range | Below €1 Million €1 Million - €3 Million €3 Million - €5 Million Above €5 Million |

| By Location | Major Cities (Berlin, Munich, Frankfurt) Coastal Areas Countryside Retreats Ski Resorts |

| By Property Features | Swimming Pools Home Automation Systems Eco-Friendly Features Luxury Finishes |

| By Sales Channel | Direct Sales Real Estate Agencies Online Platforms Auctions |

| By Investment Type | Residential Investment Rental Investment Vacation Homes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Villa Buyers | 150 | High-Net-Worth Individuals, Real Estate Investors |

| Real Estate Agents | 100 | Luxury Property Specialists, Real Estate Brokers |

| Property Developers | 80 | Developers of Luxury Properties, Project Managers |

| Architects and Designers | 70 | Architects Specializing in Luxury Homes, Interior Designers |

| Financial Advisors | 60 | Wealth Managers, Financial Planners for High-Net-Worth Clients |

The Germany Luxury Real Estate and Villas Market is valued at approximately EUR 30 billion, driven by increasing demand from high-net-worth individuals and foreign investments, particularly from Asia and the Middle East.