Region:Asia

Author(s):Harsh Saxena

Product Code:KR1548

Pages:90

Published On:November 2024

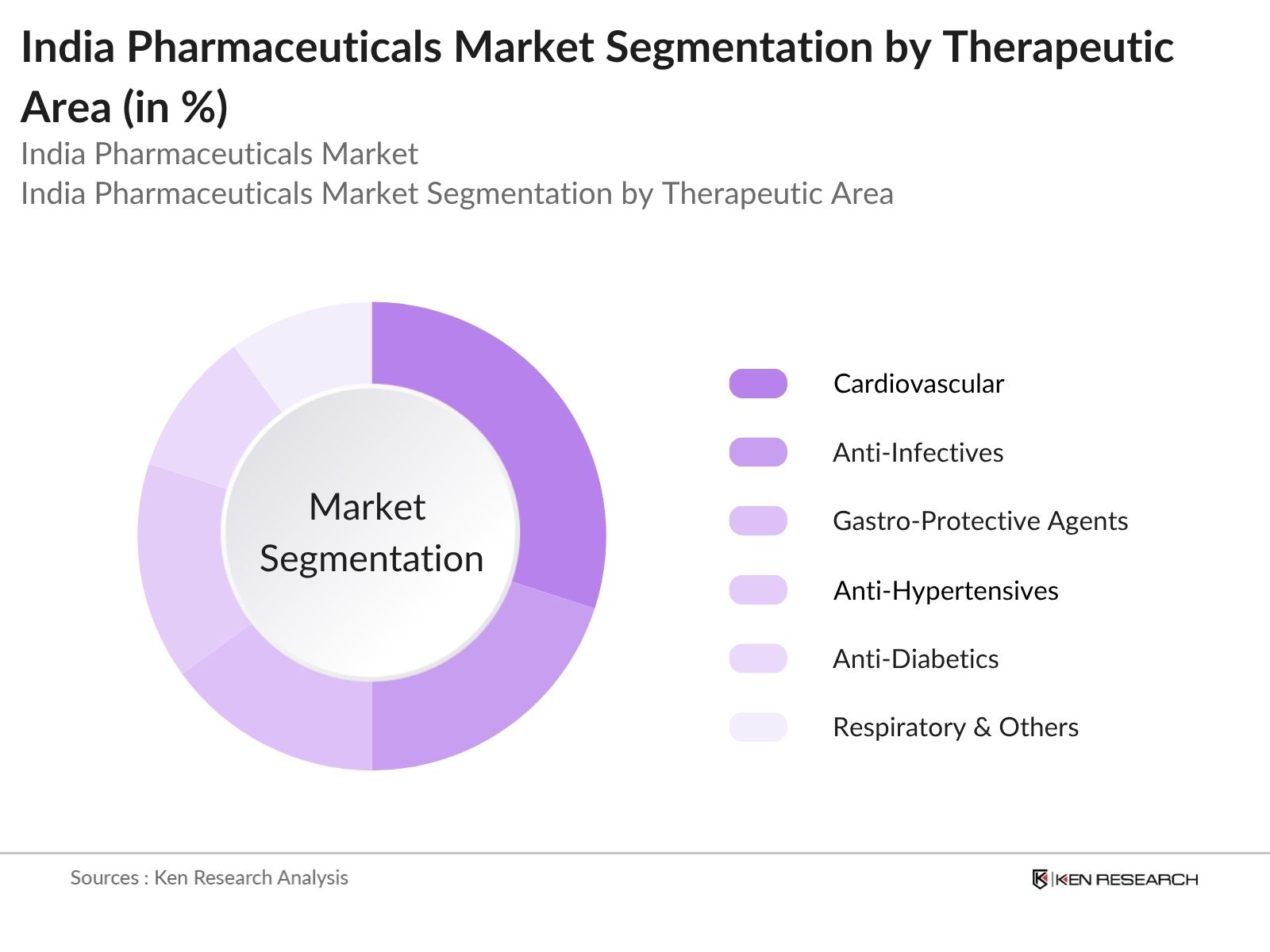

By Therapeutic Area:The Indian pharmaceutical market is segmented by therapeutic areas, including Cardiovascular, Anti-Infectives, Gastro-Protective Agents, Anti-Hypertensives, Anti-Diabetics, Respiratory and Others. Cardiovascular remains the largest segment, supported by the increasing burden of lifestyle-related diseases. Anti-Diabetics and Anti-Infectives are also substantial contributors, reflecting the rising incidence of chronic and infectious conditions. Meanwhile, CNS and Dermatology show the fastest growth, driven by better diagnosis, awareness, and evolving patient needs. The market continues to diversify with increasing demand across specialized and preventive therapeutic categories.

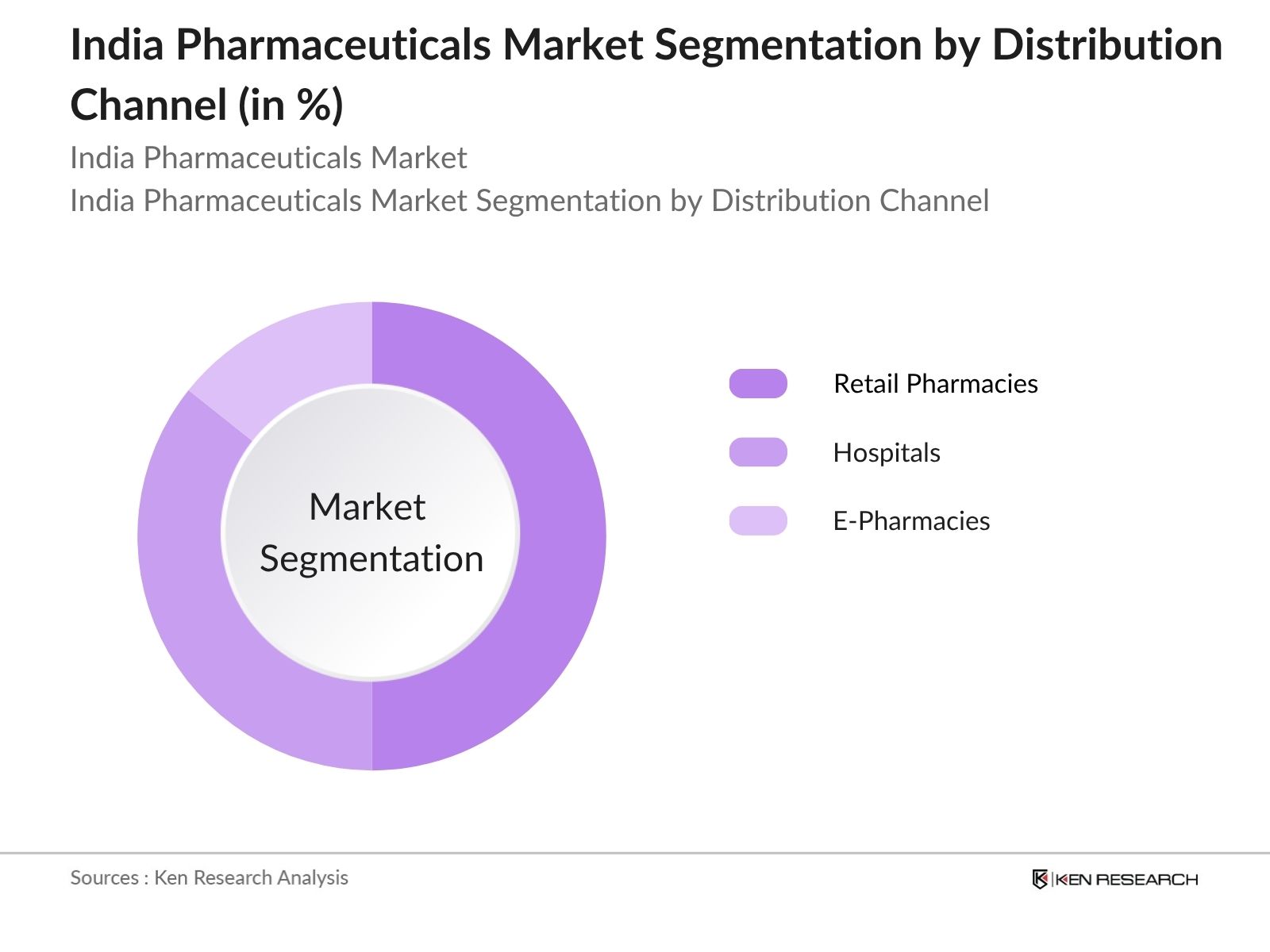

By Distribution Channel:The Indian pharmaceutical market by distribution channel includes Retail Pharmacies, Hospitals, and E-Pharmacies. Retail Pharmacies dominate the market, contributing the largest share due to their widespread presence and consumer trust. Hospitals follow as critical distribution points, catering to inpatient and specialized treatments. E-Pharmacies represent the fastest-growing segment, driven by digital adoption, telemedicine guidelines, and the demand for convenient, transparent, and doorstep delivery services. The overall distribution mix is shifting toward a more integrated model, with digital and institutional channels jointly shaping the future of pharmaceutical access in India.

The India Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sun Pharmaceutical Industries Ltd., Cipla Ltd., Dr. Reddy's Laboratories Ltd., Cadila Healthcare (Zydus), and Abbott contribute to innovation, geographic expansion, and service delivery in this space.

The India pharmaceuticals market is poised for significant transformation, driven by advancements in technology and increasing healthcare demands. The rise of digital health solutions, including telemedicine and e-pharmacy, is expected to enhance patient access to medications. Additionally, the focus on personalized medicine will likely lead to tailored treatment options, improving patient outcomes. As the government continues to support healthcare initiatives, the market is set to experience robust growth, fostering innovation and expanding access to essential medicines.

| Segment | Sub-Segments |

|---|---|

By Therapeutic Area | Cardiovascular Anti-Infectives Gastro-Protective Agents Anti-Hypertensives Anti-Diabetics Respiratory & Others |

| By Distribution Channel | Retail Pharmacies Hospitals E-Pharmacies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chronic Disease Management | 100 | Healthcare Providers, Pharmacists |

| Generic Drug Market Insights | 80 | Pharmaceutical Manufacturers, Regulatory Affairs Specialists |

| Patient Adherence Programs | 60 | Patient Advocacy Groups, Healthcare Administrators |

| Market Access Strategies | 50 | Market Access Managers, Health Economists |

| Pharmaceutical Supply Chain Dynamics | 40 | Supply Chain Managers, Logistics Coordinators |

The India Pharmaceuticals Market is valued at approximately INR 2000 billion, driven by increasing healthcare expenditure, the prevalence of chronic diseases, and a growing demand for generic medications. This market is a significant player in the global pharmaceutical landscape.