Region:Europe

Author(s):Geetanshi

Product Code:KRAB2758

Pages:97

Published On:October 2025

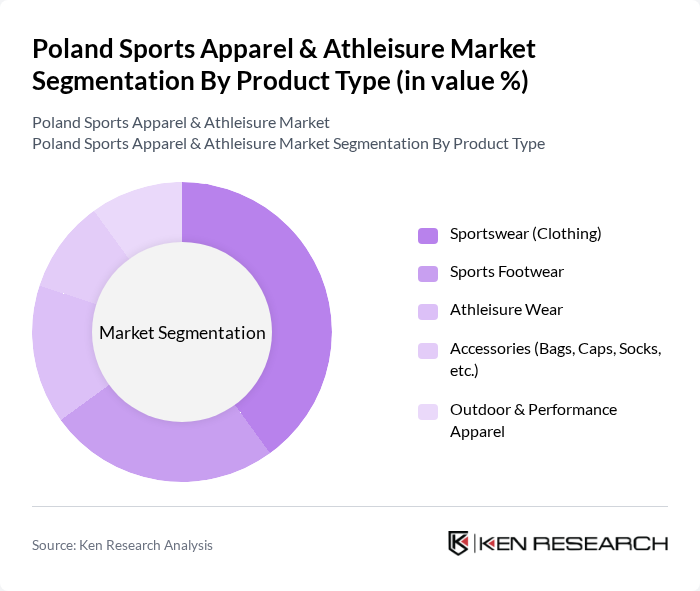

By Product Type:The market is segmented into Sportswear (Clothing), Sports Footwear, Athleisure Wear, Accessories (Bags, Caps, Socks, etc.), and Outdoor & Performance Apparel. Sportswear (Clothing) remains the leading subsegment, supported by increased participation in sports and fitness activities and the widespread adoption of sports clothing for casual and leisure wear. Consumers prioritize comfort, versatility, and technical functionality, making sportswear the preferred choice for both active and everyday use .

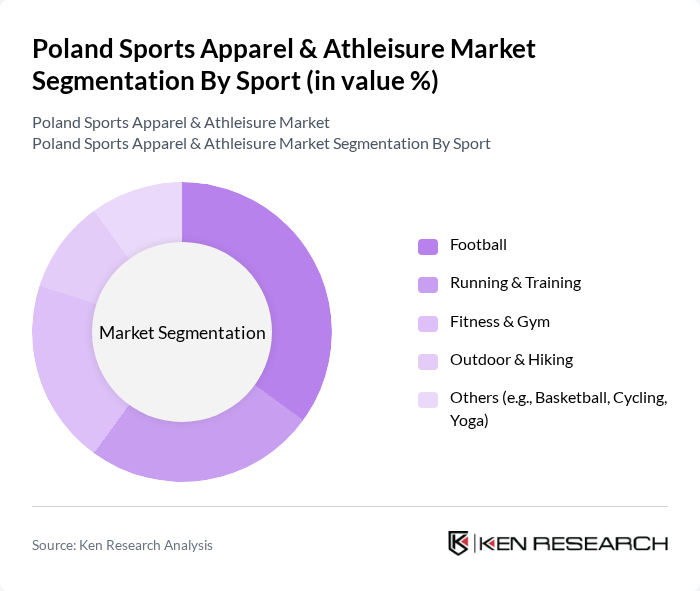

By Sport:Segmentation by sport includes Football, Running & Training, Fitness & Gym, Outdoor & Hiking, and Others (e.g., Basketball, Cycling, Yoga). Football is the dominant subsegment, reflecting Poland's strong football culture and the popularity of both local and international leagues. The proliferation of football clubs and increased youth participation drive demand for football-related apparel and equipment, making it a key market driver .

The Poland Sports Apparel & Athleisure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas AG, Nike, Inc., Puma SE, Under Armour, Inc., New Balance Athletics, Inc., ASICS Corporation, Reebok International Ltd., Lululemon Athletica Inc., Columbia Sportswear Company, The North Face (VF Corporation), Fila Holdings Corp., Skechers USA, Inc., H&M Group, Decathlon S.A., 4F (OTCF S.A.), Martes Sport Sp. z o.o., Outhorn (OTCF S.A.), Reserved (LPP S.A.), Go Sport Polska Sp. z o.o., Trec Wear (Trec Nutrition Sp. z o.o.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland sports apparel and athleisure market appears promising, driven by ongoing trends in health consciousness and fashion. As consumers increasingly seek multifunctional clothing, brands are likely to innovate in design and technology integration. Additionally, the rise of sustainable practices will shape product offerings, aligning with consumer values. Companies that adapt to these trends while navigating economic challenges will be well-positioned for growth in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sportswear (Clothing) Sports Footwear Athleisure Wear Accessories (Bags, Caps, Socks, etc.) Outdoor & Performance Apparel |

| By Sport | Football Running & Training Fitness & Gym Outdoor & Hiking Others (e.g., Basketball, Cycling, Yoga) |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Sports & Fitness Clubs Wholesale/Distributors |

| By Price Range | Budget Mid-Range Premium |

| By Brand Origin | International Brands Local Brands |

| By Material | Synthetic Fabrics Natural Fabrics Blended Fabrics |

| By Usage Frequency | Daily Users Weekly Users Occasional Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Apparel | 150 | Store Managers, Retail Buyers |

| Consumer Preferences in Athleisure | 120 | Active Lifestyle Consumers, Fitness Enthusiasts |

| Brand Perception Studies | 100 | Marketing Managers, Brand Strategists |

| Trends in E-commerce for Sports Apparel | 90 | E-commerce Managers, Digital Marketing Specialists |

| Impact of Sustainability on Purchasing Decisions | 80 | Sustainability Officers, Product Development Managers |

The Poland Sports Apparel & Athleisure Market is valued at approximately USD 2.7 billion, reflecting a robust growth driven by increasing health consciousness and the rising popularity of athleisure wear for everyday use.